As someone who has been closely following the crypto market for several years now, I can confidently say that the Q3 report by CoinGecko paints a fascinating picture of the industry’s dynamic nature. The sharp decline in NFT trading volume is certainly a notable change, and it’s interesting to see how Ethereum and Bitcoin are adjusting to this new landscape, with Bitcoin’s Ordinals activity showing some resilience.

Following the Bitcoin halving in Q2, there’s no denying a period of relative calm compared to previous years. However, the third quarter of 2024 introduced fresh challenges that were influenced by global political shifts and economic transformations.

As a result, the crypto market continues to be a mix of ups and downs.

Despite a relatively stable market environment, there was hardly a moment of tranquility as the U.S. Federal Reserve’s policies, China’s economic initiatives, and unanticipated actions by Japan consistently stirred up activity in the realm of cryptocurrencies.

As a crypto enthusiast delving into the latest findings of the Q3 2024 CoinGecko Crypto Industry Report, I’ve been analyzing key events and their impact on heavyweights like Bitcoin and Ethereum, as well as emerging sectors such as DeFi, NFTs, centralized, and decentralized exchanges.

With the market changing so fast, understanding these trends is critical for anyone involved.

We were able to implement crucial updates in the industry thanks to the insights provided by CoinGecko’s report, enabling you to plan your strategies accordingly based on upcoming trends.

Key Takeaways

- The crypto market dropped by 1% in Q3 2024, closing at $2.33 trillion amid global economic uncertainty and interest rate fluctuations.

- Bitcoin’s market share increased to 53.6% by the end of Q3, reaching its highest dominance since April 2021, despite only a 0.8% gain in its price.

- Stablecoins grew by $11 billion in Q3, with Tether leading the market, holding a 70% share of the $170.2 billion stablecoin market.

- Prediction markets exploded, growing 565.4%, with Polymarket dominating as bets on the U.S. elections fueled trading volumes.

- The NFT market saw a sharp 61.3% decline in Q3, with Ethereum and Bitcoin NFT volumes suffering the most, while Layer 2 networks saw modest activity.

- Spot trading volume across the top 10 centralized exchanges dropped by 14.8%, with Binance’s share falling below 40%, while Crypto.com made significant gains.

1. Crypto Market Dips 1% in Q3 2024 Amid Economic Uncertainty

In Q3 of 2024, the value of the cryptocurrency market dipped by 1%, ending with a total worth of approximately $2.33 trillion. Following a peak in July, the market experienced a decline in August, primarily as a result of worldwide economic strains.

As a crypto investor, I observed that despite a hike in interest rates in Japan, they remained steady in the U.S. This economic shift seemed to have a positive impact on the market as it somewhat rebounded. The recovery was likely fueled by a reduced interest rate in the U.S. and an economic stimulus measure taken by China.

The average trading volume dropped from Q2 by 3.6% to $88 billion daily.

2. Bitcoin’s Dominance Grows to 53.6%

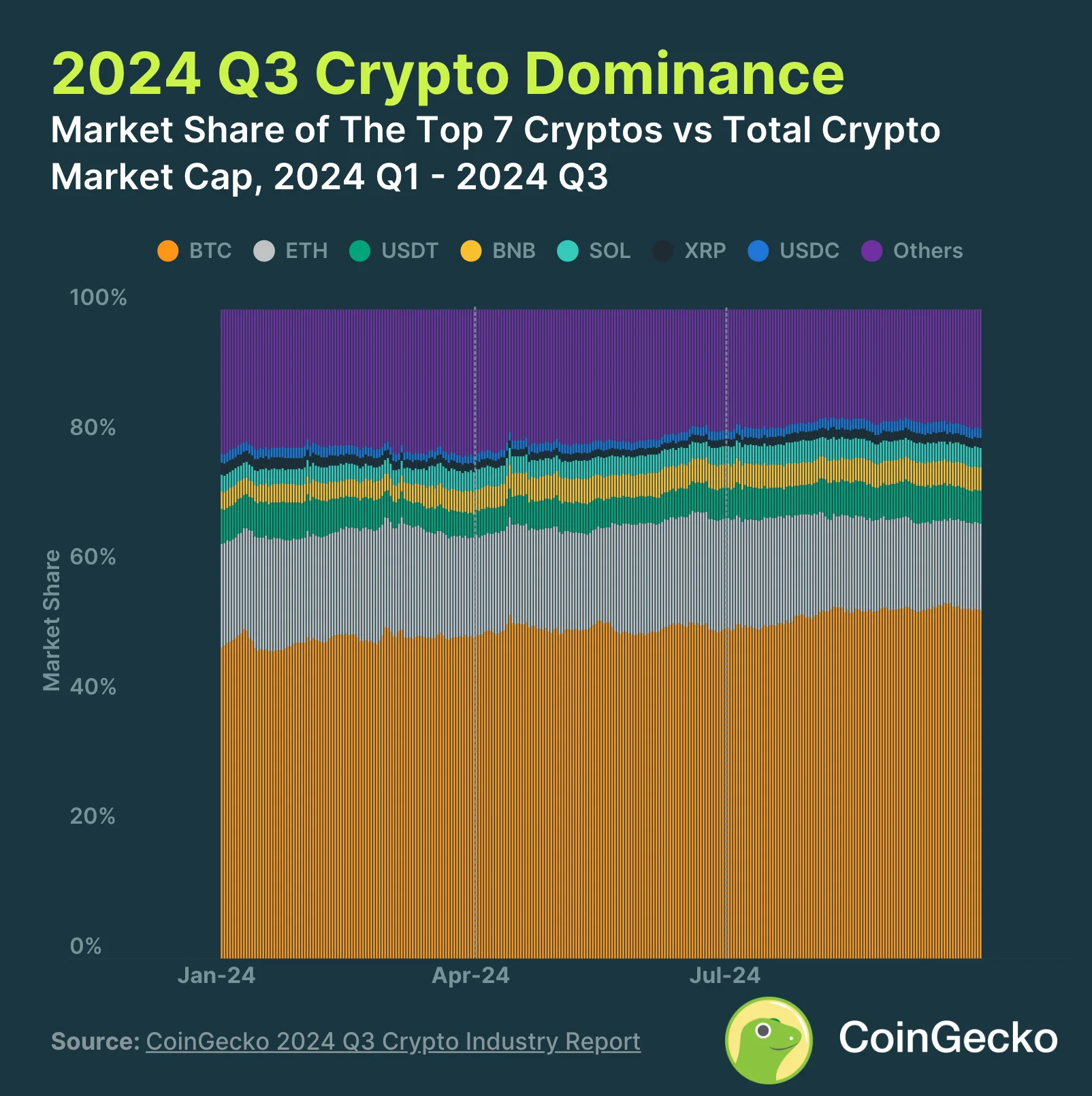

Despite a slight drop in the overall crypto market cap in Q3 2024, Bitcoin’s (BTC) market share grew to 53.6%, up 2.7% from the previous quarter.

Despite a modest 0.8% increase for Bitcoin, it surpassed other cryptocurrencies such as Ethereum (ETH) and BNB, which experienced more substantial losses in market influence. This recent event represents the highest level of Bitcoin’s dominance over the market since April 2021.

Among the leading seven cryptocurrencies, Ethereum experienced the most significant decrease, amounting to 3.6%. This dip caused its market share to close Q3 at 13.4%. Interestingly, despite the introduction of Ethereum ETFs in July, there seems to be a decline in enthusiasm within its ecosystem, potentially contributing to this drop.

3. Stablecoins Market Cap Grows by $11B

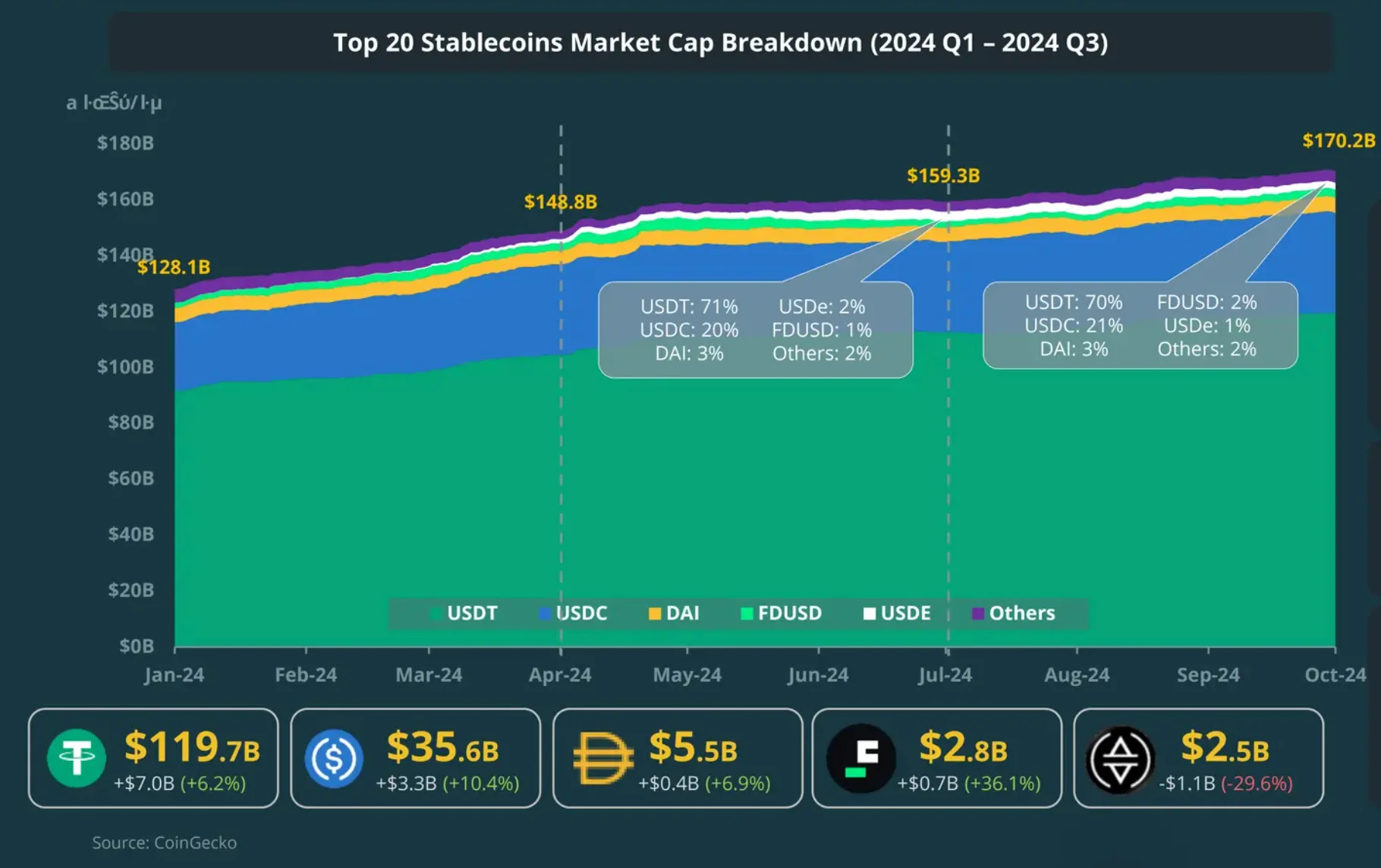

By the close of Q3 in 2024, the combined market value of the top 20 stablecoins expanded by an impressive $11 billion, culminating at approximately $170.2 billion. This represented a significant rise of 6.9% compared to the previous quarter’s total of $159.3 billion.

Stablecoins like USDT (Tether) and USDC (USD Coin) continued to dominate the market, with Tether accounting for about 70%, and USDC holding approximately 21%. The majority of the market expansion was seen in these two coins, with Tether increasing by $7 billion and USDC adding around $3.3 billion.

Conversely, USDe experienced its initial drop, totaling $1.1 billion in outflows, largely because of a significant decrease in its sUSDe APY. On the other hand, PYUSD and GHO registered substantial gains at 66.5% and 72.5% respectively. Unfortunately, GUSD (-35.3%) and crvUSD (-47.9%) suffered the greatest losses in market capitalization during Q3.

4. Gold Outperforms Bitcoin, Rising 13.8%

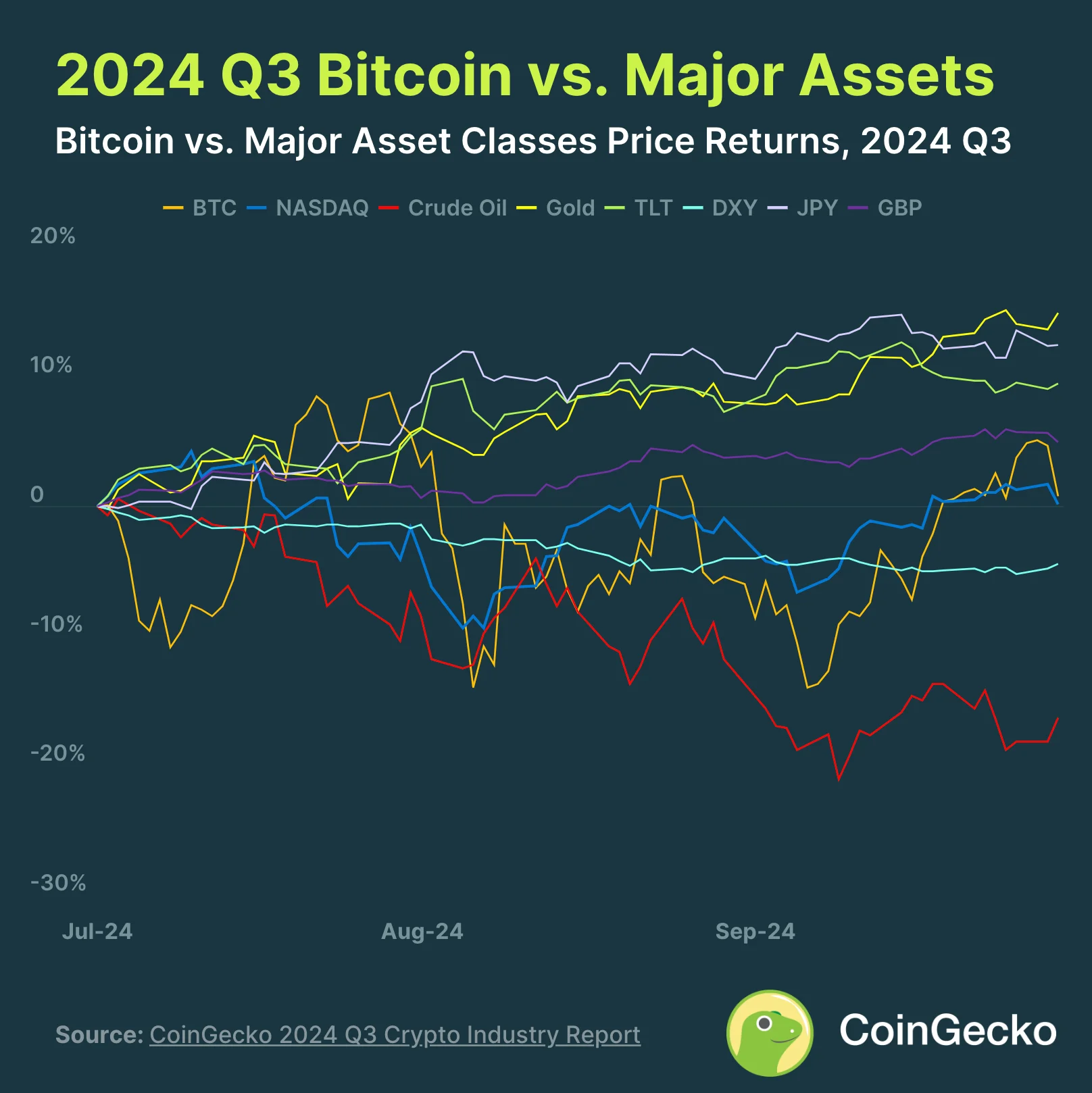

By Q3 2024, Bitcoin experienced a modest rise of approximately 0.8%, however, other major asset classes registered higher growth rates. Gold took the lead with an impressive 13.8% surge. This upswing was primarily fueled by economic apprehensions in the United States and geopolitical tensions in the Middle East.

Similarly impressive was the rise in the Japanese Yen, gaining 12.0% following the unexpected increase in rates by the Bank of Japan. However, only crude oil and the U.S. Dollar Index (DXY) fared worse than Bitcoin during this period due to worries about demand and potential interest rate reductions.

All major fiat currencies strengthened against the dollar.

5. Prediction Markets Surge 565.4%

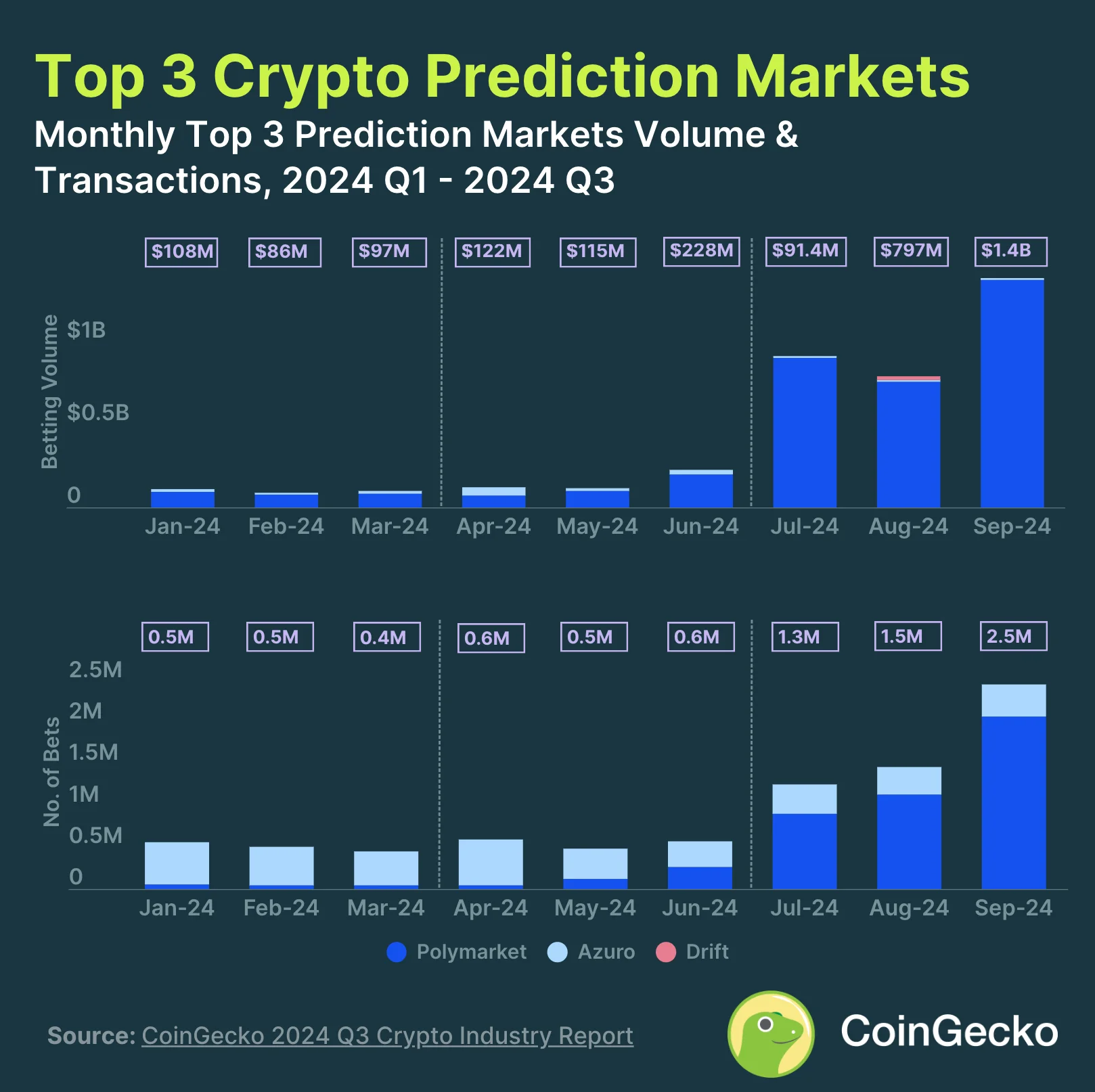

prediction markets experienced significant expansion, growing an impressive 565.4%, as there was heavy betting on the forthcoming U.S. elections. The leading three platforms collectively handled a staggering $3.1 billion in transactions, marking a substantial increase from the $466.3 million recorded in the preceding quarter.

In a clear and straightforward manner, we can rephrase the statement as follows: Polymarket ruled supreme in the market, accounting for an astounding 99% of the total market share. Furthermore, the volume of bets placed on this platform experienced an extraordinary increase of 713.2%.

Beginning from January 2024, a total of $1.7 billion was bet on the U.S. Presidential Election, accounting for approximately 46% of Polymarket’s entire annual turnover.

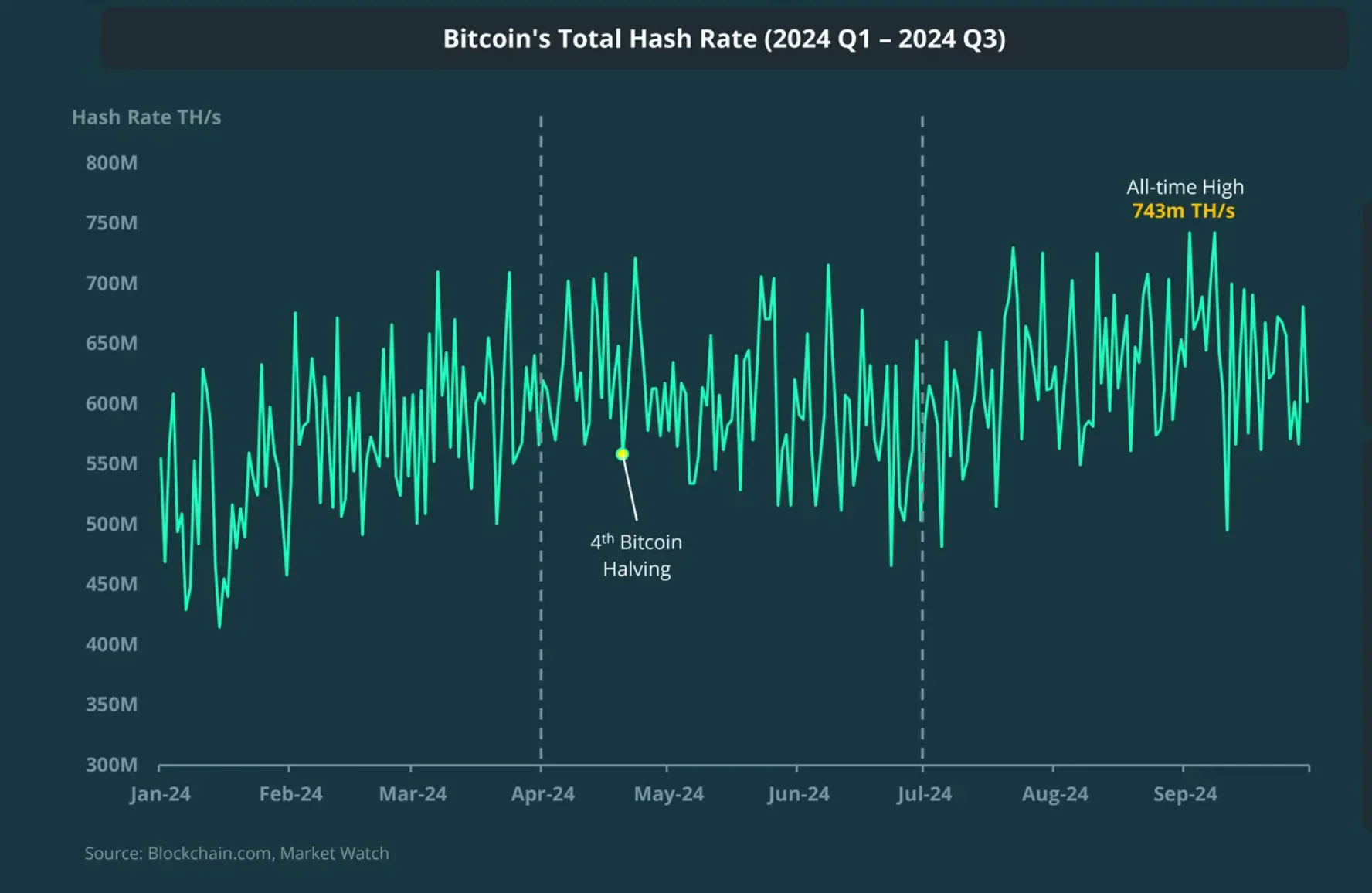

6. Bitcoin Hash Rate Hit a New All-Time High

Bitcoin’s total computational power, known as hash rate, recovered from its dip following the halving event in Q3 2024, rising by approximately 19.6%. This surge took the hash rate from 503 million trillion hashes per second (TH/s) in July to 602 million TH/s by the end of the quarter. Remarkably, the daily average hash rate peaked at a record high of 743 million TH/s around early September.

Although there was an increase in the industry, the profitability of miners decreased progressively each month, falling by 6% in September. Noteworthy events in the mining sector include Russia allowing crypto mining and five leading mining companies broadening their horizons into artificial intelligence (AI) by establishing high-performance computing (HPC) facilities.

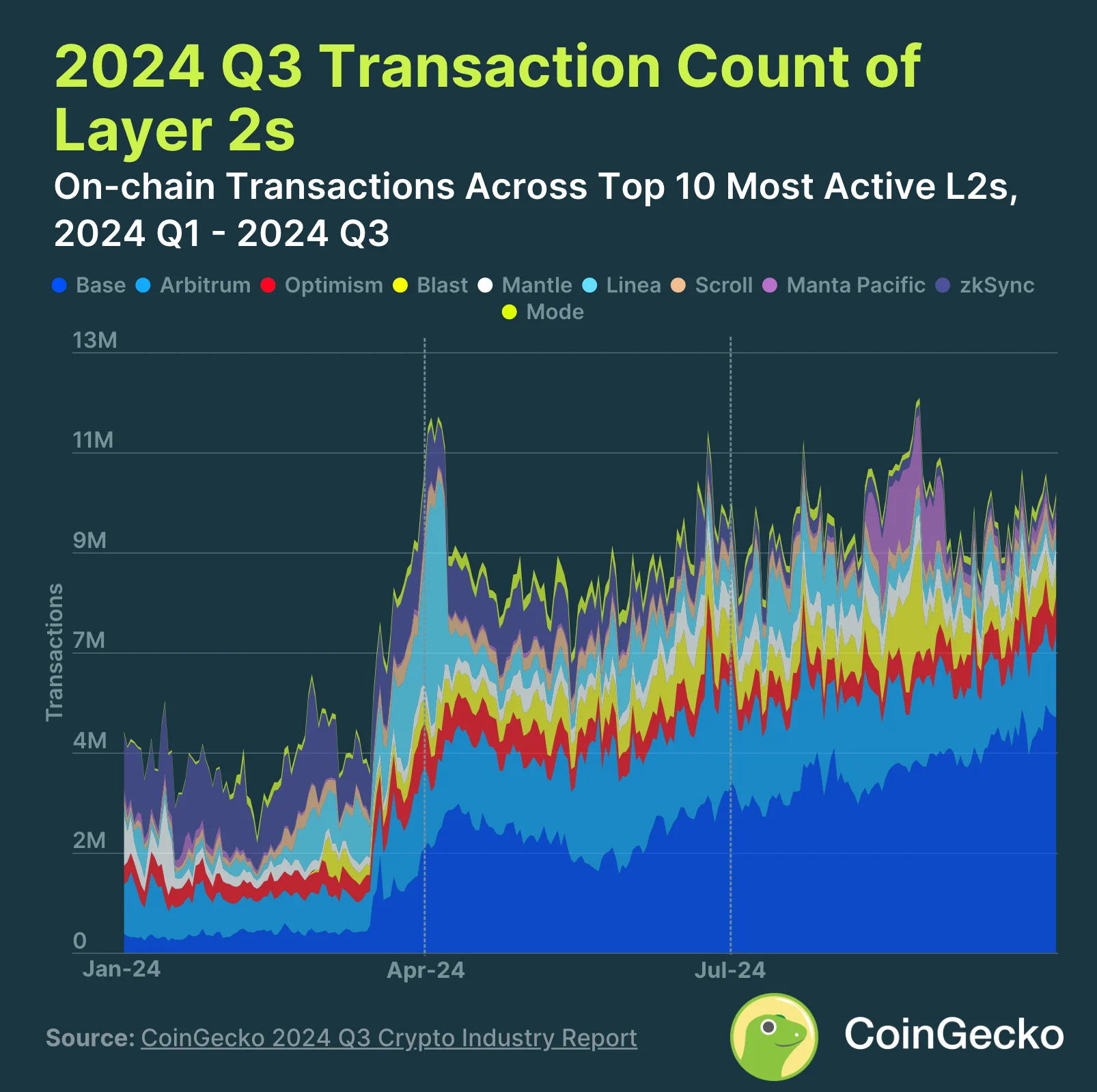

7. Ethereum Layer 2 Transactions Up 17.2%

By the close of September, daily transactions on the leading 10 Ethereum Layer 2 platforms experienced a growth of approximately 17.2%, nearing 10 million transactions. Meanwhile, the Ethereum primary network handles around 1 million transactions per day.

In this context, Base took the lead, managing approximately 42.5% of all second-layer transaction operations. Arbitrum came in second with around 18.9%, and Blast trailed behind with about 8.1%.

Manta Pacific experienced a surge in August, primarily driven by the widely used on-chain Telegram application named Taman. However, the traffic decreased following its initial rollout.

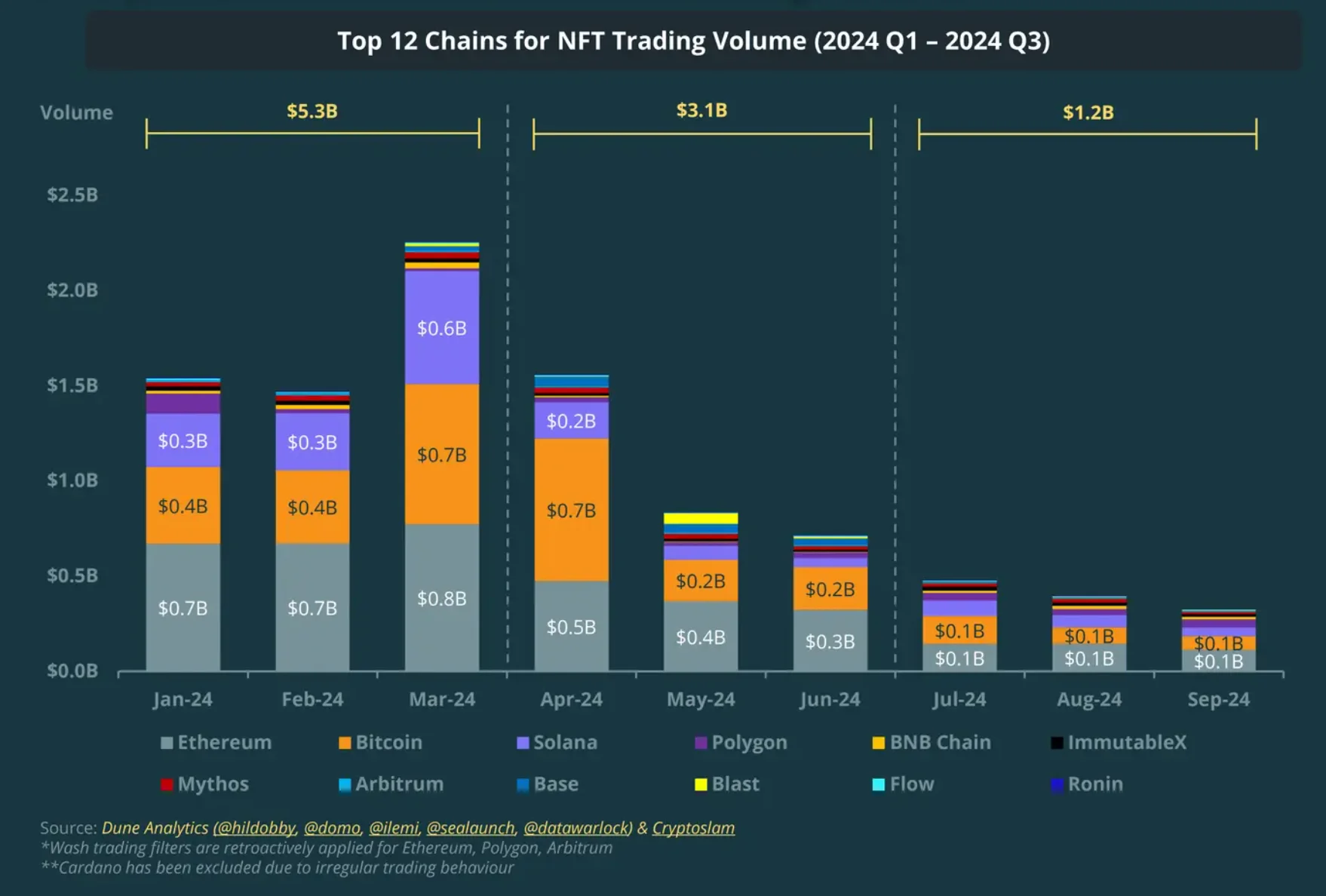

8. NFT Trading Volume Declined by 61.3%

In the third quarter, there was a significant decrease in transactions on the NFT market, dropping by about two-thirds compared to the second quarter. The trading volume plummeted from approximately $3.1 billion in Q2 down to only $1.2 billion in Q3.

The trading volume of Ethereum Non-Fungible Tokens (NFTs) decreased by a substantial 64.7%, causing Ethereum’s market dominance to drop from 45% to 35%. Meanwhile, Bitcoin’s NFT trading saw a decline as well, but its Ordinals activity managed to represent 25.2% of the total volume, surpassing Solana’s 16%.

In the third quarter, activity involving Non-Fungible Tokens (NFTs) on secondary networks such as Blast and Base persisted due to well-known collections and games, yet their trading volumes significantly decreased, resulting in approximately $3 million worth of transactions.

Despite the downturn, Layer 2 networks now control 7% of NFT trading volume.

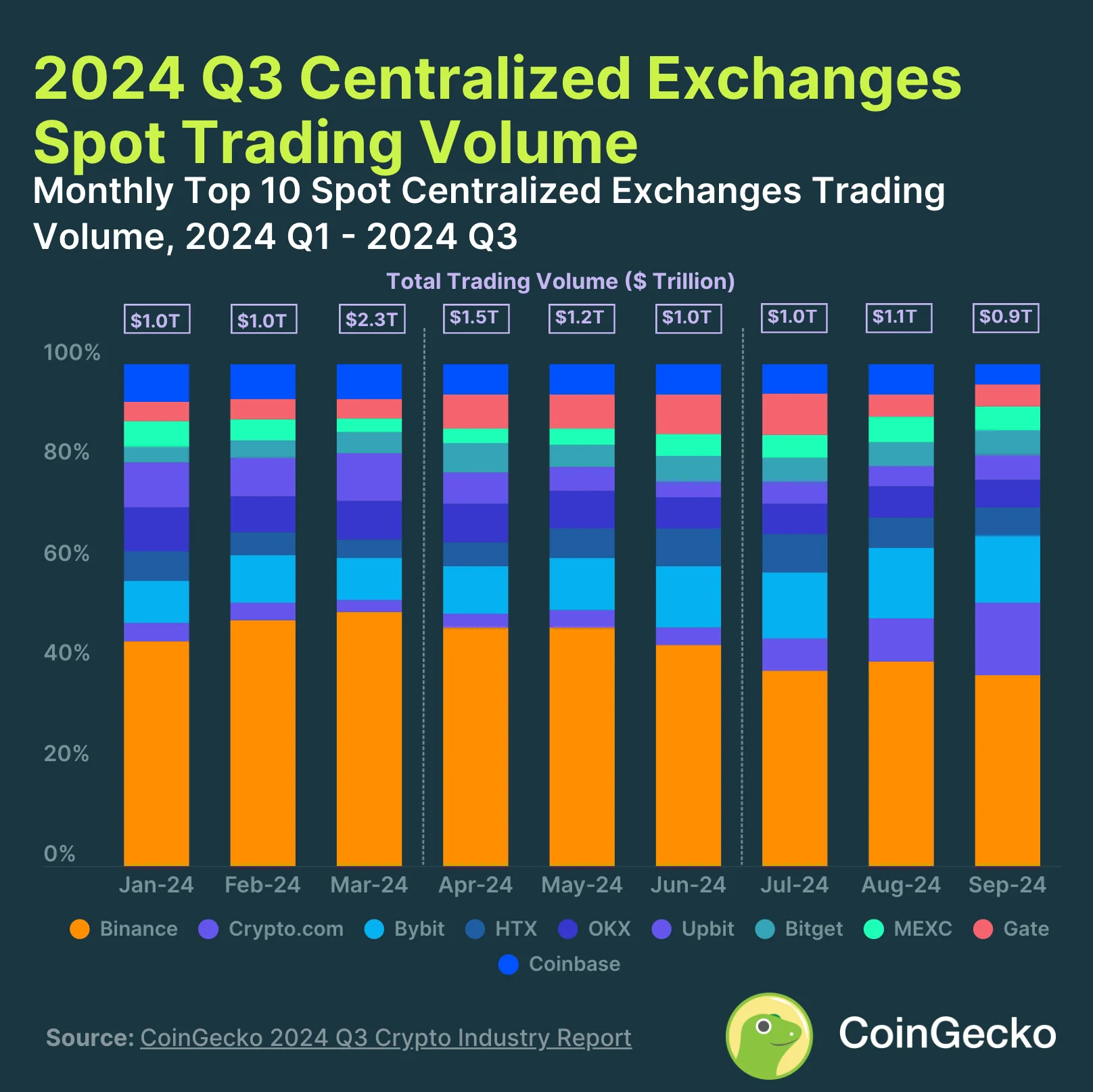

9. Centralized Exchange Spot Trading Volume Drops to $3.05T

According to a recent report by CoinGecko, it was found that the leading 10 centralized cryptocurrency exchanges (CEXs) collectively handled a trading volume of approximately $3.05 trillion during the last quarter. This figure represents a decrease of 14.8% compared to the previous quarter’s figures.

For the first time since January 2022, Binance’s dominance as the largest cryptocurrency exchange has dipped below 40%, ending at 38% in September. Meanwhile, Crypto.com significantly boosted its position, climbing from ninth place to second, with a staggering 160.8% increase in trading volume and securing a 14.4% market share.

Contrarily, OKX and Gate.io witnessed a significant decrease of over 30% in their trading volumes. Similarly, Coinbase suffered a dip of 23.8%, which moved it down from its sixth position to tenth in the ranking system.

10. Ethereum’s DEX Trading Dominance Slips as Solana and Base Gain Ground

Despite Ethereum continuing to lead in decentralized exchange (DEX) trading, its dominance dipped under 40% due to a significant decrease of almost 20% in trading volumes, which fell to approximately $130.5 billion.

As a crypto investor, I’ve seen impressive growth in my Solana holdings recently, largely due to the surging popularity of meme coins. This digital currency has managed to corner a significant 22% share of the market, with an astounding $21.5 billion worth of trades taking place.

Base also grew, increasing its market share to 13% with $12.3 billion in volume.

Tron moved up into the top 10 rankings, propelled by the debut of the SunPump meme token creator, capturing around 2% of the market with approximately $1.7 billion worth of transactions.

Final Thoughts

In Q3 2024, it’s evident that the cryptocurrency market underwent substantial transformations due to global economic fluctuations and political events.

Even though there weren’t any major fluctuations in prices, the sector continued to be lively, as diverse factors influenced the movement within distinct areas.

If you’re interested in or keeping an eye on the crypto market, it’s crucial to stay updated as the market evolves over the next few months. Therefore, make use of the provided details, and I wish you all the best until the next CoinGecko report is released.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Disney’s Snow White Promotion in Chaos as Rachel Zegler Goes ‘Out of Control’

2024-10-20 16:24