Oh, what a curious little tale we have here! 🧮 Twins Cameron and Tyler Winklevoss, the dynamic duo who once tangled with Facebook’s Zuckerberg (poor souls), are now strutting onto the public stage again-with their cryptocurrency exchange, Gemini. And guess what? They’ve got $18 billion in assets tucked under their crypto-capes! 🦸♂️🦸♂️ But hold your applause, dear reader, for this isn’t just any ordinary debut-it’s an IPO circus act!

Gemini has filed its papers with the US Securities and Exchange Commission (SEC), like a nervous student handing in homework late. 📝 Their dream? To list their Class A common stock on the Nasdaq Global Select Market under the ticker symbol GEMI. Yes, because nothing screams “innovation” like slapping three random letters together.

A Tale of Two Classes (and Lots of Control) 🪑👑

Now, brace yourself for some corporate wizardry-or should I say, twizardry? The filing reveals that Gemini will have a dual-class stock structure. Class A shares give you one measly vote per share, while Class B shares-reserved entirely for the Winklevoss twins and their cronies-grant ten votes each. Talk about hogging all the power! It’s almost as if they don’t trust anyone else to run their billion-dollar baby. 🐷💼

This clever arrangement makes Gemini a “controlled company,” which sounds far more sinister than it actually is. Still, it’s enough to make shareholders everywhere roll their eyes so hard they might get stuck that way. 👀

And who’s helping orchestrate this grand performance? None other than Goldman Sachs, Morgan Stanley, Citigroup, and Cantor Fitzgerald-the financial equivalent of a boy band reunion tour. 🎤🎶

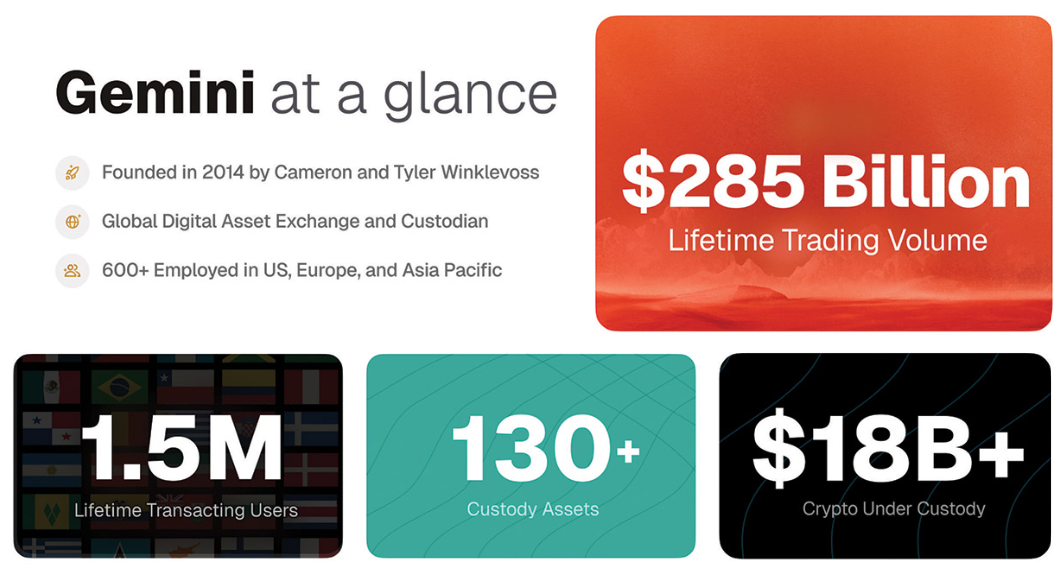

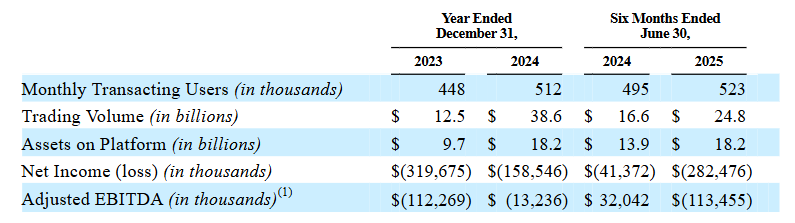

Gemini boasts over 500,000 monthly active users and manages more than $18 billion in customer assets. That’s enough money to buy several small islands or at least fund a lifetime supply of chocolate bars. 🍫🌍 But wait, there’s more! The platform claims to have processed over $800 billion in transfers and racked up a lifetime trading volume exceeding $285 billion. Impressive numbers, no doubt-but let’s not forget, folks, these are cryptos we’re talking about. One day they’re soaring higher than a helium balloon; the next, they’re plummeting faster than a dropped ice cream cone. 🍦📉

But Wait… There’s a Catch! 🚨💸

Oh, how quickly the plot thickens! Despite all the glowing metrics, Gemini’s financials tell a slightly less rosy story. In 2024, the company pulled in $142.2 million in revenue but somehow managed to lose a whopping $158.5 million. And things didn’t improve much in early 2025-they bled another $282.5 million on revenues of just $67.9 million. Ouch. That’s enough red ink to fill a bathtub. 🛁🩸

Analysts whisper behind closed doors that these losses highlight the struggles of scaling in the wild west of crypto. Could this IPO be their Hail Mary pass to secure more cash? Only time will tell, my friends. ⏳

And speaking of cash, did you know Gemini has a cozy little credit facility with Ripple? Up to $150 million in RLUSD stablecoin, though they haven’t touched a penny yet. Meanwhile, the twins have borrowed heaps of ETH and BTC from their family office, Winklevoss Capital Fund. As of June 30, 2025, they still owe 39,699 ETH and 4,682 BTC, with annualized fees ranging from 4% to 8%. Let’s hope those loans don’t come back to haunt them like a ghost from Christmas past. 👻💳

So, dear reader, as Gemini tiptoes toward its public debut, one question remains: Will this be the start of a glorious new chapter or the beginning of a cautionary tale? Either way, grab your popcorn-it’s going to be quite the show! 🍿🎉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- USD JPY PREDICTION

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- These Are the 10 Best Stephen King Movies of All Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

2025-08-16 14:57