-

BTC had hit long liquidity at $67K and could reverse recent losses post-FOMC.

Trading firms underscored traders’ short-term bullish prospects despite the recent dip.

As a seasoned crypto investor with a few market cycles under my belt, I’ve learned that every FOMC meeting brings its unique set of challenges for Bitcoin investors. The recent drop in BTC to hit long liquidity at $67K had me worried, but the bullish sentiment from trading firms gave me some hope.

Bitcoin [BTC] extended losses to the $67K region amidst investors’ worries about the Fed decision.

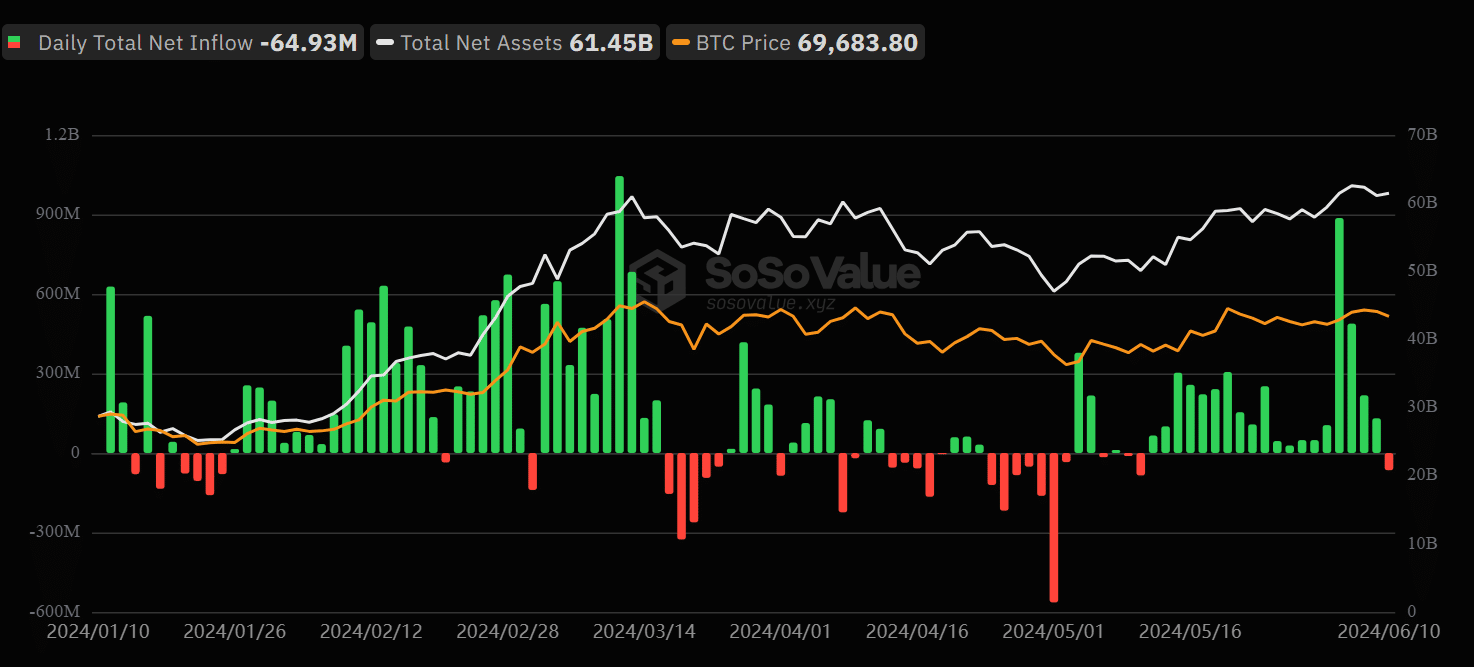

In simpler terms, the negative attitude towards Bitcoin’s short-term future was mirrored in the Bitcoin ETFs as well, with these investment vehicles breaking a monthly streak of attracting new funds.

On June 10th, there was a daily withdrawal of $64.9 million from Bitcoin ETFs as indicated by SoSo Value’s data.

The pessimistic outlook grew more pronounced after the robust US employment data released on June 7th. Additionally, heightened market turbulence was anticipated in the lead-up to the FOMC gathering slated for the 12th of June.

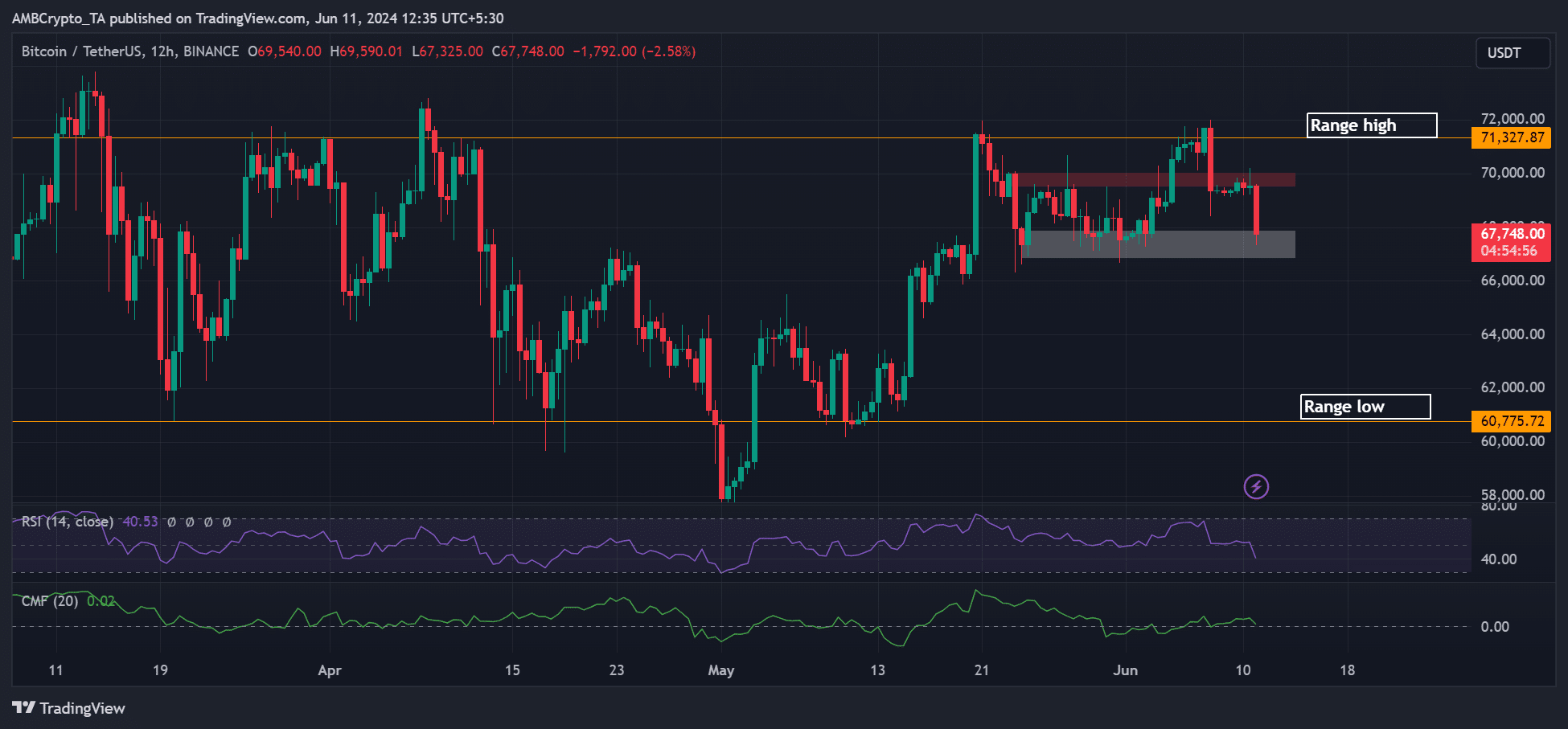

Recently, Bitcoin (BTC) has dipped to reach a new low for the week, touching on the previous support levels of around $66,800 and $67,920. Notably, these areas were identified by Hyblock Capital as significant locations where long-term investors had previously held their positions.

Will the short-term support above $67K hold post-FOMC, or will sellers overwhelm it?

Bitcoin predictions: Will $67K hold?

As an analyst, I’ve observed a significant decline in buying pressure based on my analysis of the higher timeframe chart. This trend is evident from the RSI’s downward trajectory on the same chart.

At present, the Chaikin Money Flow (CMF) indicates that the amount of money flowing into Bitcoin, or the king coin, is somewhat higher than usual based on historical data.

As an analyst, I’ve observed that the recent price level of Bitcoin at around $67,000 has acted as a cushion, preventing further declines since mid-May. However, if the Federal Reserve adopts a more hawkish stance in its upcoming decision, this could trigger sellers to breach the support and cause the price to fall below this level.

As a financial analyst, I would interpret Senator Warren’s urging for the Federal Reserve to consider lowering interest rates as potentially impactful on the value of the $67,000 held by individuals. If the Fed decides to comply with this request, it could lead to an increase in purchasing power and potential growth in various sectors of the economy. However, it is essential to keep in mind that such a move comes with its own set of risks, including inflationary pressures and potential currency devaluation. As always, careful monitoring and strategic planning are crucial when making financial decisions in response to economic policy changes.

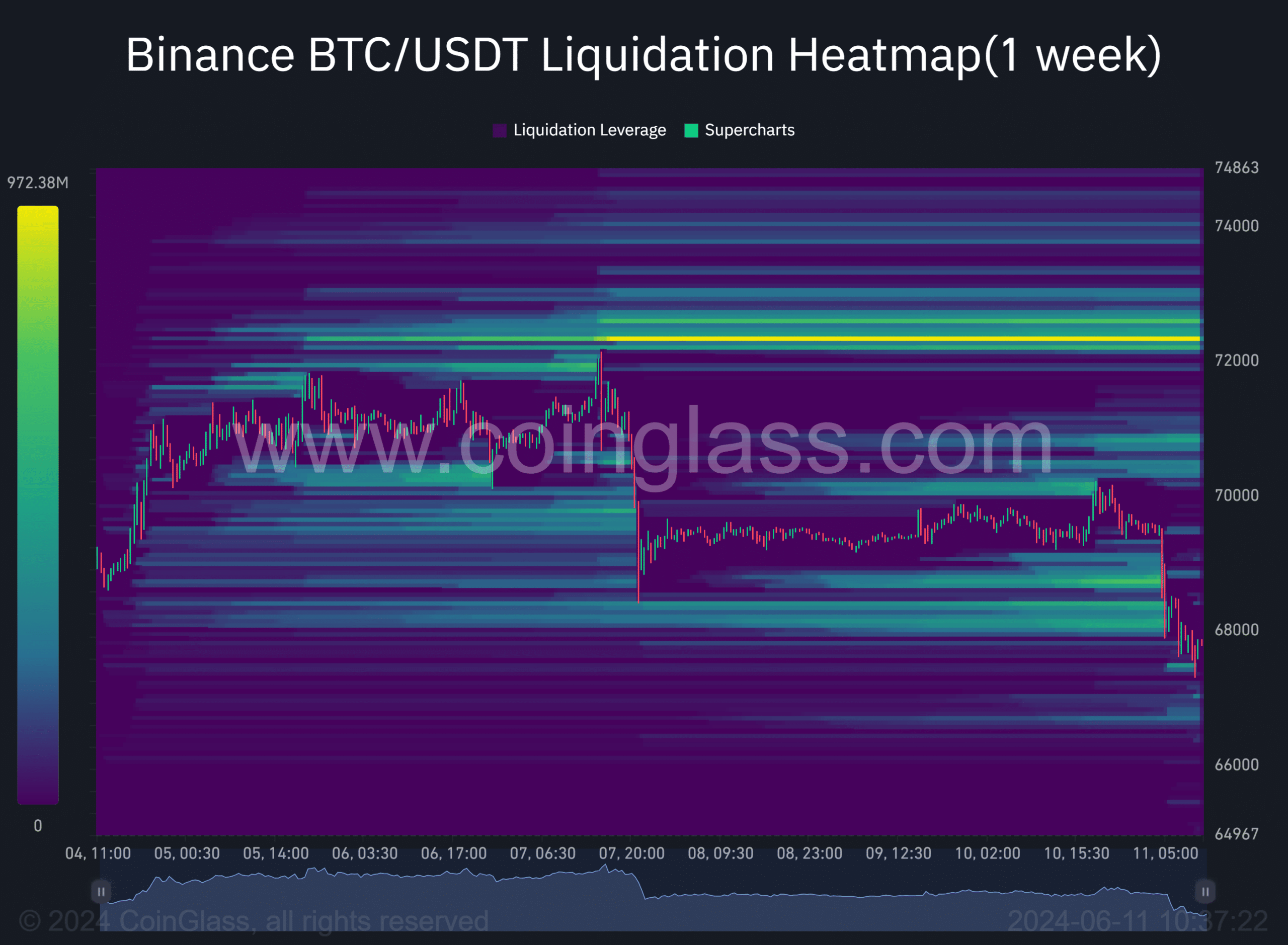

That said, the recent drop has cleared the long liquidity at $68K. However, the next key liquidity was overhead, at $70K and $72K, as shown by Coinglass data.

This meant that BTC could reverse the recent losses if it eyes the overhead liquidity.

The bullish scenario was also projected by crypto trading firm QCP Capital, who said,

As a crypto investor, I’m keeping a close eye on this week’s FOMC meeting from the Fed. In today’s trading session, I noticed an uptick in buying interest for near-term contracts. The call options demand outpaced put options, resulting in a higher call skew.

As an analyst, I would put it this way: In the derivatives market, our trading desk placed a greater number of call bets, which represent a bullish outlook, compared to put bets, signifying a bearish stance.

Deribit, the prominent cryptocurrency derivatives exchange, echoed QCP’s optimistic outlook for the short term, stating in agreement.

Based on technical analysis, there are signs pointing towards a possible Bitcoin price surge. Traders are keeping a close watch for an uptrend and exploring Call Butterfly Spread options as a potential strategy.

However, a hawkish Fed will dent the bullish thesis and could lower BTC to $64K or range lows.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

2024-06-11 15:03