- TON network crossed the $1B milestone in USDT growth

- TON’s price chart has remained muted amid stagnant interest

As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The recent surge in TON’s USDT stablecoin growth to $1B is indeed noteworthy, pushing it into the top 10 networks by stablecoin dominance. However, the muted response from TON’s price chart seems to suggest that the market may not be as excited as the numbers might indicate.

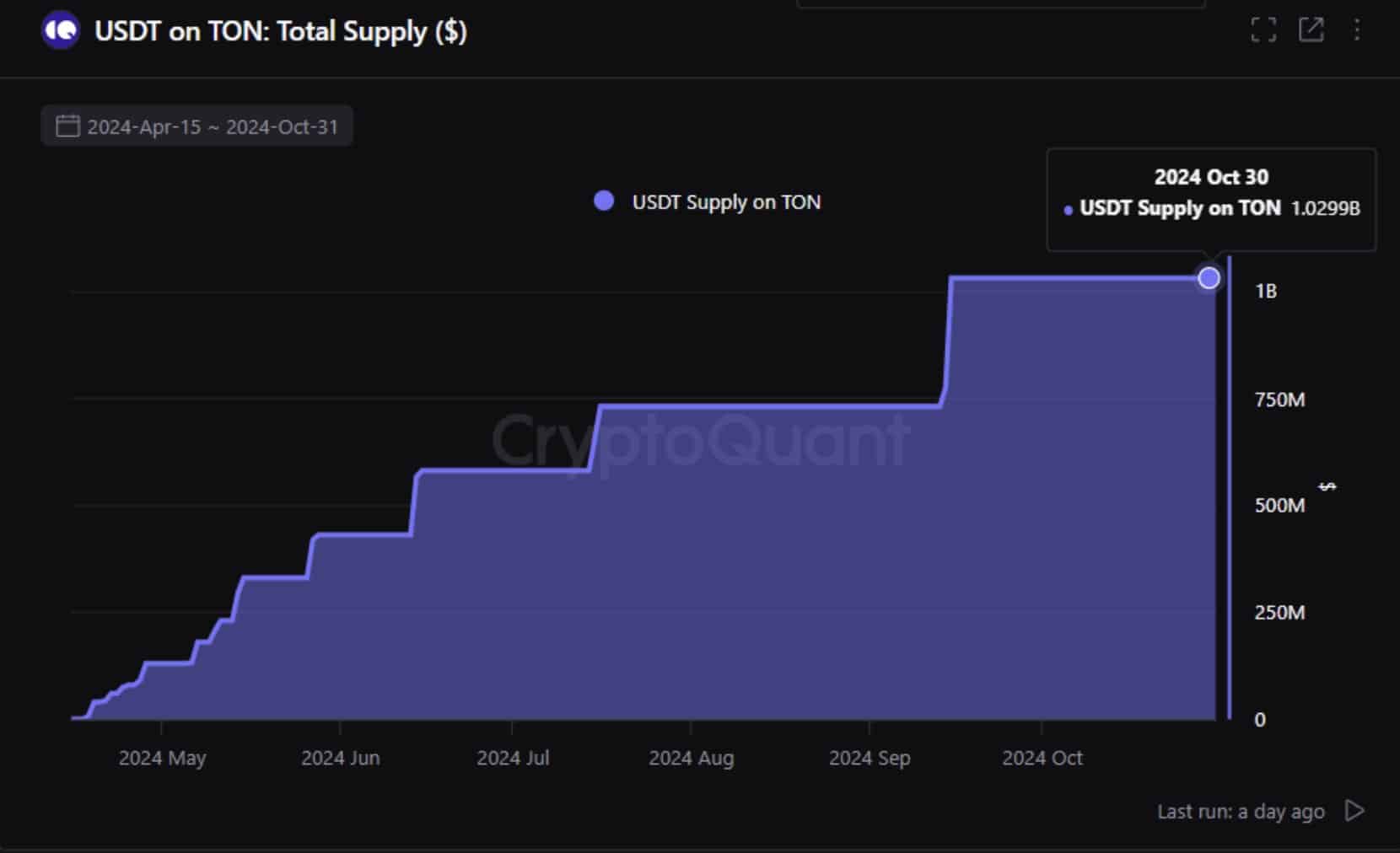

Toncoin’s [TON] USDT stablecoin growth crossed the $1 billion mark after a +670% surge in six months.

In simple terms, this development has moved the chain associated with Telegram into the 10th position among stablecoin networks, slightly behind Optimism which is tied to Ethereum.

Toncoin’s growth drivers

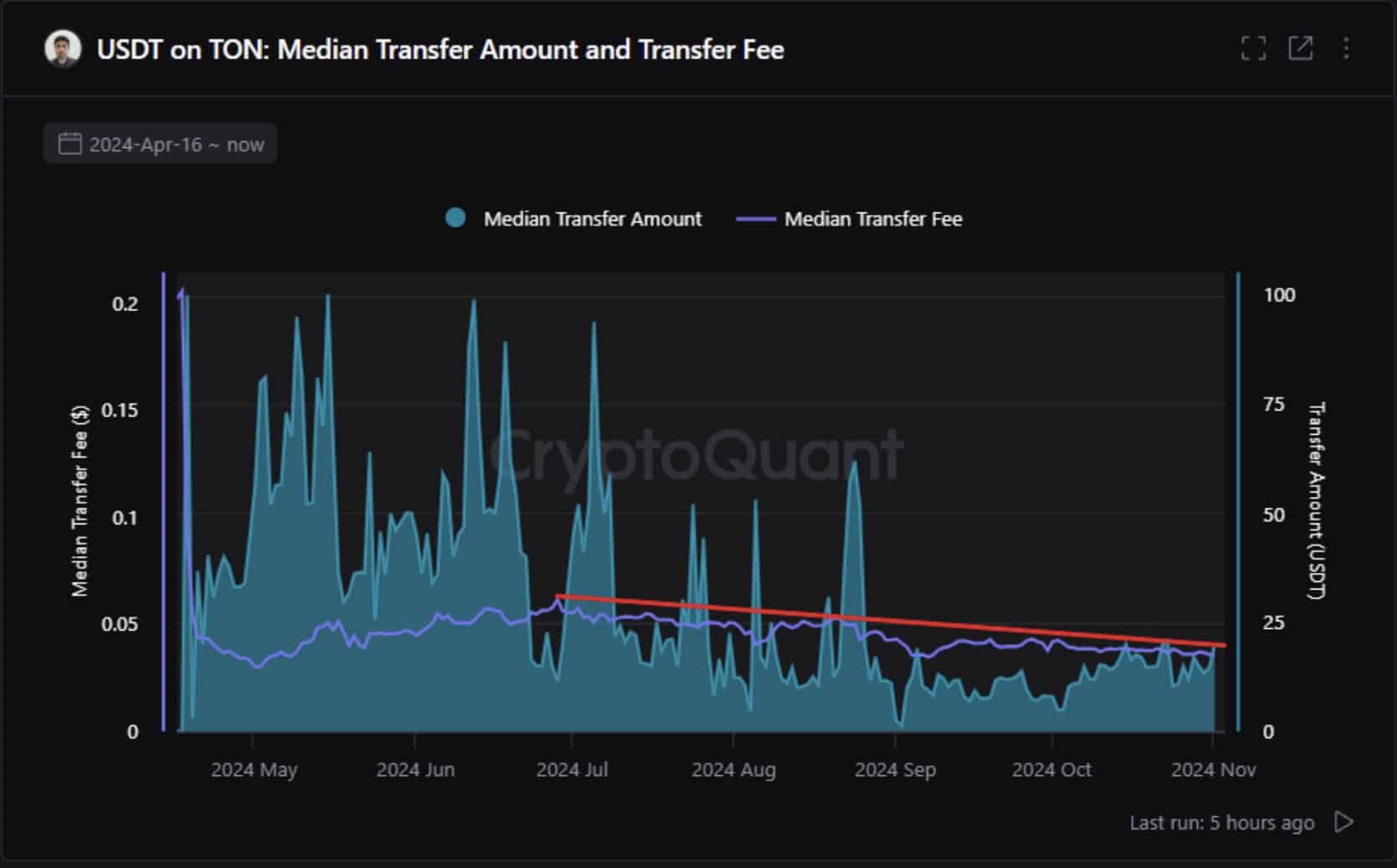

In response to its expansion, CryptoQuant analyst Burak Kesmeci connected the development’s success with a broader increase in stablecoins and Toncoin’s attractive transaction fees. Simply put, he stated that these factors played a role in its performance.

Anticipating a surge, the estimated USDT supply could grow up to a staggering $200 billion (currently at $120B) during the bull market. This expansion is likely to fuel increased interest in swift and cost-effective blockchain networks such as TON, potentially resulting in a steady increase of USDT on the TON network.

Additionally, the average transaction fee for USDT on the TON network decreased significantly, going from $0.061 to $0.035 – representing a substantial 42% decrease in fees during the same timeframe.

During the span of May to June, I observed a significant surge in TON’s value, approximately 80%. Interestingly enough, this upward trend somewhat echoed the expansion seen in stablecoins during the same period.

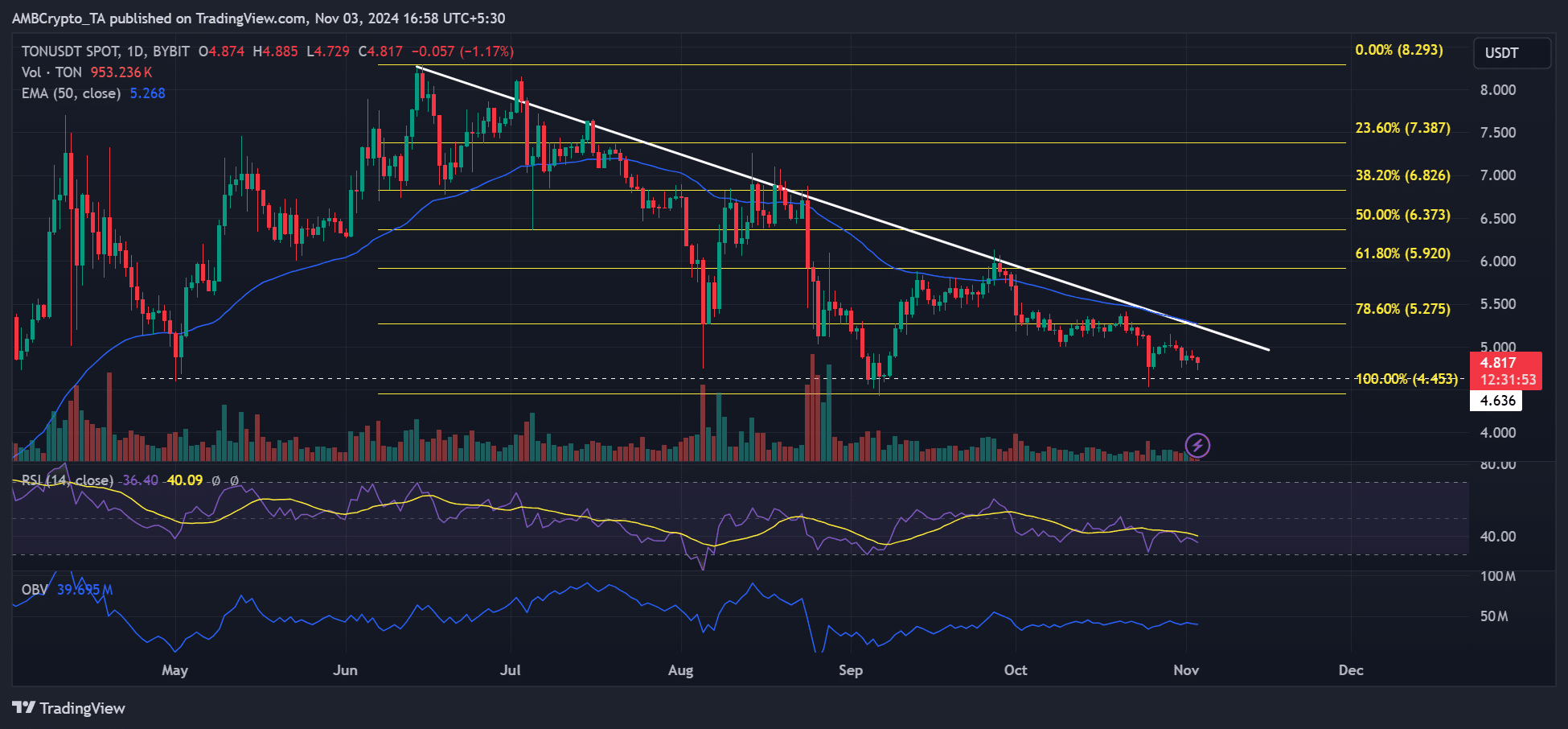

In August, I experienced a setback with my TON investment as its value dipped significantly. This downturn can be partially attributed to the arrest of Telegram’s Founder, an event that seems to have cast a shadow over the cryptocurrency market. Much like other altcoins, TON found itself struggling to break through its significant long-term trendline resistance.

In other words, the low on-balance volume for TON’s market has revealed a lack of strong demand, and its struggles to stay above the trendline during the last few months indicate challenges for the altcoin.

Making a strong push beyond $5 could solidify a change in market structure, potentially leading to further upward momentum.

At the current moment, there was a notable buildup of bullish sentiment towards the Binance exchange, as observed at the time of publication.

Approximately half of the leading traders on Binance had more long (buy) positions than short (sell) ones for the altcoin, suggesting a relatively optimistic outlook for a rebound in its price following its recent downward trend.

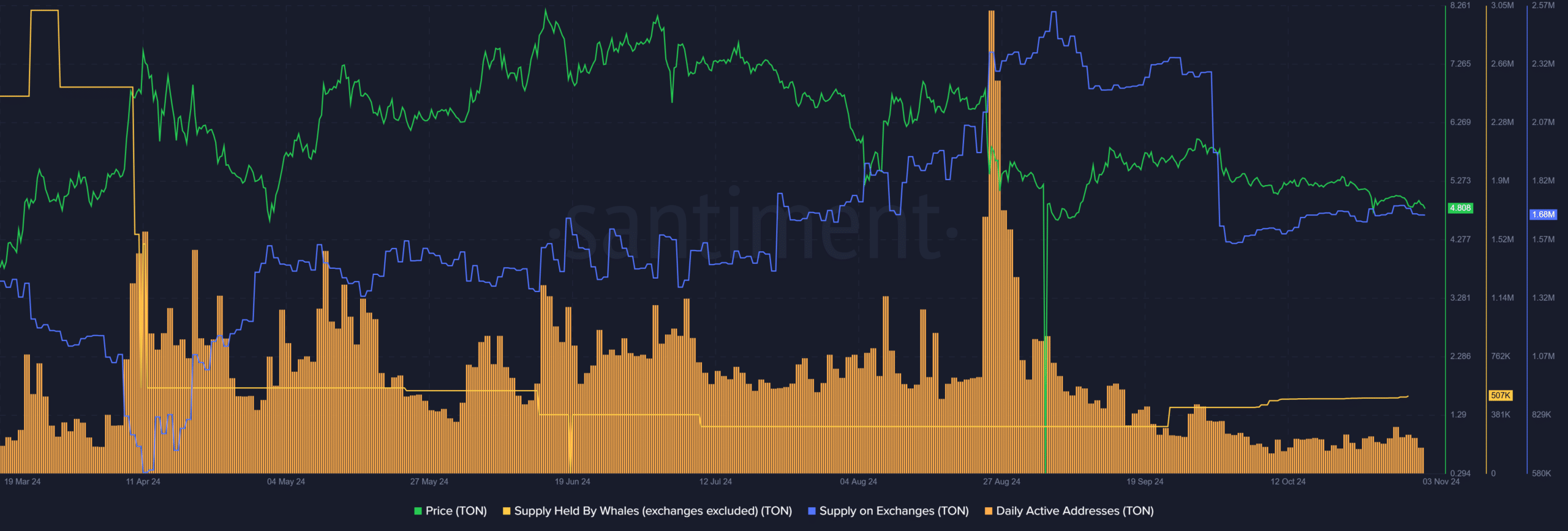

On the other hand, the demand to sell altcoins remained relatively subdued in September. This was evident through a significant decrease in the amount of altcoins available for trading on exchanges. However, starting from October, this metric has been gradually increasing, suggesting an uptick in selling activity.

Read Toncoin [TON] Price Prediction 2024-2025

Over the same time frame, the whale’s stockpile has increased as well. This indicates that whales might be buying up discounted TON from retailers who are trying to get rid of their holdings. Consequently, it implies that the pressure on exchanges due to sell-offs could be offset by these purchases, resulting in a zero-sum game.

However, a robust recovery for TON might face setbacks due to subdued enthusiasm, which is suggested by the relatively low number of daily active addresses.

From my perspective as an analyst, it’s clear that a significant increase in stablecoin adoption alone may not be enough to significantly boost the price trajectory of TON.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-04 08:07