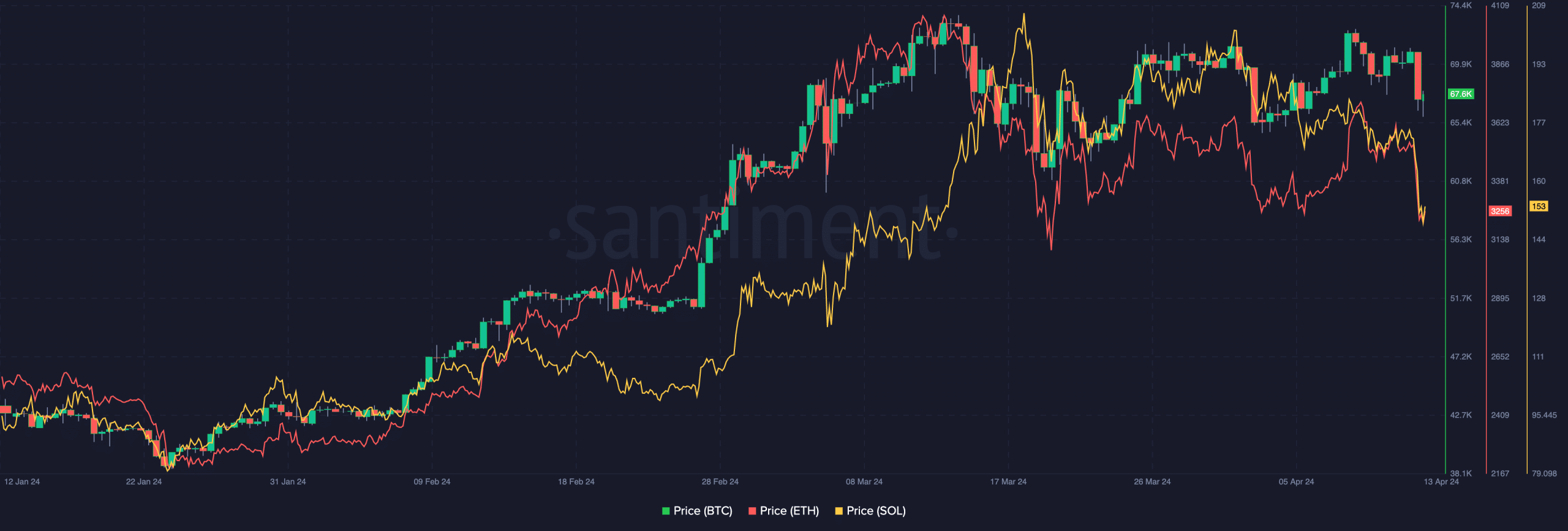

- Bitcoin, Ethereum, and Solana fell significant on the price charts

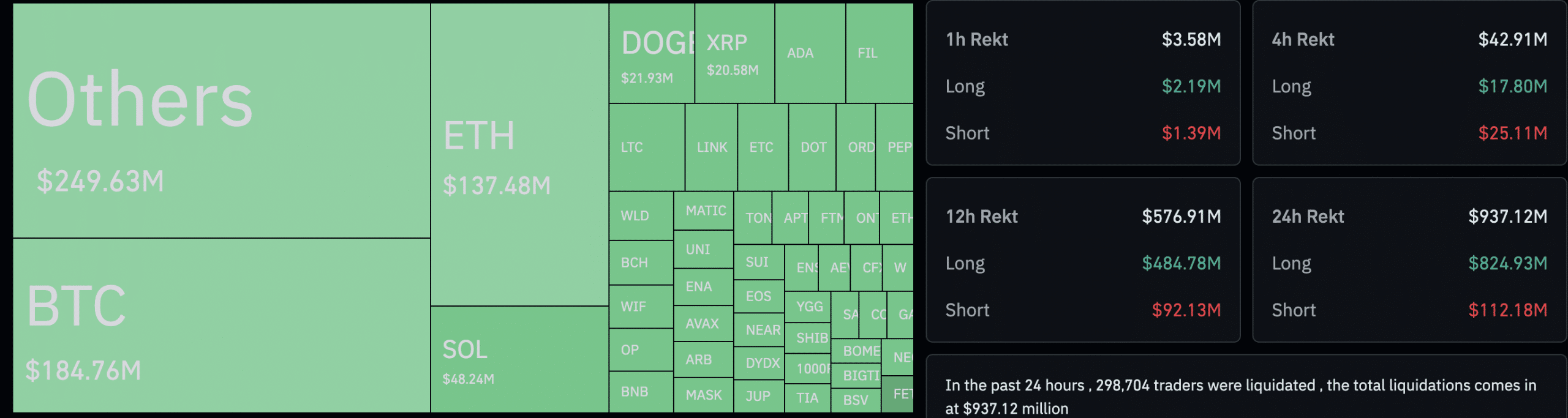

- Almost $1 billion worth of positions were liquidated in the last 24 hours

In the past week, Bitcoin’s price experienced a notable increase. However, it underwent a correction over the last 24 hours, resulting in a 4.95% decrease. At present, Bitcoin is priced at $67,829.94. The decline in Bitcoin’s value can be attributed to traditional markets experiencing a downturn due to heightened geopolitical tensions between Iran and Israel. Consequently, the S&P500 and Nasdaq indices dropped, while the value of gold rose as investors sought refuge in safe-haven assets.

When Bitcoin’s price dropped, it caused a domino effect, making other cryptocurrencies lose value on the charts as well.

Another one bites the dust

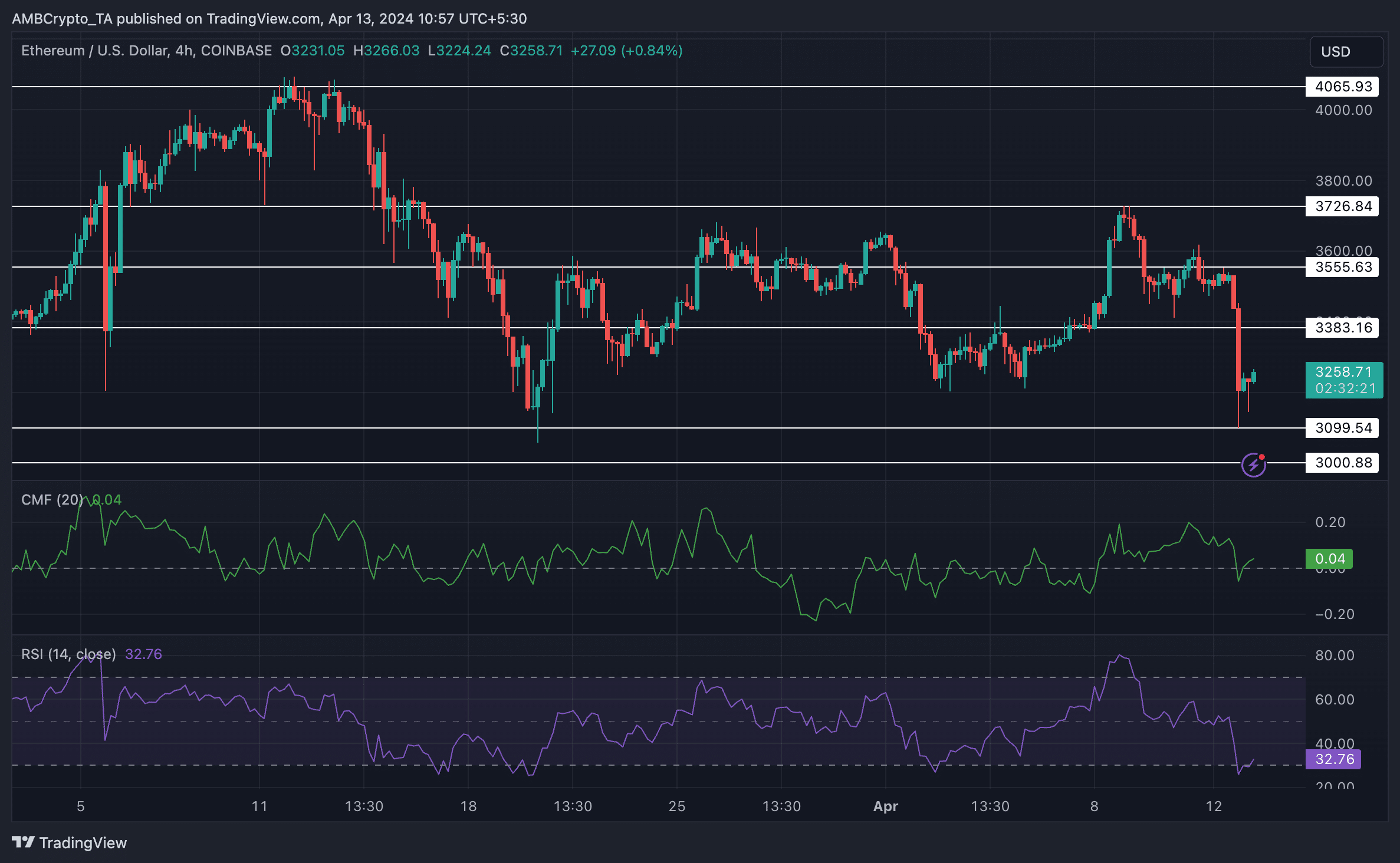

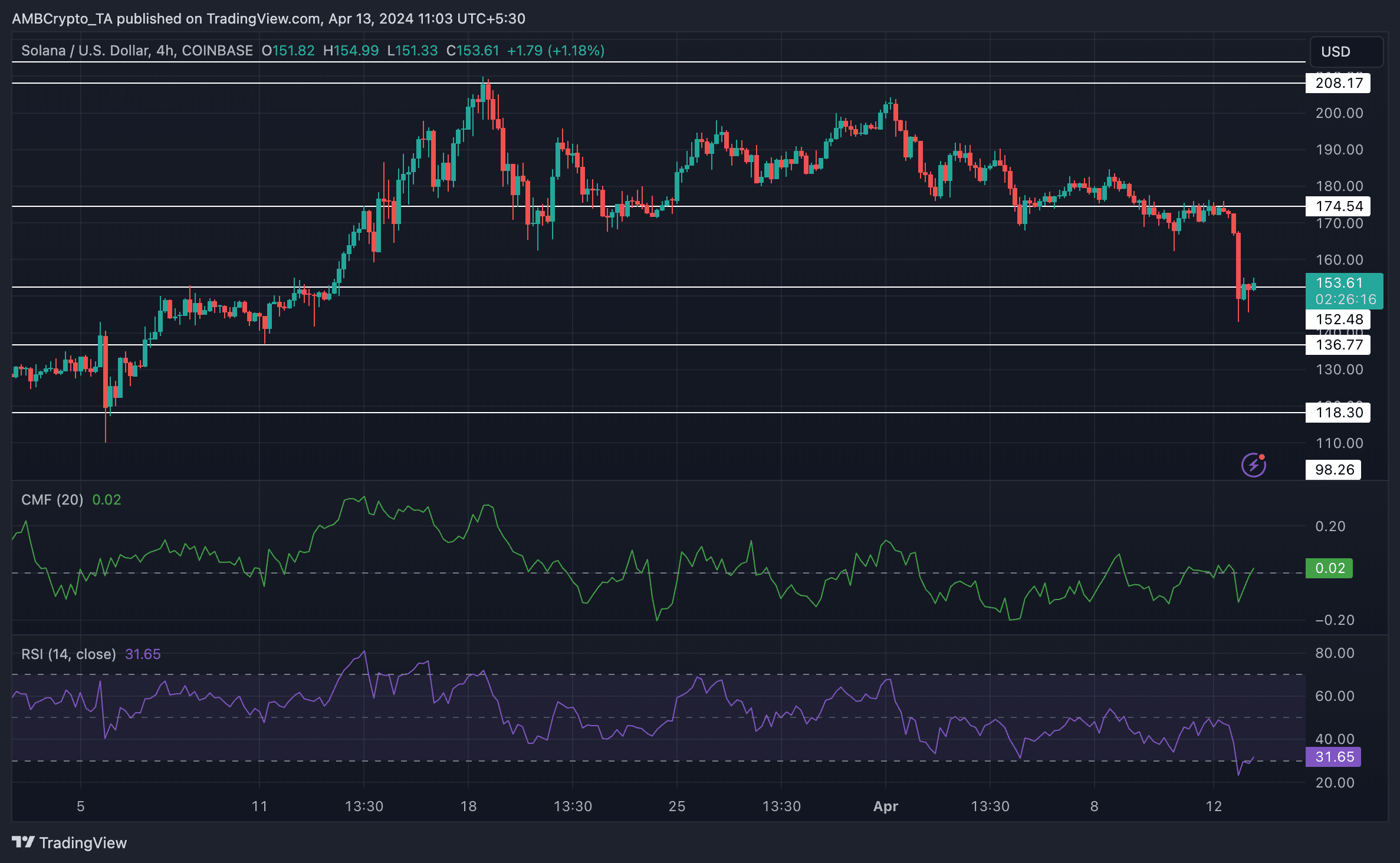

The prices of Ethereum [ETH] and Solana [SOL] dropped significantly in tandem with Bitcoin’s decline, resulting in a more severe loss for both. In the last 24 hours, SOL experienced a decrease of 11.93%, while ETH saw a decline of 8.33%. Consequently, these cryptocurrencies breached their previous resistance levels, negatively impacting their bullish momentum on the price charts.

The price of ETH dropped as low as $3099 during this market downturn. But it bounced back and reached $3256.96 by the present moment.

Prior to now, Ethereum reached that price point on March 20th. If Ethereum continues on its current path, it could hit $3384 again in the near future.

Starting from early April, Solana followed a similar downward path. Although the correction was not too old, the price chart of Solana suggested a possible drop in value. From the first day of the month onwards, SOL displayed several successive lower lows and lower highs, which were signs of a bearish market trend.

In order to rally, a massive resurgence in bullish momentum would be required for both ETH and SOL.

Are whales to blame?

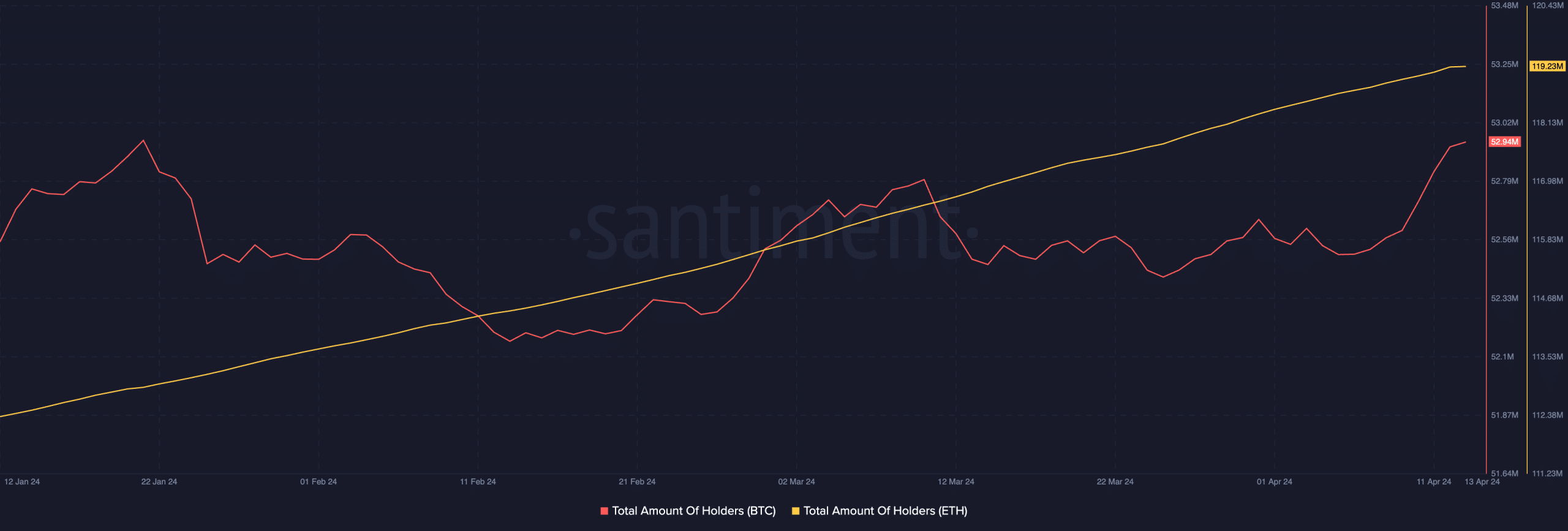

Although the prices of Bitcoin and Ethereum have experienced corrections, the demand for these cryptocurrencies hasn’t waned. Intriguingly, based on Santiment’s data analyzed by AMBCrypto, there has been a significant increase in the number of addresses holding both Bitcoin and Ethereal over the recent weeks.

It’s possible that the drop in prices recently was instigated by some large investors taking profits, referred to as “whales” in financial markets.

How are traders holding up?

Over the past day, a staggering $947 million in trading positions were terminated. Among these, approximately $824.94 million represented long positions. Those who had optimistically wagered on Bitcoin, Ethereum, and Solana suffered the greatest financial losses. However, it’s important to note that with Bitcoin’s halving approaching, it remains uncertain which way the price will trend.

Read More

- SQR PREDICTION. SQR cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- STG PREDICTION. STG cryptocurrency

- USD CHF PREDICTION

2024-04-13 10:47