- XRP’s price dropped by more than 11% in the last 24 hours.

A few market indicators suggested that the bearish trend might change.

After the market downturn, Ripple‘s [XRP] price has seen frequent drops without indicating any signs of bouncing back.

A potential price drop may be on the horizon, as the most recent token test did not confirm a long-term uptrend, indicating a possible downturn.

XRP has obstacles to cross

Based on data from CoinMarketCap, the token’s price decreased more than 18% within the last week. The token experienced a significant drop in the past 24 hours, with a decline of over 10%.

Currently, XRP is being bought and sold for around $0.4844 each, giving it a total market value of more than 26.7 billion dollars.

During this period, the price of XRP didn’t touch the triangle pattern, which had been forming for six years, with it dipping beneath the $0.5 mark instead.

If the token failed to check the specified pattern, its value could potentially decrease more in the upcoming days for investors.

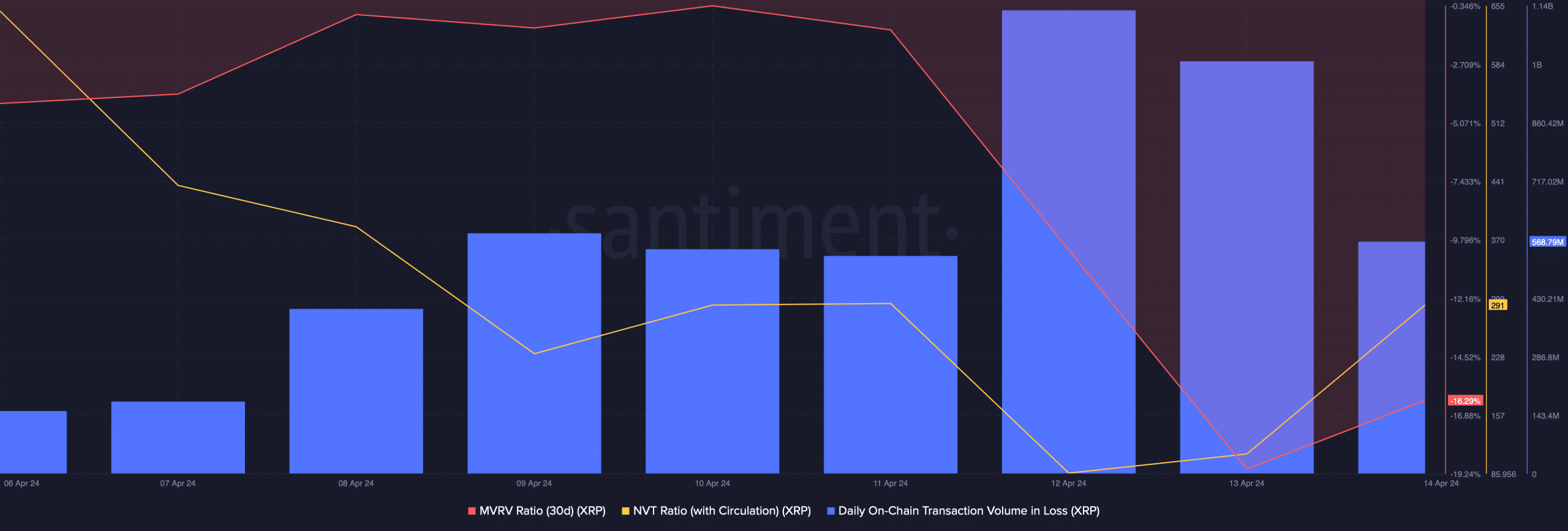

According to AMBCrypto’s examination of Santiment’s figures, several indicators suggested a bearish trend for the token. Notably, its MVRV ratio experienced a significant drop during the previous week.

After a dip, its NVT ratio also gained upward momentum, hinting that XRP was overvalued.

In recent days, the daily transaction volume of the token on the blockchain, representing its loss phase, has seen a significant increase. This surge can be linked to the recent market downturn.

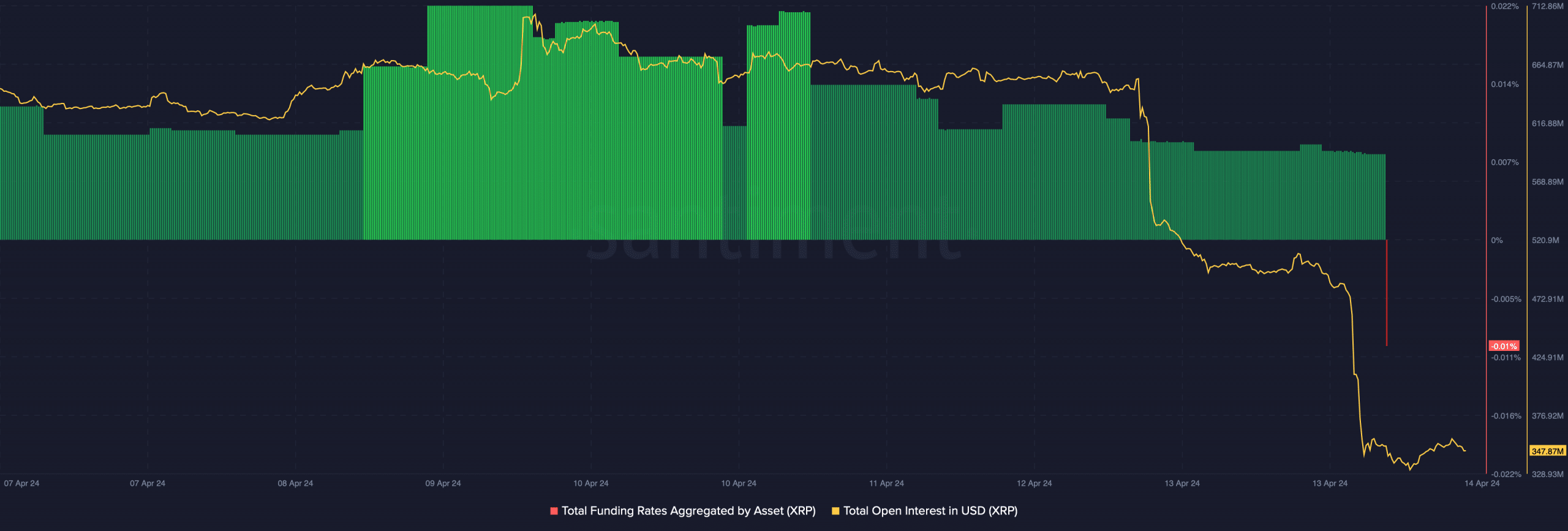

Despite a bullish signal from XRP‘s derivatives metric, its Open Interest saw a significant decrease. This sudden change could potentially lead to a trend reversal for the token, enabling it to bounce back from recent losses.

The Funding Rate decreased, which often indicates a potential increase in asset prices. Typically, market prices don’t follow the same trend as the Funding Rate, implying a possible price surge in the near future.

A further downtrend incoming?

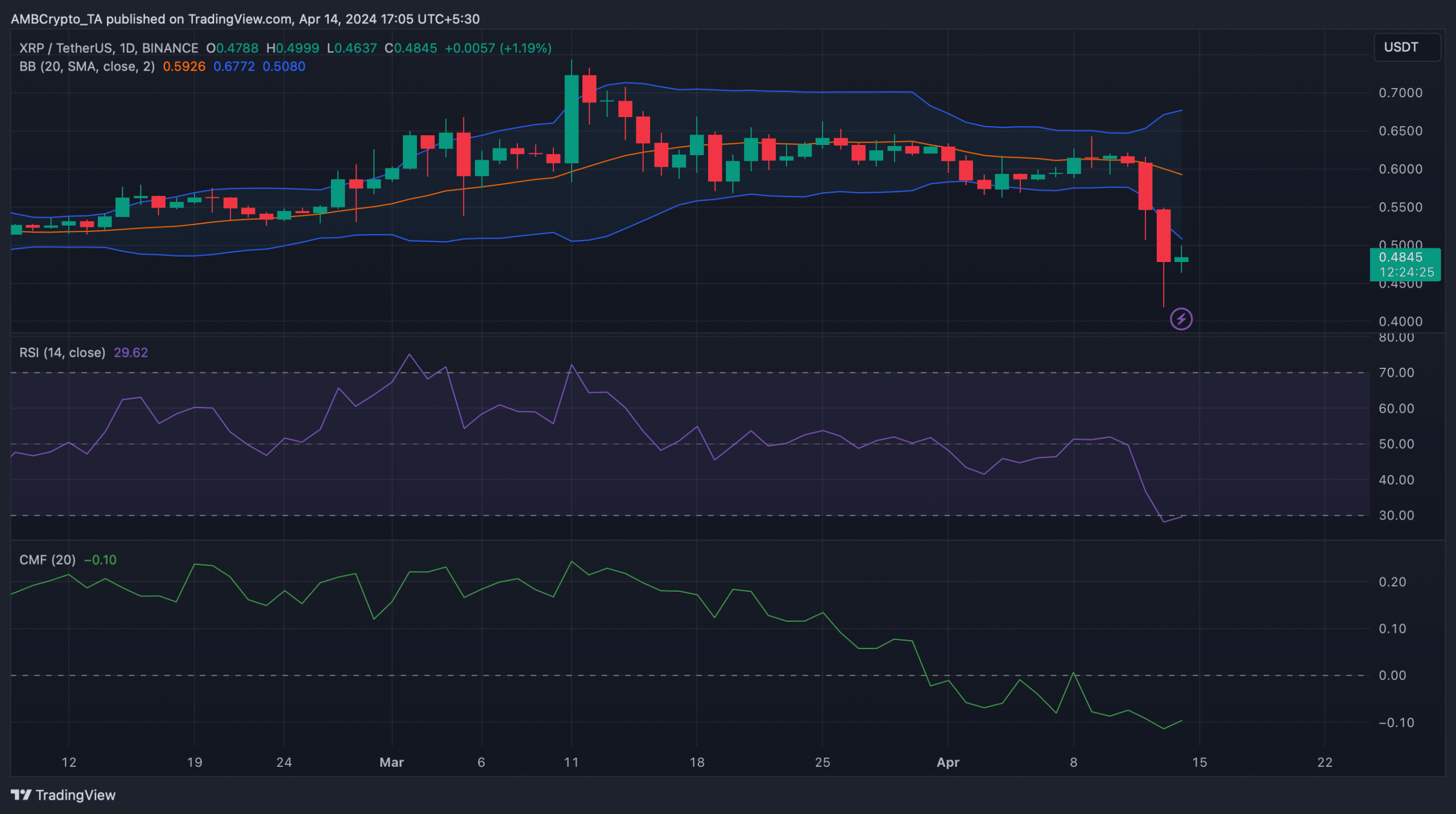

To gain a clearer perspective on XRP‘s direction, AMBCrypto examined its daily price chart in detail. The value of XRP reached the bottom boundary of the Bollinger Bands.

The RSI of the token, which measures its relative strength, has dipped into the oversold territory, signaling potential buying interest and a possible price rise. Additionally, the Chaikin Money Flow, another indicator of money flow, has ticked up slightly, suggesting a trend reversal and potential uptrend for the token.

Despite this, it’s important to note that no definitive statements can be made about the current global political situation, as it has become increasingly volatile and unpredictable.

The unresolved issues in the Middle East could potentially cause crypto markets to decline and maintain a downward trend for the next few weeks.

Read Ripple’s [XRP] Price Prediction 2024-25

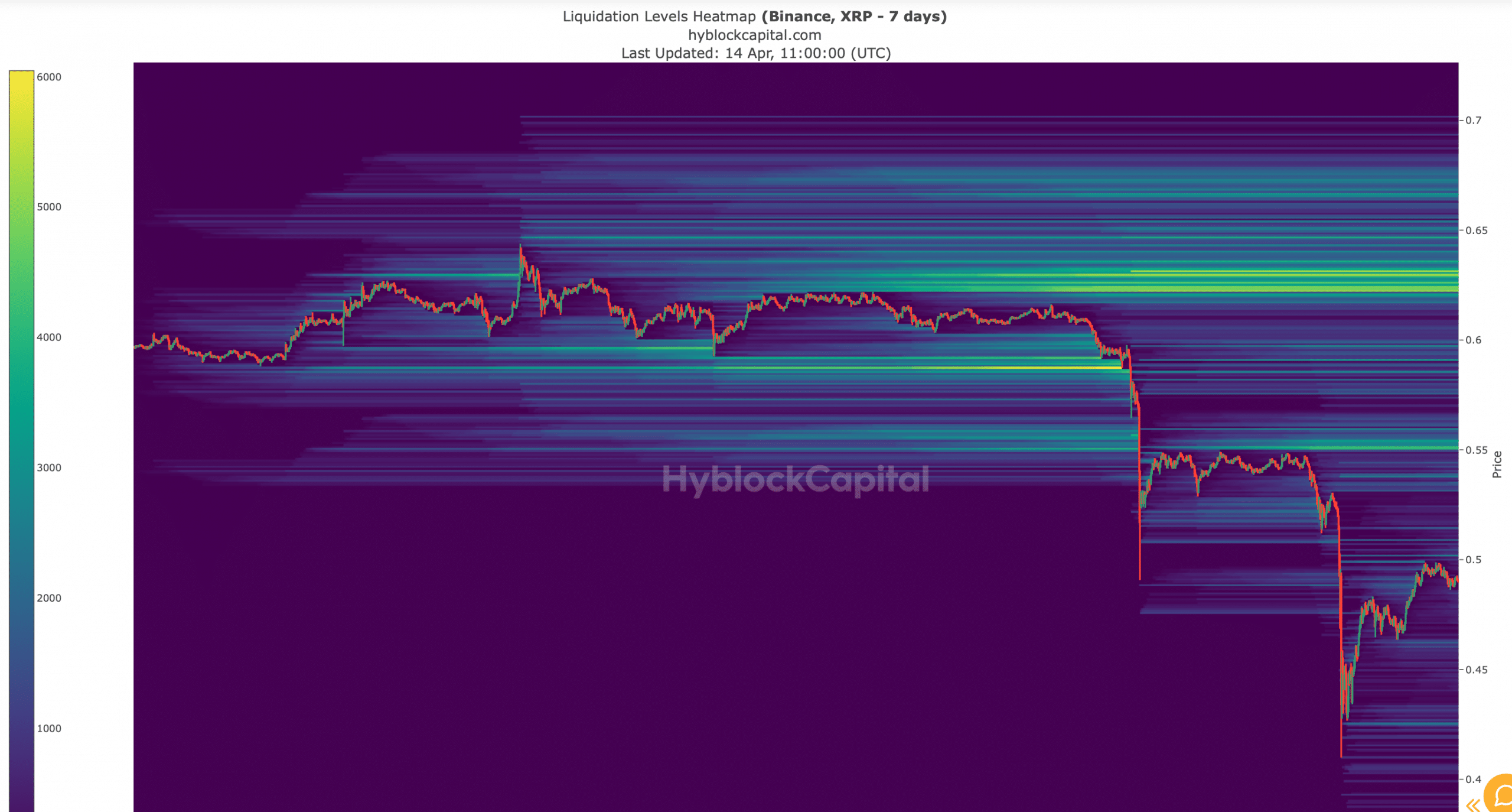

At AMBCrypto, we examined Hyblock Capital’s findings to identify potential low points for XRP should the trend decline further. Our analysis revealed a supportive level around $0.46.

Should the token approval process succeed, there could be an uptrend in XRP prices. Conversely, if events take a different turn, XRP may slide down to $0.42.

Read More

- JASMY PREDICTION. JASMY cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-04-15 08:08