- TIA’s breakout from a falling wedge pattern pointed to bullish momentum

- Social dominance and favorable liquidation trends supported TIA’s potential for a strong rally

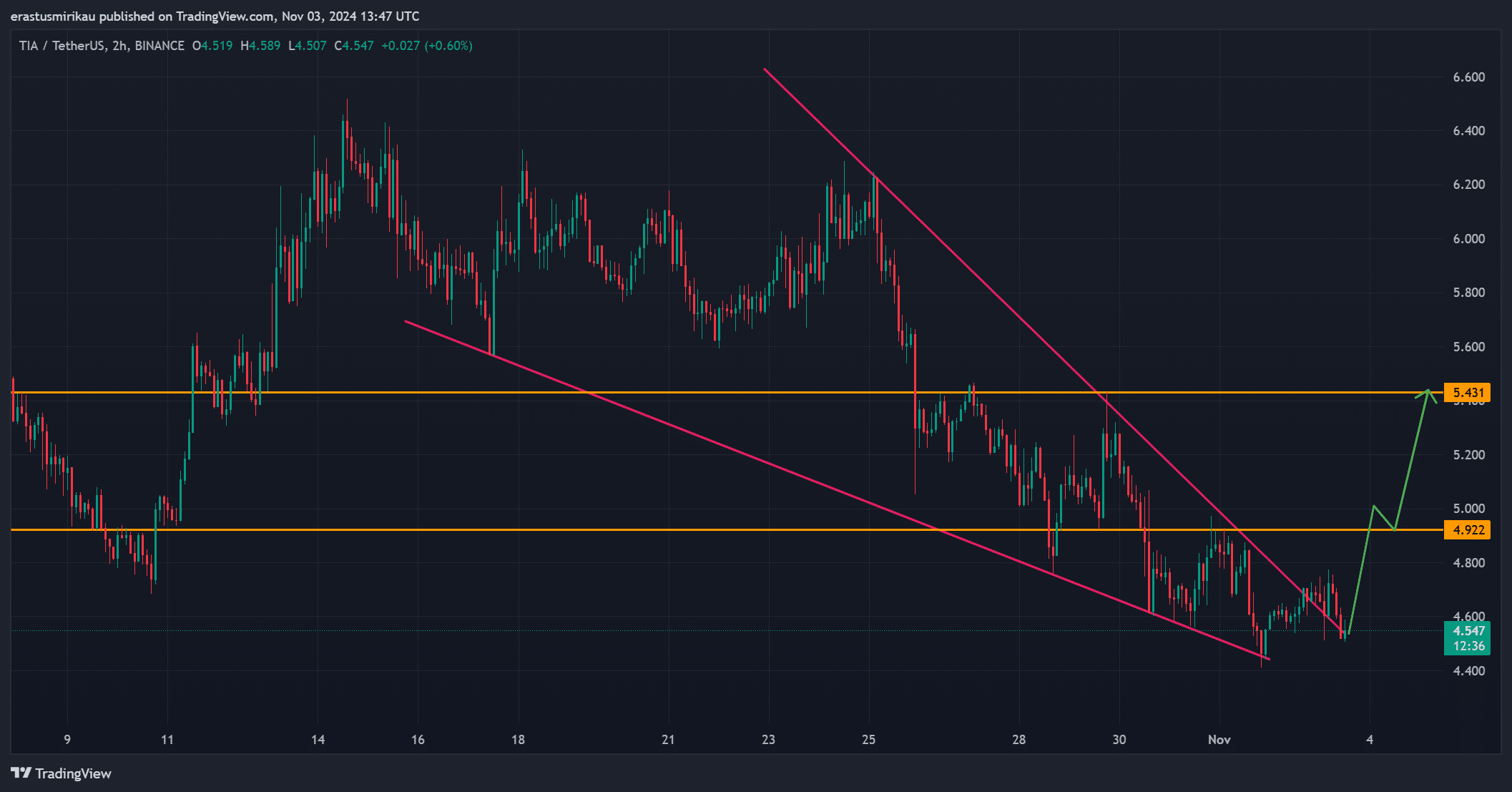

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself quite intrigued by Celestia (TIA). The token’s recent breakout from a falling wedge pattern is reminiscent of a falcon taking flight after being caged for too long.

In simple terms, the Celestia TIA token has shown a significant surge, escaping from a declining trend line formation known as a falling wedge within the H4 timeframe. This breakout is usually indicative of an impending bullish reversal, and it appears that this pattern caught the interest of traders as well.

Currently, TIA is being traded at $4.54, representing a 1.31% decrease over the past day. Yet, this minor decline might be transient, considering some positive indicators suggest a possible transition towards an uptrend.

TIA’s chart hints at bullish potential

A falling wedge breakout can be a strong bullish indicator, and Celestia’s recent chart suggested exactly that. At press time, the token faced a crucial resistance around $4.92 – A level that has previously capped upward movements. Therefore, surpassing this first barrier could fuel further buying pressure, with the next significant resistance zone around $5.43.

Advancing past this stage might spark a substantial surge in value, given that increased investor attention could be triggered. Therefore, analysts are closely monitoring Celestia’s behavior near these key points.

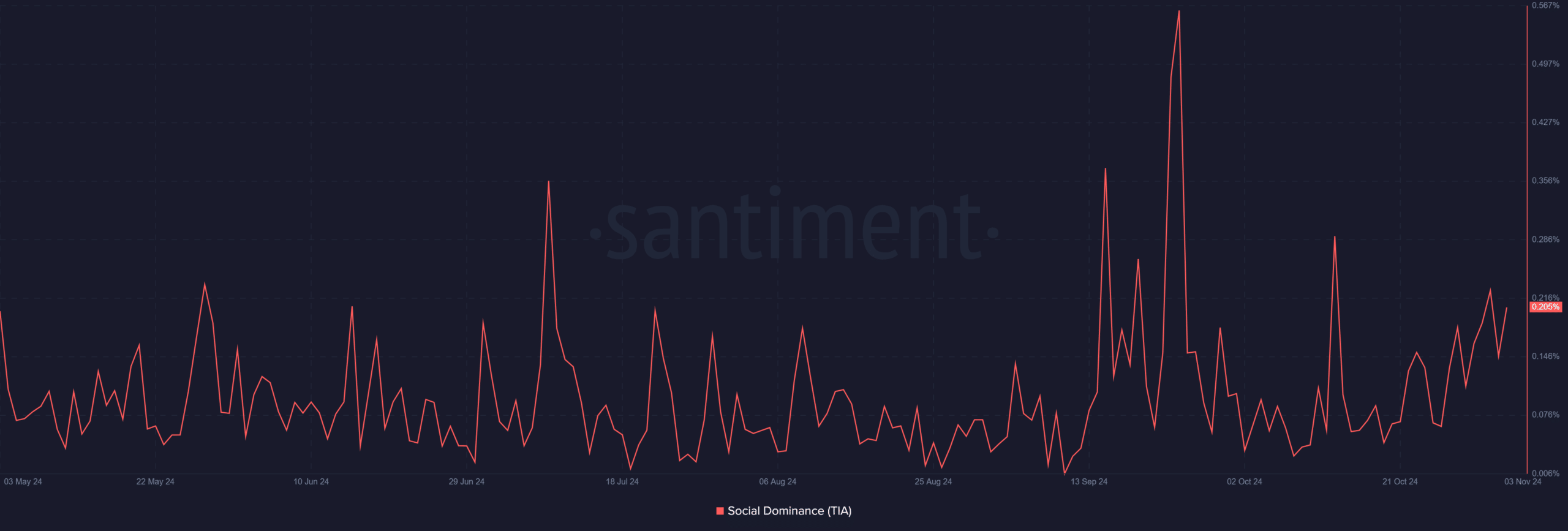

Rising social dominance adds momentum

Moreover, social analysis shows a rising curiosity about TIA, potentially strengthening its market trends. The latest figures demonstrate that TIA’s influence in the crypto sphere has grown, with a social standing of 0.205%. This suggests an expanding interest from the crypto community.

As an analyst, I’ve noticed that increased social activity among investors often coincides with a surge in trading volumes and heightened investor excitement. This pattern suggests that market buzz can play a significant role in shaping investment decisions.

As a result, an increase in positive public opinion may draw in fresh investors and boost the token’s rising trend. In this case, the convergence of technical breakout indicators and growing community engagement could be beneficial for Celestia’s near-term prospects.

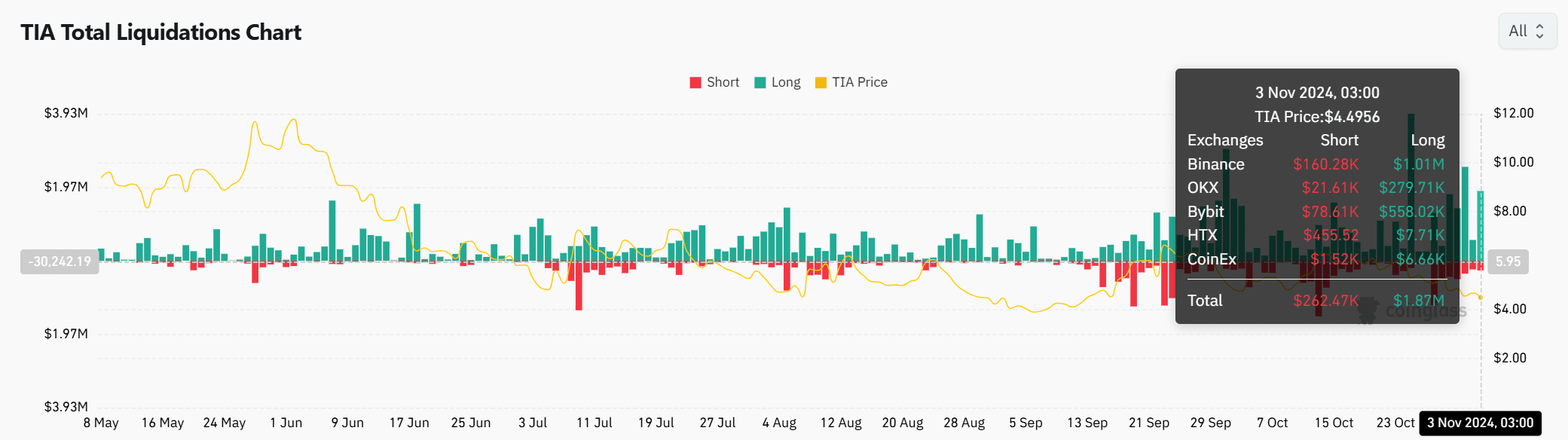

Liquidation data signals bullish sentiment

To add on, the pattern of liquidation indicates advantageous circumstances for TIA. Currently, there are more open long positions than short ones, with approximately $1.87 million in long positions compared to $262.47k in short positions across platforms like Binance, OKX, and Bybit. This discrepancy suggests that a majority of traders are preparing for an upward trend.

Furthermore, a noticeable decrease in short liquidations suggests that negative attitudes towards TIA might be diminishing. Given the prevalence of bullish sentiments, it seems that there’s a stronger possibility for an increase in TIA’s price, particularly if demand persists and grows further.

Can TIA conquer the $6.50 barrier?

As an analyst, I’m observing a robust surge in TIA, accompanied by heightened social attention and a promising liquidation setup. This suggests that TIA could be poised for a substantial upward movement. Nevertheless, it’s crucial to surmount the immediate hurdle at $5.43 before aiming for potential targets within the $6.20 – $6.50 range.

If TIA manages to surpass these current thresholds, it might draw wider interest from the market, potentially paving the way for a prolonged upward trend. Consequently, the forthcoming days are significant for TIA’s price movement as it endeavors to leverage this recent surge in momentum.

Will TIA break through?

Based on the technological advancement, increased public interest, and improving market dynamics, TIA appears to be showing strong indications of overcoming its resistance levels. If it manages to surge past $5.43 and aim for $6.50, this could signal a bullish momentum.

As a crypto investor, I understand that for TIA to establish a strong upward momentum and a lasting rally, it’s crucial that we maintain consistent buying power.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-04 09:12