-

BTC might hike to $67,269 in the first phase of the projected upswing

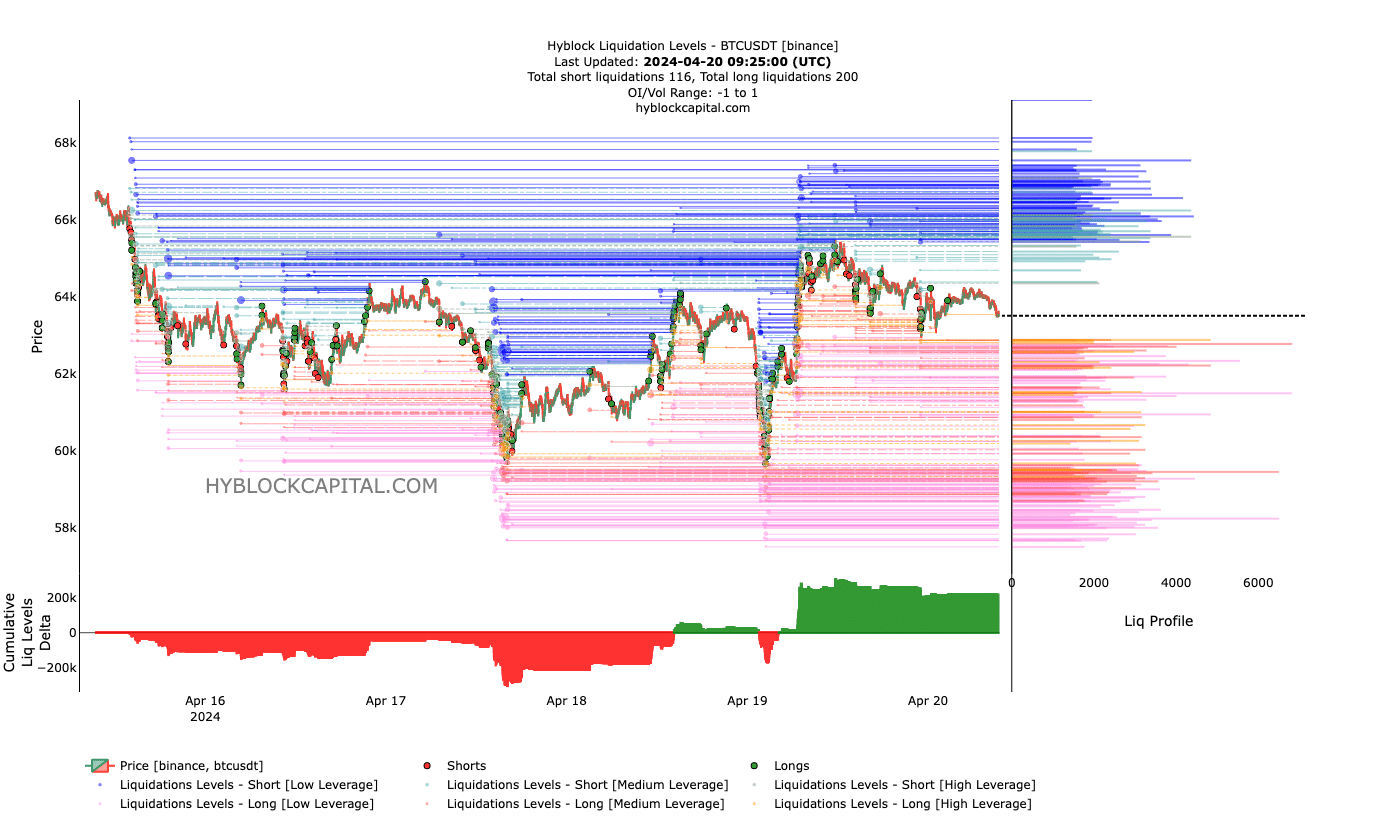

The liquidation levels showed a bearish bias that may soon be invalidated

After the fourth halving, the situation for Bitcoin [BTC] may have shifted. Nevertheless, when it comes to its price, change seems to bring more sameness. Based on their analysis of coin transfers, AMBCrypto arrived at this finding. According to CryptoQuant’s data, there has been a substantial rise in the amount of BTC transferred to derivative exchanges.

In simpler terms, we noticed that this phenomenon is likely caused by whale activity. Rapid occurrences of this event in the past have suggested that whales are getting ready to buy large amounts of Bitcoin.

Big guns are becoming aggressive

Anonymous on-chain expert Datascope added insights on this matter based on his observations tracked on CryptoQuant.

Transactions moving Bitcoin from exchanges to derivative platforms are seen as a key sign. Lately, we’ve observed that this activity has played a major role in driving up Bitcoin’s price.

At the current moment, Bitcoin’s value is reportedly $63,572. It’s important to mention that prior to the halving event, AMBCrypto predicted that Bitcoin might have been valued fairly based on previous analyses.

Based on our new assessment, the standstill could instead turn into a positive development. One sign pointing towards this possibility is the current liquidation levels.

Liquidation levels signify approximate prices at which a trader’s position may be forcibly closed by an exchange. This occurs when a trader’s margin account falls short or when they have taken on excessive leverage and their bet goes against them.

Currently, Bitcoin’s price is showing signs of potential interest around the range of $65,434 to $67,269 based on recent market liquidity developments.

One observation we made is that there’s been significant purchasing activity since the price dipped beneath $64,000. Should buying intensity grow further, it could potentially lead to profitable opportunities for investors with minimal leverage.

Bears won’t survive what’s coming

In the end, we examined the Cumulative Liquidation Levels Difference (CLLD). At present, this difference was showing a positive figure. A negative CLLD value signifies a greater number of short positions being liquidated.

Instead, a favorable interpretation suggests an increase in the number of prolonged sales transactions. Yet, it influences market pricing as well.

Based on the information given, it appears that the CLLD signaled a pessimistic outlook. But, whales placing orders during the present liquidity conditions could potentially change this trend.

If the cost drops in this scenario, it could activate some stop-losses. However, after some of the market liquidity is withdrawn, there’s a possibility that the price may recover and start rising again.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

If this situation continues, it’s possible that Bitcoin will surge and reach $75,000 in the near future. On the other hand, in the immediate term, Bitcoin’s price might dip below $63,000 before experiencing a significant increase at a later stage.

Read More

- OM/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- ETH/USD

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

2024-04-21 01:11