- Ethereum’s metrics revealed bulls have a reason to be concerned, despite its recent rally

- Higher timeframe bias was bullish, but a 2% -7% drop might happen within a week or two

As a researcher with experience in cryptocurrency markets, I’ve closely observed Ethereum’s recent price action and its associated metrics. While the surge past the critical resistance zone of $3.1k was a significant development, I’m concerned that bulls may have reasons to be apprehensive.

As an analyst, I’d rephrase it as follows: On the 20th of May, Ethereum [ETH] successfully breached its significant resistance level at $3,100 following a three-week-long attempt. This noteworthy price action occurred shortly after the announcement that the spot Ethereum Exchange Traded Fund (ETF) had been approved. The official approval was granted on the 23rd of May.

After the significant increase, the trading volume and NFT marketplace activity on our platform have decreased, returning to the levels observed earlier in May. American investor engagement has also waned noticeably.

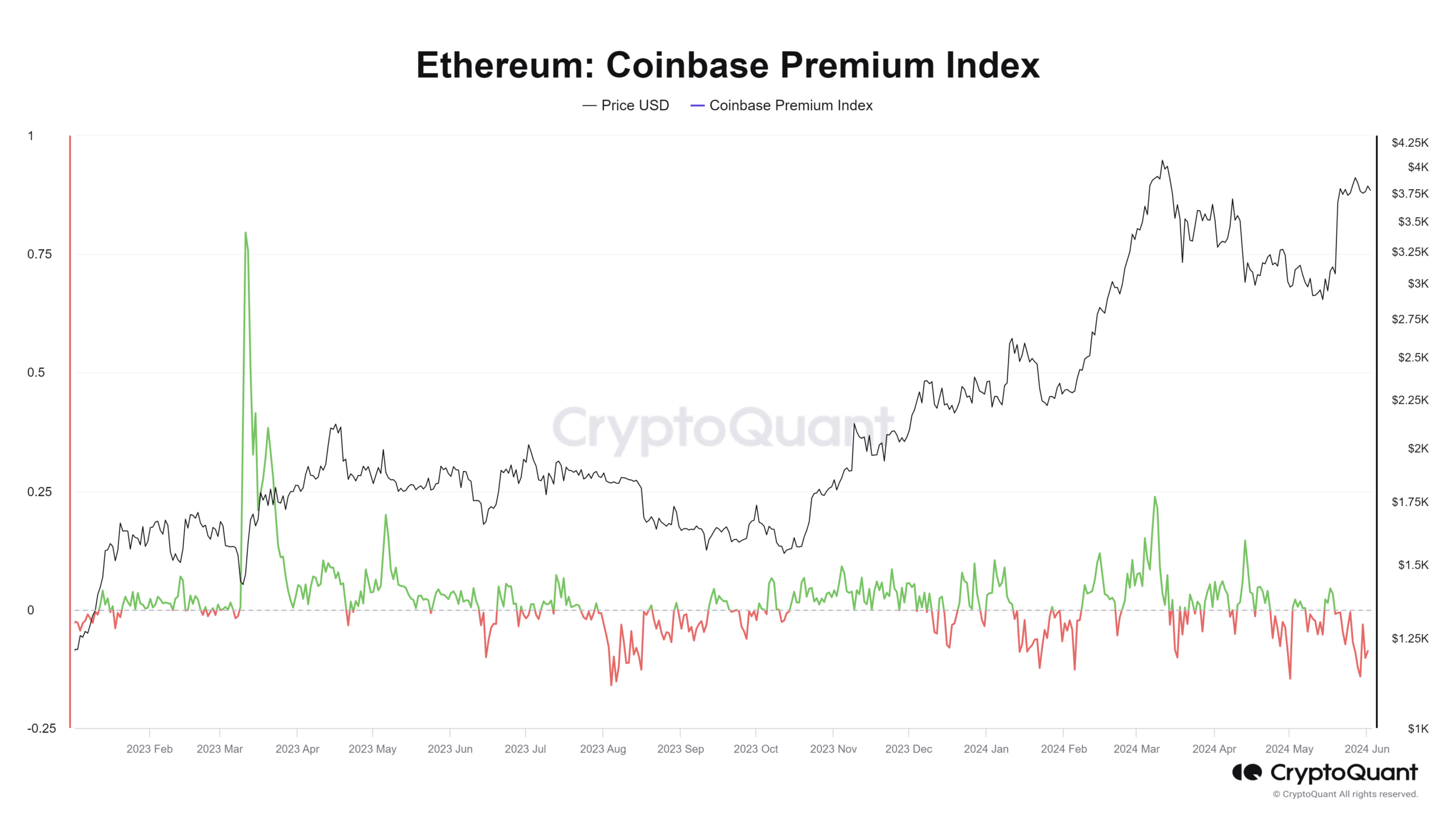

Coinbase Premium reached 2024’s lows

The Ethereum Price Differential between Coinbase and Binance, represented as a percentage, illustrates the gap between the ETH/USD trading pair on Coinbase and the ETH/USDT pair on Binance. This index offers valuable insights into investor demand from the US market, as they primarily use Coinbase over Binance for their transactions.

In August 2023, the premium for Ethereum took a significant dive to -0.16. A mere ten days later, the value of Ethereum plummeted from $1,800 to $1,600. Although the Premium Index doesn’t predict every price decrease, a decline in this indicator is a clear sign that demand in the Atlantic region could be waning.

On the 29th of May, the Ethereum price dropped to a level of -0.141, indicating decreasing demand despite trading above $3,700.

Other clues that ETH prices might retrace soon

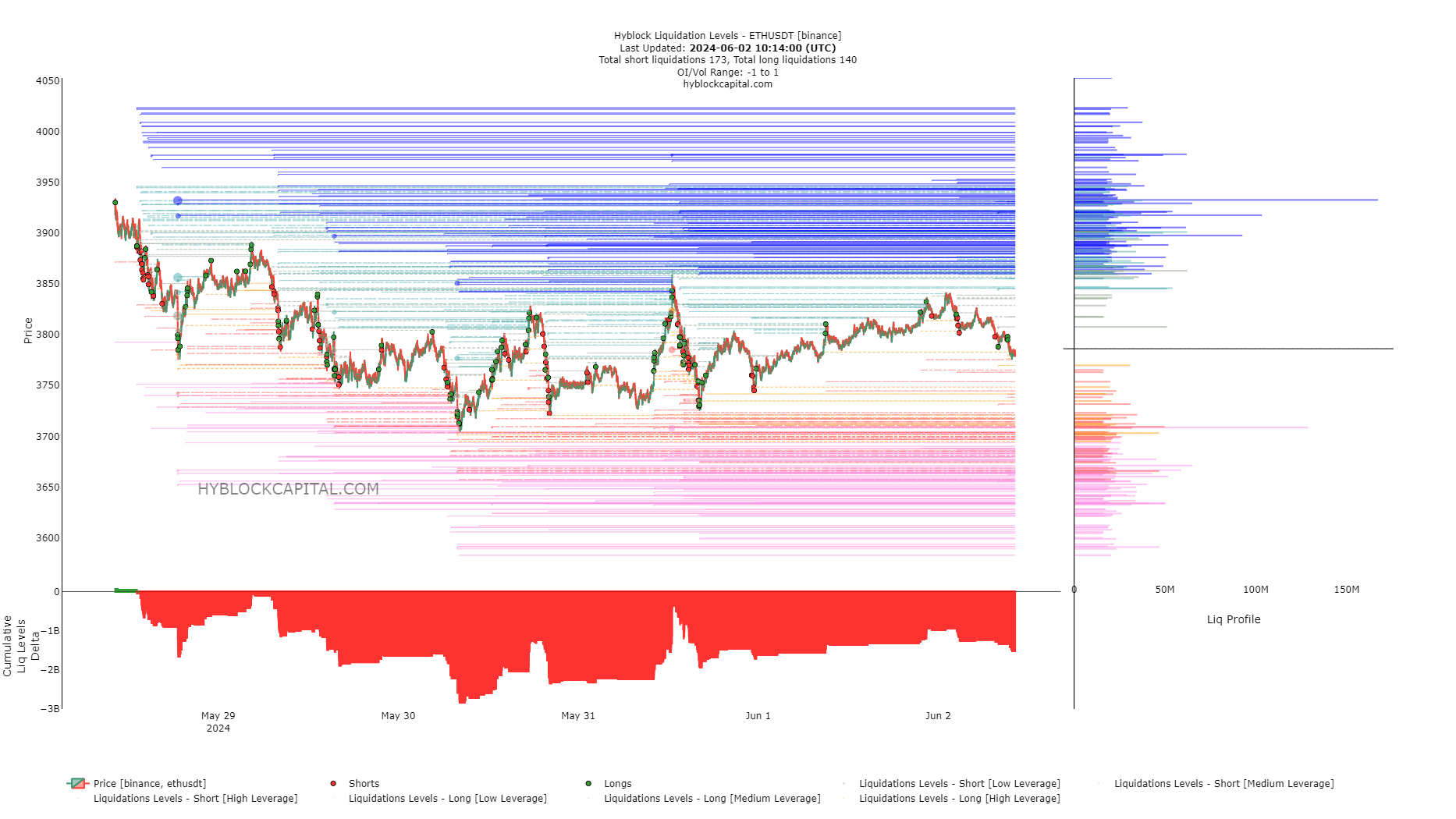

Based on the data from Hyblock, the total change in liquidation levels showed a significant deficit. Although this figure has become less negative over the last two days, there are still more short positions than long ones.

In simpler terms, if the prices increase significantly, it may cause many traders with bearish positions to sell their assets in a rush. This occurred on May 31th when the price surged past the liquidation levels of bears, which were only slightly below the current market price.

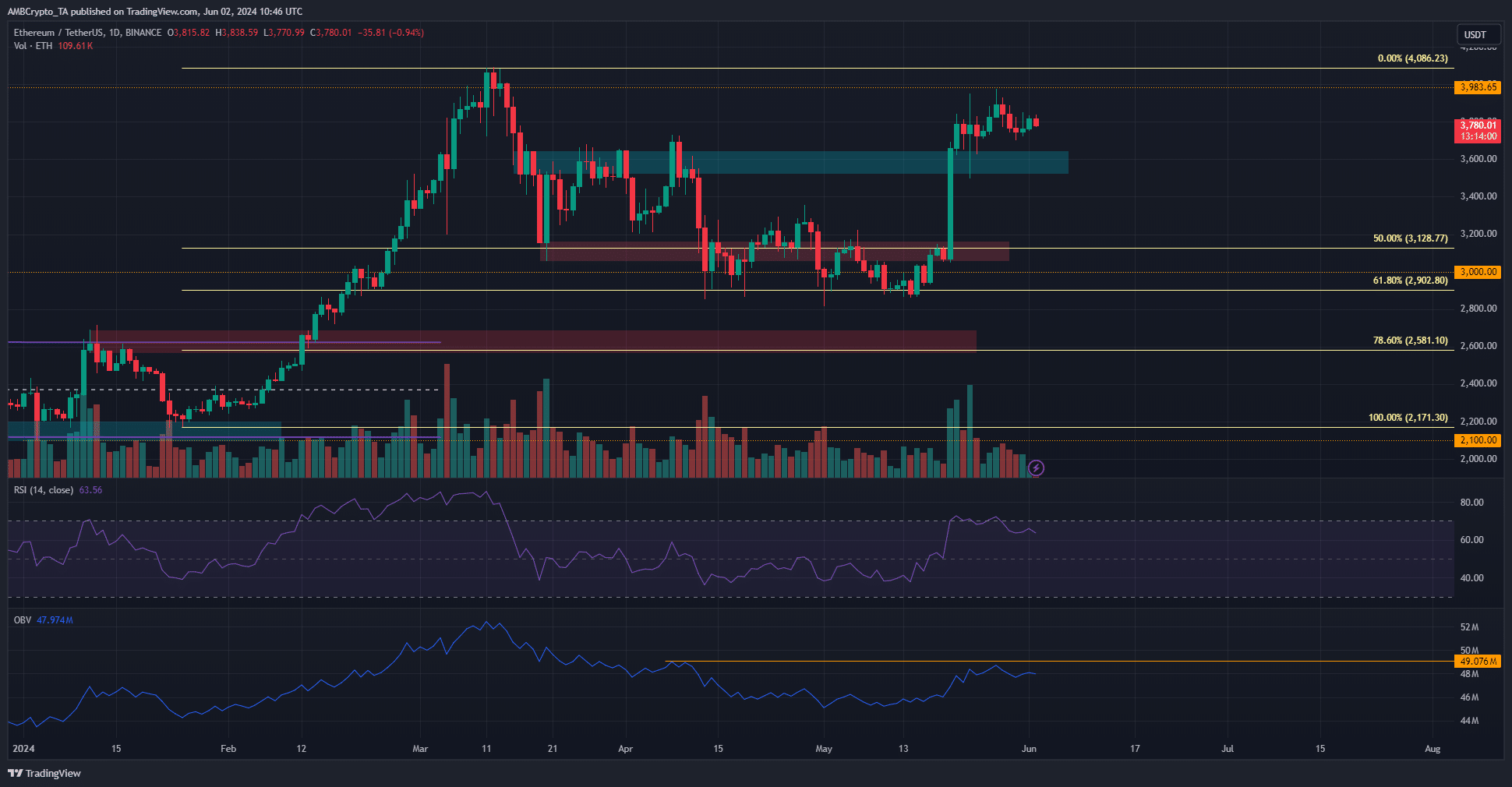

As a crypto investor, I’ve noticed that the cyan-shaded area between $3540 and $3640 on the chart served as a significant demand zone in March. The market’s structure was bullish at the time, making this area crucial for the short term. However, the On Balance Volume (OBV) indicator failed to surpass its previous high from April. This failure suggested that there wasn’t enough consistent buying pressure during the recent price rise, increasing the likelihood of a decline toward $3600.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on the analysis of Fibonacci retracement levels, the overall direction of the market has been seeing a persistent uptrend. There was a pullback to around $2.9k, which represented a 61.8% retracement level earlier this year. However, prices bounced back in May and continued their upward movement.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-06-03 01:27