-

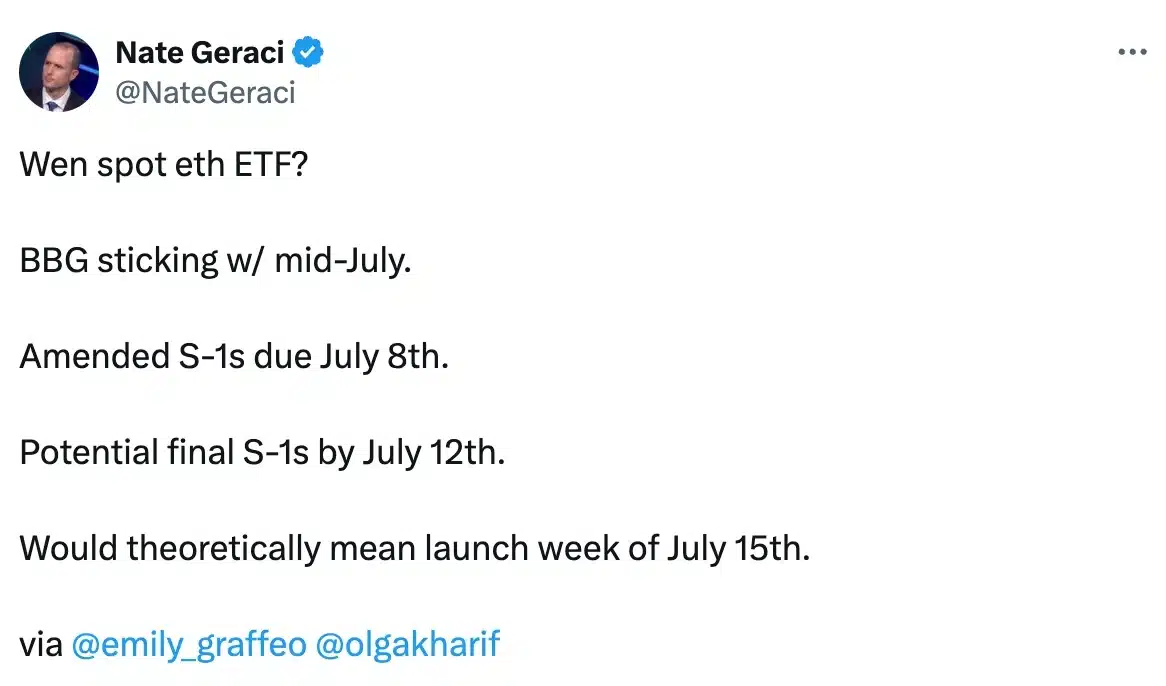

Nate Geraci predicted that Ethereum ETFs could be approved on the 15th of July.

Despite the growing anticipation around ETH ETFs, the price of the altcoin dropped 2.54%.

As a crypto investor with some experience under my belt, I’ve grown accustomed to the rollercoaster ride that comes with investing in digital assets. The latest development in the world of Ethereum ETFs has piqued my interest, and I’ve been keeping a close eye on the news.

The long-awaited approval of the spot Ethereum [ETH] ETF may have received a new date.

Based on Nate Geraci’s assertion, there’s a strong likelihood that the Ethereum spot ETF will be given the green light by July 15th.

According to Geraci’s post, a revised S-1 submission for Ethereum ETFs is anticipated in July, and it’s possible that the SEC will give their final approval as early as the 12th of that month.

Based on Geraci’s perspective, there seems to be no compelling reason for the SEC to reject ETH ETFS on July 15th.

As an analyst, I’d like to point out that the current hold-up is due to the SEC’s demand, made on the 28th of May, for companies to rectify minor issues in their S-1 submissions.

The reason behind the delay

According to reliable sources, the parties involved are actively working on finding solutions to the ongoing issues.

As a researcher following the securities industry, I’ve been keeping an eye on the SEC’s decision to approve 19b-4 filings in May. This could potentially bring good news for issuers, as it may expedite the process and make things work more smoothly in their favor.

In a recent conversation with Bloomberg TV, Steve Kurz, who heads asset management at Galaxy Digital, offered additional insight on the subject.

“We’ve gone through this procedure before. This is a systematic approach, and it’s just for show. The Securities and Exchange Commission (SEC) is already involved. We’ve done something similar for the Bitcoin ETF, so we are familiar with the necessary steps and procedures.”

Bitcoin ETF vs. Ethereum ETF

Due to hold-ups in the Ethereum ETF’s approval process, business leaders are now making parallelisms between this situation and the past attempts to get Bitcoin [BTC] ETFs authorized.

In July 2013, the Winklevoss brothers, who are the co-founders of Gemini cryptocurrency exchange, first submitted an application to the Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF) based on bitcoin spots.

By January 2024, approximately a decade had passed, and following multiple applications and stringent review by the Securities and Exchange Commission (SEC), approval was eventually granted for a total of eleven Bitcoin Exchange-Traded Funds (ETFs).

While some contend that Bitcoin’s ETF approval process encountered some delays, yet the path to acceptance was generally uncomplicated. In contrast, Ethereum’s ETF approval journey has been entangled in intricate regulatory issues.

This has led to many believing that ETH ETF will not be a good competition to BTC ETF.

Will ETH match the BTC ETF hype?

During the latest episode of the “Bankless” podcast, Matt Hougan, who is the CIO at Bitwise, made similar comments.

“I believe the market cap of Ethereum ETFs won’t reach that of Bitcoin ETFs, yet it’s anticipated to surpass the trillion-dollar mark.”

Despite the anticipation that Ethereum’s price would increase following the approval of the ETH ETF, it instead remained unchanged.

As of now, Ethereum was priced at $3,351 during our latest check, representing a 2.54% decrease over the past 24-hour period, based on data from CoinMarketCap.

Read More

- AUCTION/USD

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Solo Leveling Season 3: What You NEED to Know!

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- XRP/CAD

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-07-03 22:15