- Bitcoin neared a decline below $50k for the first time since February.

- Global stock markets plummeted amidst Japan and Taiwan’s stock market crash.

As a seasoned analyst with over two decades of market experience under my belt, I have witnessed numerous market cycles, booms, and crashes. The current state of the crypto market, particularly Bitcoin [BTC], is reminiscent of some of the most turbulent times in traditional finance.

In the last day, there’s been a significant drop in the cryptocurrency market. Among all coins, Bitcoin [BTC] has been affected the most due to this market downturn.

Currently, Bitcoin (BTC) stands at $50,436 following a 16.21% decrease in its daily performance and a more significant 27% fall over the past week.

The significant decrease in value has sparked discussions among traders and experts about Bitcoin’s potential future trajectory, as well as identifying the reasons behind this steep price decrease.

Bitcoin to drop below $50k?

Following a drop to approximately $53,000, those with long investments amounting to over $600 million were compelled to sell, leading to a staggering overall decline of around $300 billion across the cryptocurrency market.

Experiencing another drop towards $50,000, over $6 billion in long positions had to be liquidated. This downward trend has intensified pessimistic feelings among traders, who are now actively purchasing at this lower price point, hoping to capitalize on the market dip.

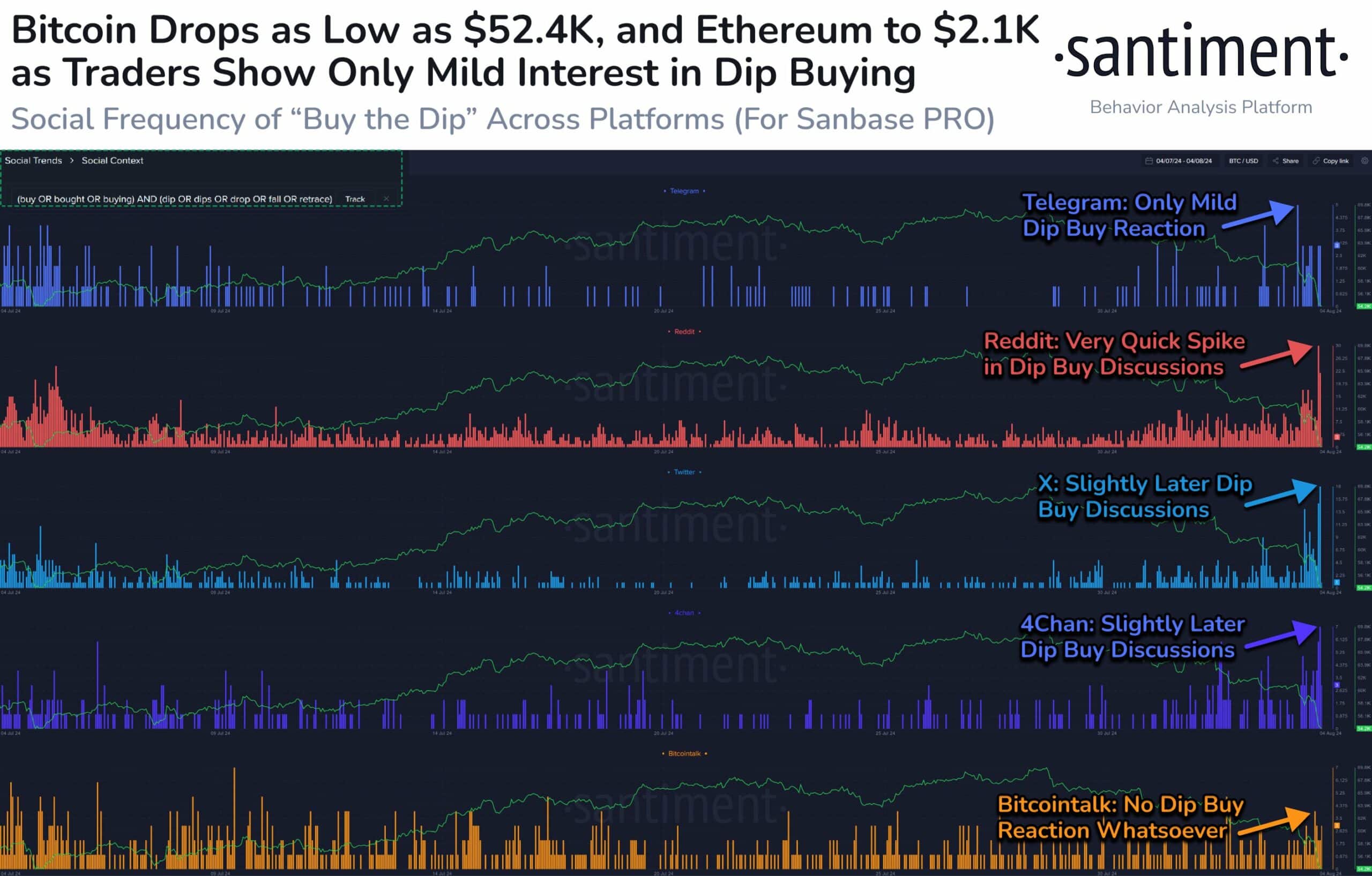

Based on sentiment analysis findings, there’s been a significant rise in talks about purchasing during market dips. Yet, the data indicates that investors and traders are currently showing less enthusiasm towards such market fluctuations.

The rise in trading activity, due mainly to large-scale selling off by holders, has amplified by about 127.75%. This surge, in turn, is contributing to a continued drop in prices.

Boosting sales can lead to increased stress, affecting the graphical representation of prices adversely. This tension, coupled with anxiety about potential future drops, is driving traders to sell off their investments at a loss due to emotional decision-making.

External macroeconomics driving BTC

Over the last week, international markets have been grappling with concerns about a potential economic downturn due to the Federal Reserve’s inability to reduce interest rates.

Due to increasing American debt levels, there’s been a significant increase in funds exiting the cryptocurrency markets, particularly from Exchange-Traded Funds (ETFs), as investors become uncertain about market conditions.

Moreover, the Japanese cryptocurrency market has triggered tremors across the broader crypto sector after experiencing a plunge of more than 8% within a day. Notably, analyst Marty Party highlighted this on his platform X.

“Japan rugpulled the world.”

Consequently, while the cryptocurrency market has made an effort to stay resilient during recent weeks, the tumbling international stock exchanges seem to be causing a drop in Bitcoin’s value. According to Spectator Index, this trend is evident even in Japan.

“Japan’s stock market falls over 4,000 points, the biggest single-day drop.”

As someone who has closely followed the cryptocurrency market for several years now, I can confidently say that the potential impact of a market crash involving major stocks like the Magnificent 7 and the SPY cannot be underestimated. Having witnessed the ripple effects of similar events in the past, I have seen how interconnected these markets are, and how a significant shakeup in one sector can easily spill over into others. In particular, the crypto market is highly sensitive to broader economic trends, and a crash in traditional stocks could very well trigger a sell-off among cryptocurrencies like Bitcoin (BTC). It’s a lesson I learned the hard way during the 2008 financial crisis, when the fallout from the collapse of major financial institutions sent shockwaves through the entire market. So while it may be tempting to dismiss such a scenario as unlikely, history has shown us that it is always better to prepare for potential risks rather than ignore them.

Besides Japan, Taiwan’s stock market experienced one of its most dismal days in over 57 years. As apprehension about a potential economic recession in the United States rises, future projections indicate a sharp decline.

What price charts suggest

In the last day, Bitcoin (BTC) has experienced a 17% drop, extending its downward trend that’s been ongoing for a month now. Over the past month, BTC has decreased by 5%, causing its market capitalization to fall below $1 trillion, to approximately $990 billion, according to CoinMarketCap.

Thus, AMBCrypto’s analysis showed that BTC was experiencing a strong downward momentum.

The Crypto’s Directional Movement Index (DMI) indicated a prolonged decrease in its value. Specifically, the positive index stood at 26, which was lower than the negative index at 29.

Moreover, The On Balance Volume indicates a decrease over the past 24 hours, implying that there was significant selling activity in the crypto market.

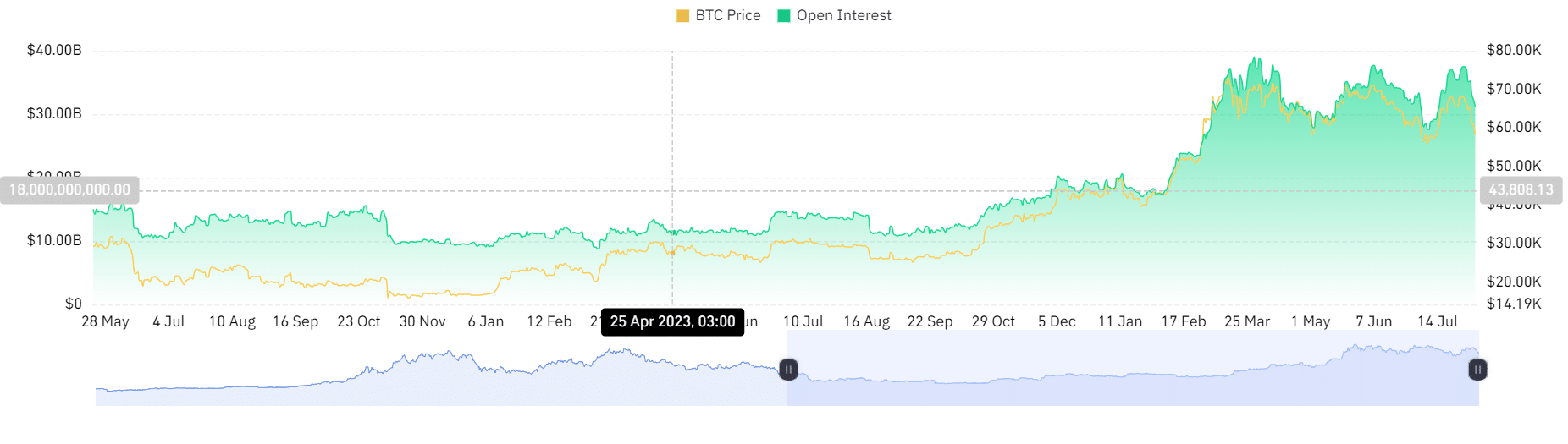

As a researcher delving deeper into the world of cryptocurrencies, my examination of ABCrypto’s data analysis on Coinglass unveiled a significant drop in its Open Interest – from a staggering $37 billion to a still substantial $31 billion. This notable decrease in Open Interest suggests that there has been a compulsory liquidation of leveraged positions.

Those who had wagered on rising prices are selling off their investments at a lower value, choosing not to invest further.

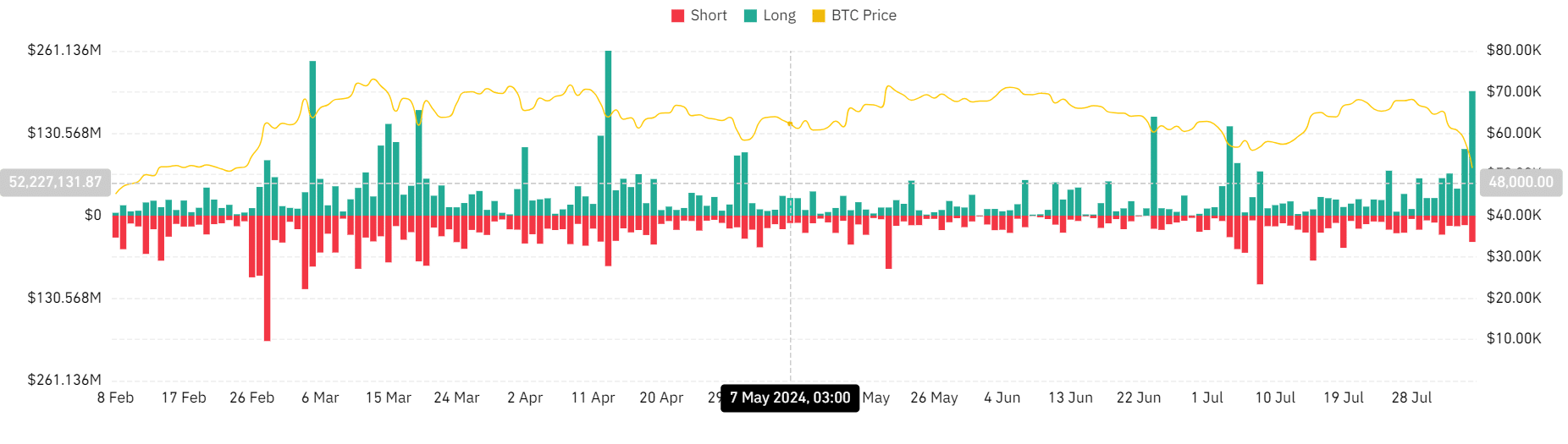

As a seasoned trader with over a decade of experience under my belt, I’ve learned that market phenomena can be influenced by various factors, and one such factor is liquidation for long positions. In my career, I’ve witnessed firsthand how these liquidations can escalate, especially when they increase substantially like they have recently. For instance, seeing the liquidation for long positions jump from $105M to $200M on daily charts is a stark reminder of the market’s volatility and the need for careful position management. It’s crucial to keep an eye on these trends as they can significantly impact a trader’s portfolio and overall success in the markets.

As a seasoned investor with over a decade of experience in the financial markets, I have seen my fair share of market fluctuations and trends. Based on my observations and analysis, the recent behavior of Bitcoin (BTC) has left me feeling uncertain about its future direction. This uncertainty is reflected in the growing number of holders who are choosing to let go of their positions due to a lack of confidence in BTC’s current trajectory. While I have always been a firm believer in the potential of cryptocurrencies, I cannot ignore the signs that suggest BTC may be heading for a correction or even a more significant downturn. It is essential to stay vigilant and adapt to changing market conditions, and I will continue to closely monitor BTC’s movement to determine if it remains a viable investment opportunity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Will BTC decline below $50k?

Bitcoin’s value dropped from around $66,000 to approximately $50,000 within the past week. As financial market worries intensify and there’s a growing pessimistic outlook, it seems that the cryptocurrency market could experience turbulence throughout August.

If the current market trends continue and Bitcoin (BTC) ends the day at a price lower than $50,670 on daily charts, it is likely to encounter its next significant support level around $47,779.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Silver Rate Forecast

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

2024-08-05 15:04