Capitol Hill, that tragic stage of American ambition and indelicate lunches, recently hosted Chairman Jerome Powell, who settled into the witness chair like some embattled Oxford don forced to address an unruly room of undergraduates—if undergraduates labored under the delusion they could outsmart the bond market. Powell, with the air of a man forced to attend his own surprise party, intoned that inflation has retreated nobly from its 2022 ascent “but remains somewhat elevated”—much like the hysteria around crypto itself. As ever, the Federal Open Market Committee lies in wait to “learn more,” as if pouncing on facts is a summer pastime.

Markets Teeter Between Champagne and Cyanide Pills

Crypto traders, by now professionally traumatized by every Powell syllable, found the message about as soothing as a lobster in a boiling pot: the next four weeks, gloriously punctuated by the 12 July CPI fête and the 19 July payrolls parade, will determine if July’s FOMC meeting offers salvation or another undignified tumble into chaos.

POWELL: WE EXPECT TO SEE MEANINGFUL TARIFF INFLATION EFFECTS JUNE, JULY, AUGUST

POWELL: IF WE DON’T, CUTTING COULD BE EARLIER

— *Walter Bloomberg (@DeItaone) June 24, 2025

Of course, unity remains a scarce commodity, both in the halls of Congress and on the once-genteel Federal Reserve Board. Governors Bowman and Waller (two individuals rumoured to read The Art of the Deal at breakfast) have declared that tariff-induced inflation is the monetary equivalent of passing gas: awkward, brief, and no reason to upend dinner. Seven of their more decorous colleagues, however, would rather let interest rates vegetate until December—anything to avoid drama. Powell, never one to relish abrupt action (or indeed, any action), told lawmakers with the satisfaction of a man still owning a working Rolodex: “I don’t think we need to be in any rush, because the economy is still strong.”

The market, as ever, saw in Powell’s hesitance a license to indulge. The front end of the curve flatter than a tepid English ale, two-year Treasury yields tumbled to 3.806 percent, the ten-year drooped to 4.285 percent—numbers last glimpsed when the weather was passable and the Middle East was unexpectedly dull. Meanwhile, traders on CME FedWatch have priced in a mere 19% chance that July will bring a cut—a bet not even a Cambridge undergraduate with a fresh trust fund would take.

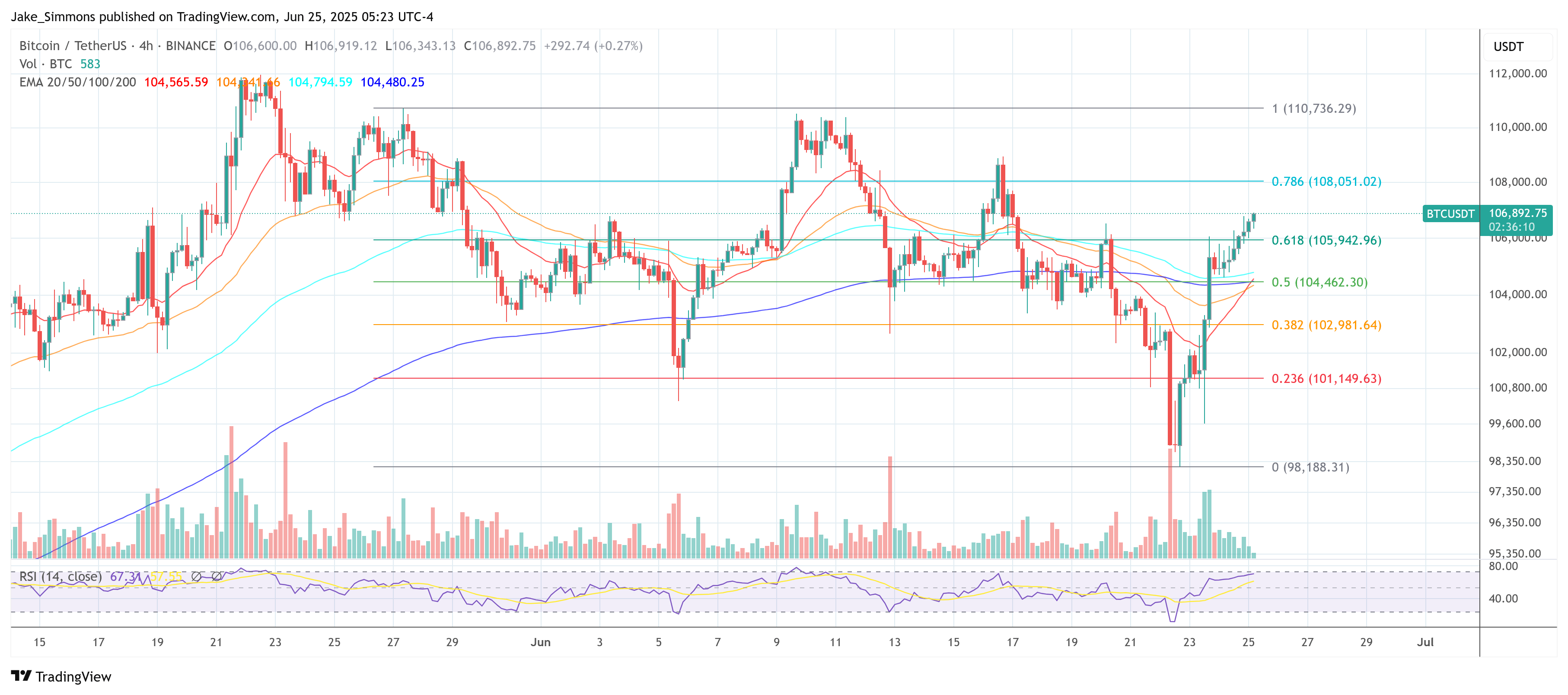

Crypto, whose mood swings could frighten a Regency debutante, promptly ignored Powell’s warnings and staged a small matinée of its own. Bitcoin, having suffered an unspeakable indignity at $99,000 on Monday, now cavorts above $106,000, possibly on the basis of nothing more than a weaker dollar and the whims of equity markets. Ethereum remains perched above $2,400, trying its best to look nonchalant as the crowd shrieks “hawkish!” Solana and BNB also put in respectable performances, because why not?

Meanwhile, industry grandees on X, the platform where nuance goes to die, did their best to distill the drama. Byzantine General opined with the gravity of a man awaiting decent champagne: “We got a lot of clarity now. All eyes on the July CPI print.” Nic from CoinBureau, playing the part of a particularly cagey butler, added that July “is in play—maybe—but nothing’s locked in,” as if trying to dissuade the host from serving the fish course. Even Jim Bianco weighed in: could the next Fed meeting play host to not one, but two dissenters? One shudders at the logistics.

For now, Powell’s “watch and wait” doctrine gives the FOMC four more weeks of indecision, also known as “fun” among civil servants. Should July’s data support the doves, then cue the confetti—crypto may yet skip merrily upward. Otherwise, the crash will arrive as suddenly as the cheque at a London hotel—unpleasant, and entirely expected. As Byzantine General rather dourly observed, the market “got clarity.” Comfort, however, remains strictly off the menu.

At the close of this absurd melodrama, Bitcoin stands at $106,892—a sum both inspiring and faintly comical, much like the present era itself.

Read More

- Best Controller Settings for ARC Raiders

- ‘Crime 101’ Ending, Explained

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- How to Get to Heaven from Belfast soundtrack: All songs featured

- Ashes of Creation Mage Guide for Beginners

2025-06-25 15:59