- A crucial resistance at $68,000 could trigger a BTC pullback.

While the coin might recover to $72,000 later, the price might trend higher.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Bitcoin’s recent surge to $67,740 does not necessarily mean that the price will only move upward. Based on my analysis of the current market conditions, there is a possibility that BTC could drop to $60,000 due to a crucial resistance level at $68,000.

According to AMBCrypto’s market analysis, Bitcoin‘s (BTC) recent surge to $67,740 does not guarantee an upward trend. Instead, it’s possible that the price may take a dip and fall to around $60,000.

As a researcher studying market trends, I utilized a tool called a liquidation heatmap to reach my findings. This visual representation assists traders in mitigating potential losses by highlighting high-risk areas. Notably, prominent liquidation zones may function as hidden support or resistance levels.

North is not the only way

Based on Coingeasiness’s data analysis, I identified a significant concentration of liquidity in the Bitcoin market between the prices of $67,626 and $68,000. This pattern suggests a potential likelihood of Bitcoin reaching these levels once more.

A significant barrier to further price increase existed at $60,160. Consequently, potential resistance in the $67,000 to $68,000 range could cause Bitcoin to retreat to $60,000. Later on, this level might function as support.

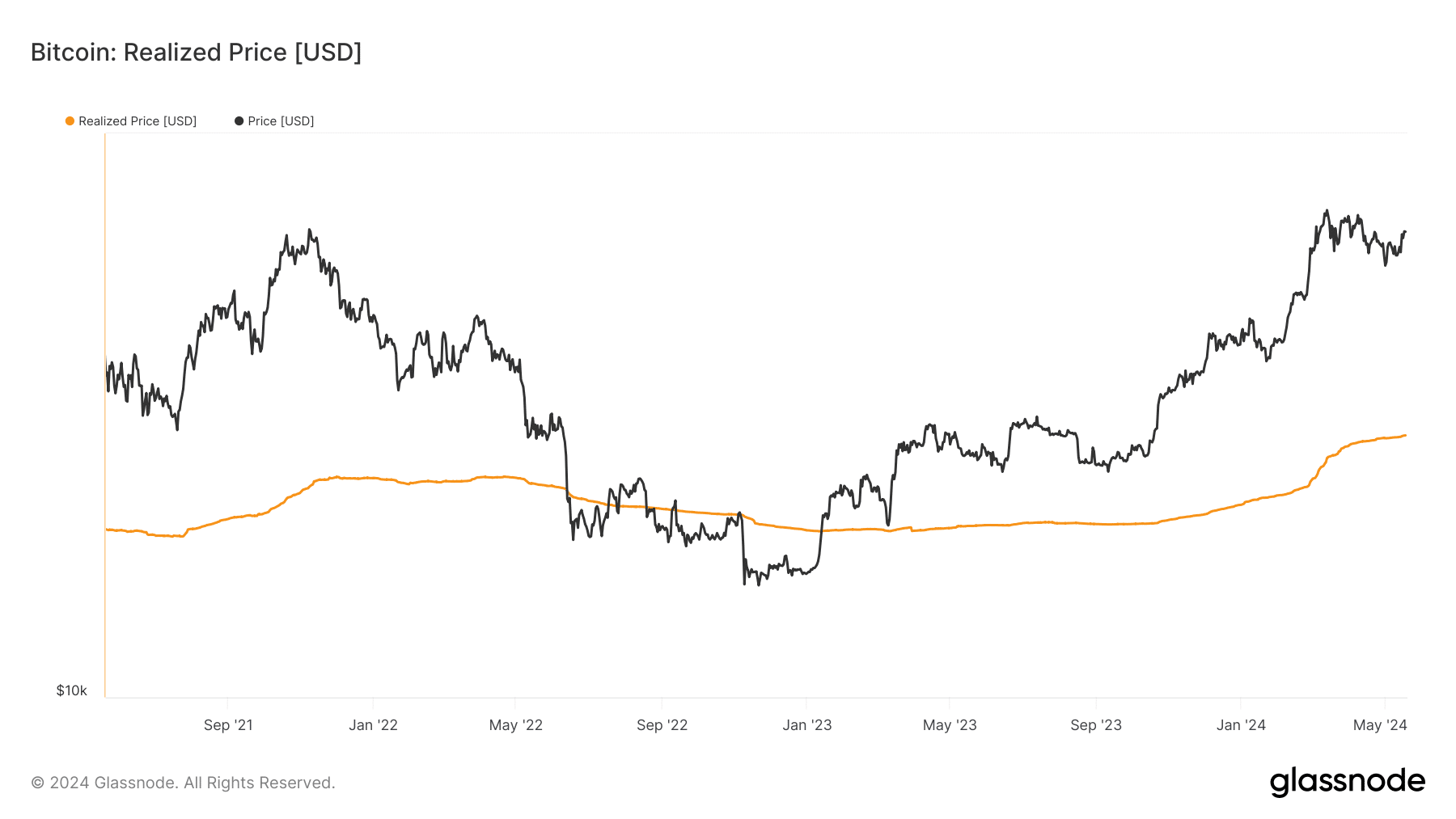

The location with the greatest accumulation of funds was worth approximately $72,000. This level could serve as a target for the upcoming price increase in Bitcoin. This predisposition was determined by the Realized Price.

The Realized Price is calculated by dividing the total realized value of all Bitcoin transactions by the current Bitcoin supply. It provides insight into the average price at which all coins in circulation were last purchased, reflecting the historical cost basis for the entire market. Similar to a liquidation heatmap, this metric can function as an indicator of potential support or resistance levels based on past buying trends.

Bitcoin is not back to the bear market

As a researcher studying the cryptocurrency market, I would explain it this way: When the Realized Price matches or surpasses Bitcoin’s current value, that signals a bear phase for Bitcoin. For instance, in November 2022, the Realized Price crossed over Bitcoin’s price, signifying a downward trend and a potential crash in the market.

At present, the Realized Price amounts to $29,142 – a figure that is more than fifty percent lower than the price at the time of publication. This information implies that Bitcoin has yet to reach its peak during this market cycle.

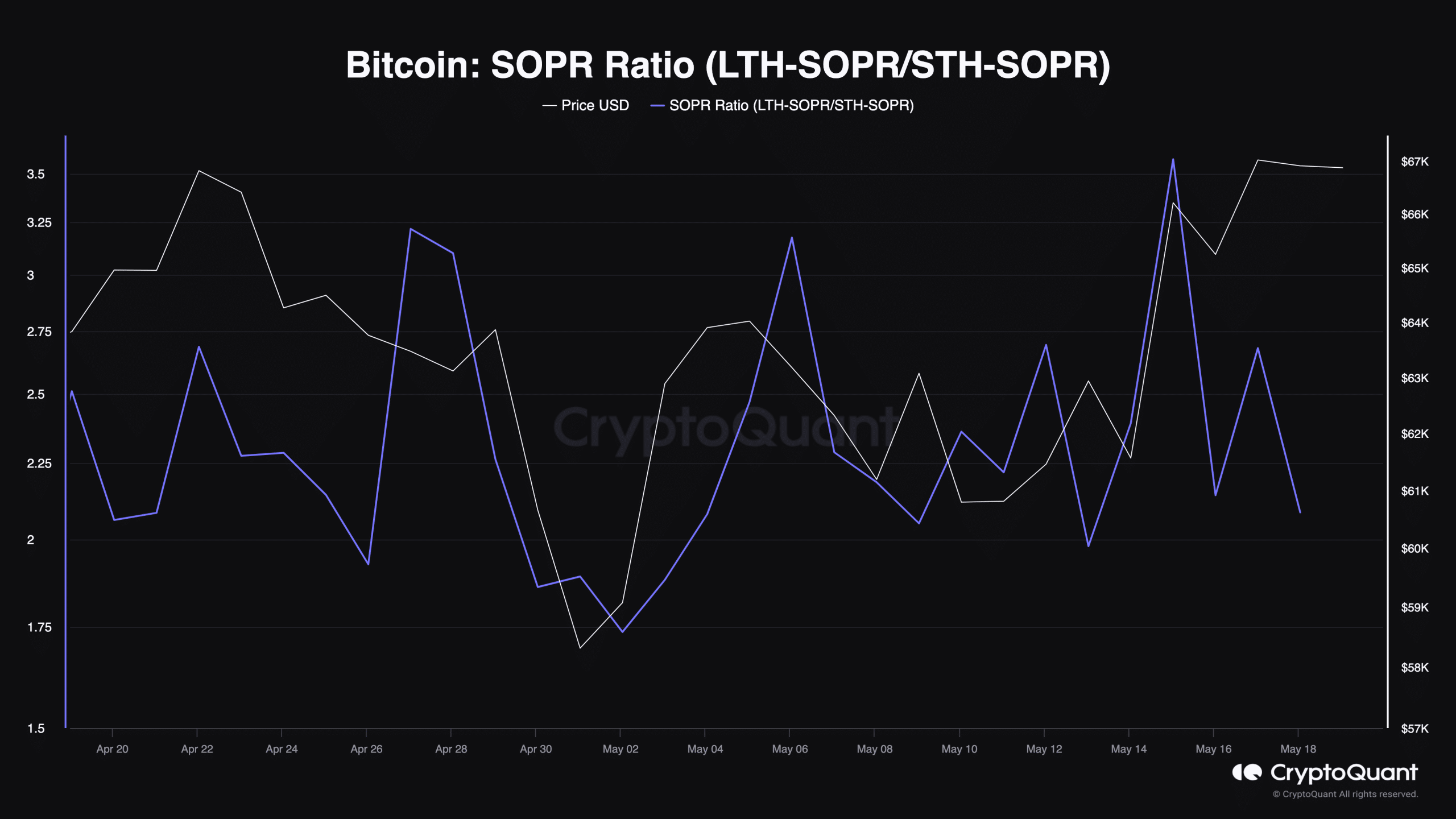

Another metric we evaluated was the Spent Output Profit Ratio (SOPR). Simply put, SOPR gauges the average profit or loss experienced by all transactions in the market when Bitcoin is spent.

As a financial analyst, I would explain that the value of this particular metric is derived from the quotient of the long-term investors’ Spent Output Profit Ratio (SOPR) and the short-term investors’ SOPR. A larger SOPR ratio for long-term holders implies they have realized greater profits compared to their short-term counterparts.

If the situation holds true, it implies that the market is nearly reaching its peak. On the other hand, a subpar SOPS (Spend Output Ratio) ratio signifies that short-term investors have secured greater profits compared to long-term investors.

At the moment of publication, the ratio stood at 2.08. This decline might be a sign that Bitcoin’s price could increase further. For instance, this ratio reached an identical value prior to Bitcoin’s record high in March.

The metric’s present condition hinted at a potential BTC surge. A plausible target for this upswing might be $72,000.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

But as mentioned earlier, the first step to hitting the region could be a correction to $60,000.

During this period, Bitcoin might experience a pause in its price movement with no significant gains or losses. Subsequently, there could be a gradual withdrawal of capital from the cryptocurrency, leading to a potential decline before any potential recovery.

Read More

- JASMY PREDICTION. JASMY cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-05-20 10:15