Bitcoin ETFs, in a stunning act of financial resurrection, clawed their way back to life with a meager $20 million inflow. Meanwhile, ether ETFs threw a going-out-of-business party, bleeding $128 million in outflows. It’s like watching a slow-motion train wreck, but with more decimals.

Crypto ETFs Split Paths as Bitcoin Rises but Ether Retreats With $128 Million Outflow

The crypto ETF market is a chaotic circus 🤡, with bitcoin tentatively inching forward while ether moonwalks into the abyss. Investors, ever the thrill-seekers, are hedging their bets like a drunk gambler at a roulette table-except the house always wins, and the chips are cryptocurrency.

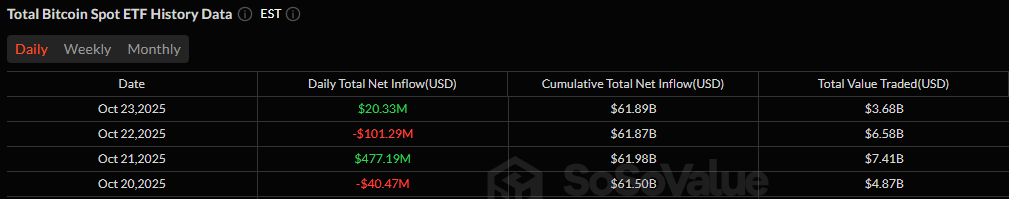

Bitcoin ETFs ended the day with a net inflow of $20.33 million, thanks to four funds pretending they still matter. Blackrock’s IBIT, the Wall Street equivalent of a golden retriever in a shark tank, devoured $107.78 million. Bitwise’s BITB added $17.41 million, while Fidelity’s FBTC and Grayscale’s Bitcoin Mini Trust tossed in $7.22 million and $3.42 million respectively. But let’s not forget the real MVPs: the outflows.

Grayscale’s GBTC lost $60.49 million, and Ark & 21shares’ ARKB bled $55.02 million. Still, bitcoin ETFs managed to close green, like a phoenix made of blockchain and regret. Trading activity hit $3.68 billion, and net assets rose to $149.43 billion. Progress? Or just a slower crash? 🤷♂️

Ether ETFs, meanwhile, are currently enjoying a “fire sale” with $127.51 million in outflows. Fidelity’s FETH led the exodus with a $77.04 million exit, followed by Blackrock’s ETHA ($23.35 million). Bitwise’s ETHW ($8.85 million), Grayscale’s Ether Mini Trust ($6.91 million), ETHE ($5.71 million), and Vaneck’s ETHV ($5.65 million) all joined the dance of despair. Trading volumes? A paltry $1.52 billion. Net assets? A sad $26.02 billion. It’s like a funeral for profits, and everyone’s invited. 🎭

The diverging flows scream one thing: investors trust bitcoin like a loyal pet, but ether? They’re treating it like a used car salesman with a shady grin. The market’s current mood? “Let’s gamble on BTC, but ETH? Nah, we’re done here.” 🚂

FAQ💹

- Why did Bitcoin ETFs see inflows?

Because investors thought, “Why not throw good money after bad?” 🤷♀️ - Why are Ether ETFs still facing outflows?

Because traders whispered, “This ETH thing is a scam. Let’s cash out before the music stops.” 🎶 - Which funds led the Bitcoin ETF gains?

Blackrock’s IBIT (the financial world’s favorite pet), Bitwise’s BITB (the underdog with a heart of gold), and Fidelity’s FBTC (because Fidelity says so). 🐾💛 - What do these flows signal for the market?

They scream, “BTC is the belle of the ball, and ETH is stuck in the parking lot!” 🕺💃

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Build a Waterfall in Enshrouded

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- USD JPY PREDICTION

- Best Controller Settings for ARC Raiders

- Best Werewolf Movies (October 2025)

2025-10-24 15:04