-

XRP noted a decline in key on-chain metrics.

The time for panic and despair is now, but there’s one route to profits.

Since April 12th, XRP‘s daily price chart for Ripple has predominantly shown red, indicating a decline. The coin dropped by approximately 32% in value between its peak on Friday and its lowest point on Saturday.

The action hit its lowest point in the past 8 months, while also dropping below the previous month’s lows.

An AMBCrypto article released not long ago indicated a decrease in Ripple’s network expansion. Consequently, the number of users adopting the platform has dwindled, as well as the desire for purchasing XRP, due to reduced demand.

The selling wave of the past week

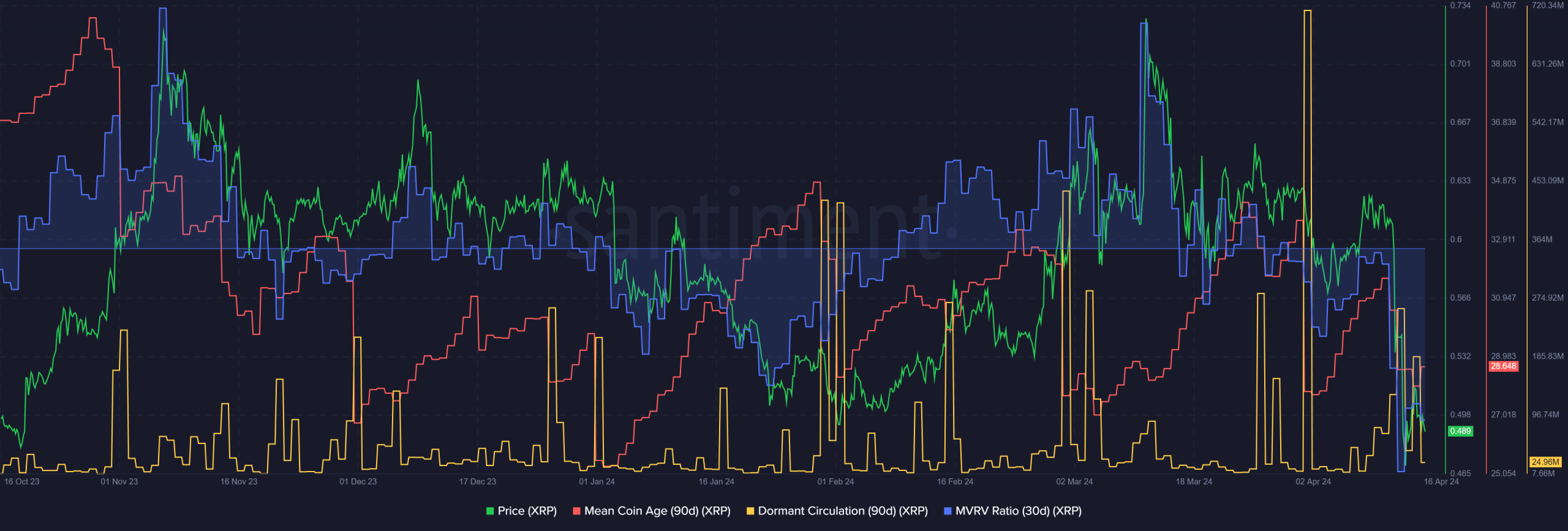

Starting from March 23rd, the average age of coins in circulation, represented by the mean coin age metric, has been decreasing. This suggests an uptick in XRP tokens being transferred between wallets, possibly for selling purposes.

April 12th saw a significant decline in both the average age of coins in circulation and the MVRV (Market Value to Realized Value) ratio for XRP. This downturn occurred concurrently with a sharp decrease in price, indicating that many XRP holders were selling off their coins out of fear.

Additionally, the dormant coin age also saw a large spike on that day.

In unison, they indicated significant resistance to sales. Furthermore, despite the Multiple Value Reversion (MVR) indicator suggesting a bargain, it might be challenging for long-term investors to rationalize purchasing XRP.

The psychology of ranges

A cryptocurrency expert, choosing to remain anonymous on X (previously known as Twitter), pointed out that following a significant price decline, there are generally two possible scenarios. The first is a quick recovery, where prices bounce back strongly. The second is an extended slump in prices.

In simpler terms, both situations could signal bullish or bearish trends. But, if the price stayed within a range and didn’t move much, it might become challenging for new investors to keep their investments.

The yellow bar is a month old, and the purple one is nearly nine months old. From February to around mid-March, Bitcoin‘s [BTC] price surged from $41,800 to $73,700, representing a 76% increase. During this period, XRP experienced a rise of approximately 51%.

Despite this, the price failed to surpass its previous highs. Consequently, long-term investors may have experienced significant losses during the subsequent price decline.

Currently, the $0.46 price range’s nearness offered a tempting chance for a swing trader to make purchases.

Despite the query persisting, it’s uncertain if XRP will surpass other major cryptocurrencies in the upcoming months given the trends observed over the past nine months.

However, the 2020-21 run saw XRP trapped beneath a similar resistance at $0.65.

During the second half of April 2021, XRP experienced a significant surge, increasing by 243% within just 15 days and peaking at $1.96 – though it didn’t set a new all-time high (ATH). Simultaneously, Bitcoin broke through the $60,000 barrier for the first time in this period.

Read Ripple’s [XRP] Price Prediction 2024-25

During this market cycle, XRP investors may need to be patient and endure losses for an extended period before potentially experiencing significant gains in the last two weeks.

While this is speculation, it’s still something for investors to consider.

Read More

2024-04-17 09:11