-

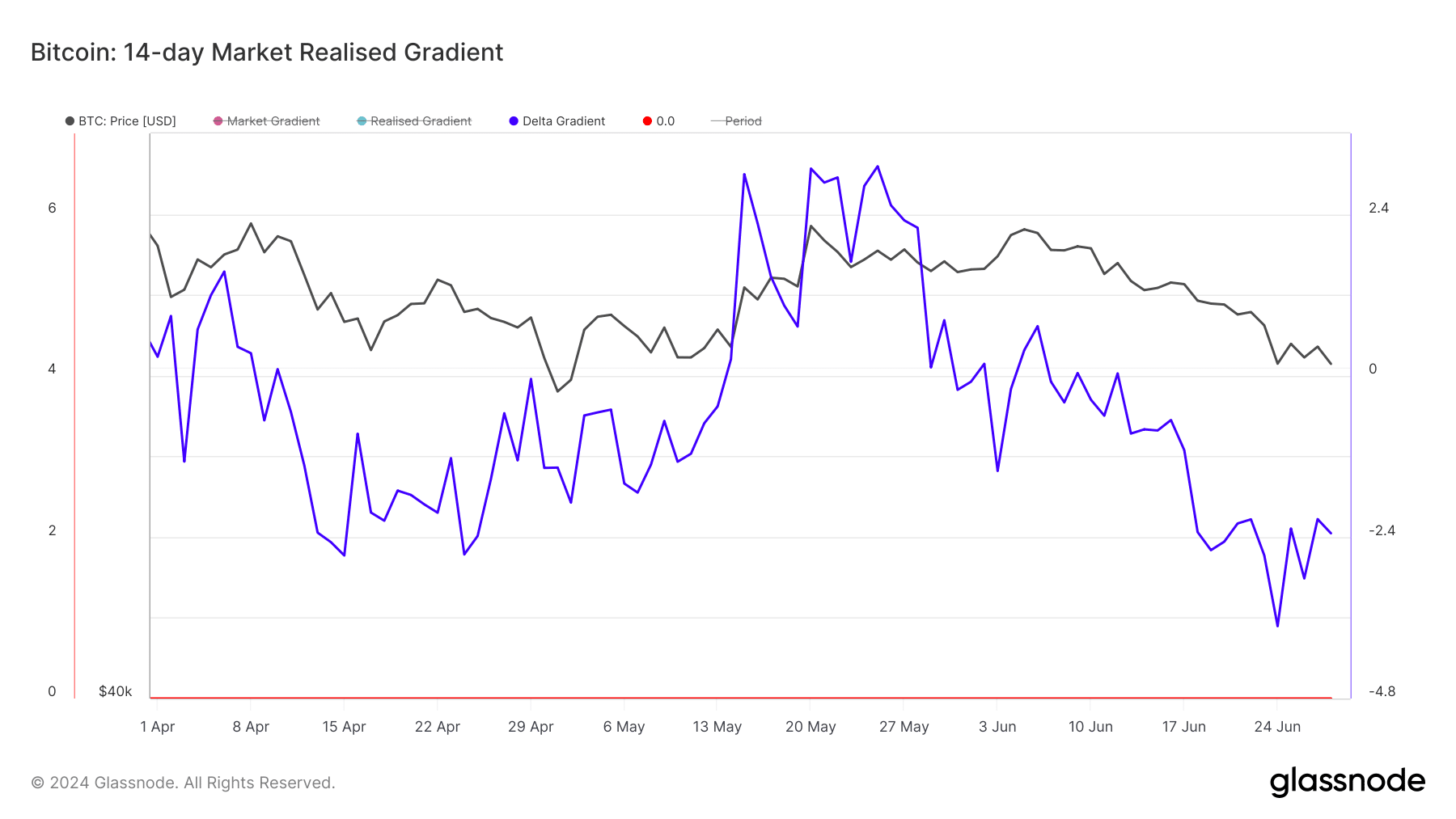

The Delta Gradient revealed that Bitcoin’s potential decline could last one to two months.

The fall in active addresses raises concerns about demand for BTC.

As a seasoned crypto investor with a few battle scars from past market corrections, I can’t help but feel uneasy about the latest developments in Bitcoin’s price action. The Delta Gradient revealing a potential decline that could last one to two months and the falling active addresses raising concerns about demand for BTC are not signs of a healthy market.

Based on historical trends, if Bitcoin’s [BTC] price behavior follows a familiar pattern, we can expect its value to decrease further than it currently is. This potential downturn may persist for approximately a month or two.

In the article published by AMBCrypto, they didn’t reach this conclusion carelessly; instead, they relied on substantial data. We will delve into the details. One significant indicator that supports this forecast is the Delta Gradient.

South is the way

the Delta Gradient. This metric compares the rate of change in momentum (the speed at which a coin is gaining or losing value) with its true organic capital – the underlying economic value derived from its fundamental attributes such as technology, adoption, and use case. In simpler terms, it helps us understand whether the price swings are driven more by market speculation or by real economic developments.

When the gradient is positive, an uptrend appears. Most times, this uptrend lasts 28 to 60 days.

At the moment of publication, Bitcoin had experienced a decline of 2.34 percent. This figure in the red suggests that the price drop could persist, and the duration of this potential downtrend might be comparable to what we’ve recently seen.

From my perspective as an analyst, at the current moment, Bitcoin is being traded at a price of $61,062. This represents a 4.96% decrease over the last week. If the Delta Gradient persists in its downward trend, it’s possible that Bitcoin’s value could drop below the $60,000 mark again, as we have seen in the past.

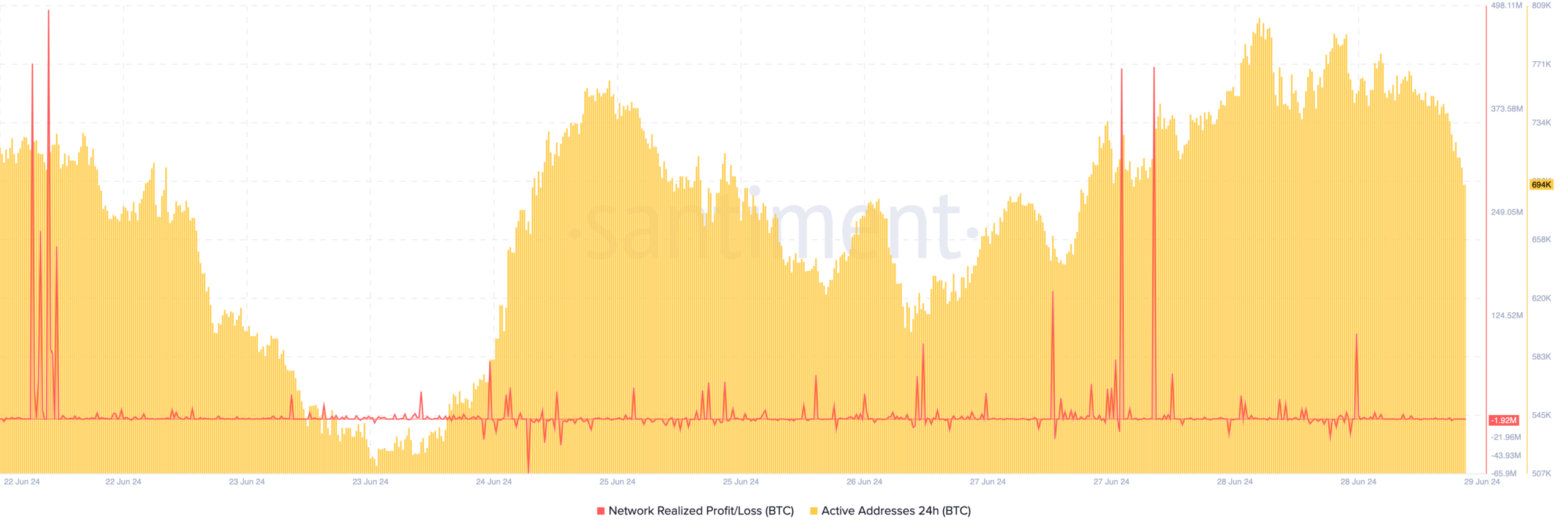

As a researcher studying Bitcoin’s price dynamics, I found that its response aligned with the situation when the Realized Price surpassed the current market value. Additionally, I delved into the examination of the Network Realized Profit/Loss.

Mixed signals appear on the charts

I. As an analyst, I would describe this metric as follows: This figure represents the total worth of deals that have resulted in either gains or losses in the recent period. When this value is positive, it signifies a prevalence of profitable trades. However, such a scenario may lead to a potential decrease in prices due to increased profit-taking.

Should the metric take on a negative value, this signifies an increase in actualized losses for Bitcoin. If this amount is substantial, there could be a price uptick. As reported by Santiment, the Network Realized Profit/Loss for Bitcoin stood at a deficit of approximately $1.92 million.

This implied that a chunk of the transactions on-chain ended in losses.

Normally, such a decline in supply is believed to signal an upcoming price hike. However, this may not hold true for Bitcoin given its decreasing network activity.

As a researcher observing the cryptocurrency landscape at present, I’ve noticed that the number of active addresses has decreased significantly in the past few days. It was previously hovering around the 1 million mark, but now stands at approximately 694,000. This metric is an essential indicator of user engagement and activity within the given cryptocurrency ecosystem.

In simpler terms, when Bitcoin’s price drops, as we’ve seen lately, it indicates that people aren’t actively trading or using Bitcoin extensively. This, in turn, might result in less demand for the cryptocurrency and potentially cause its value to decrease further.

Realistic or not, here’s BTC’s market cap in ETH terms

As a market analyst, I’ve observed that a decreasing demand often leads to lower prices. Nevertheless, according to my assessment based on current trends, Michael van de Poppe, another analyst, believes that Bitcoin’s (BTC) correction may come to an end shortly.

According to him, the recently concluded week was good for the coin. He said,

As a cryptocurrency investor, I’m observing an encouraging development with Bitcoin’s weekly candles. I anticipate that the correction may have largely run its course at this point. It’s important to note that during past market cycles, we didn’t always experience the most pronounced deep corrections in every instance.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- POL PREDICTION. POL cryptocurrency

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Daredevil: Born Again Spoiler – Is Foggy Nelson Alive? Fan Theory Explodes!

- XRP CAD PREDICTION. XRP cryptocurrency

- BERA PREDICTION. BERA cryptocurrency

2024-06-30 09:11