-

Altcoin season seems closer than most think amid strong market shifts.

Savvy traders are reportedly shifting focus to altcoins from BTC.

As a seasoned crypto investor with a knack for spotting trends and navigating market shifts, I must admit that the signs of an impending altcoin season are hard to ignore. The recovery of Bitcoin in September has undeniably boosted confidence across the board, but it’s the surge in altcoins, particularly those in the AI and memecoin segments, that have caught my attention.

Bitcoin [BTC] made a remarkable recovery in September, rallying from $52.5K to $65K.

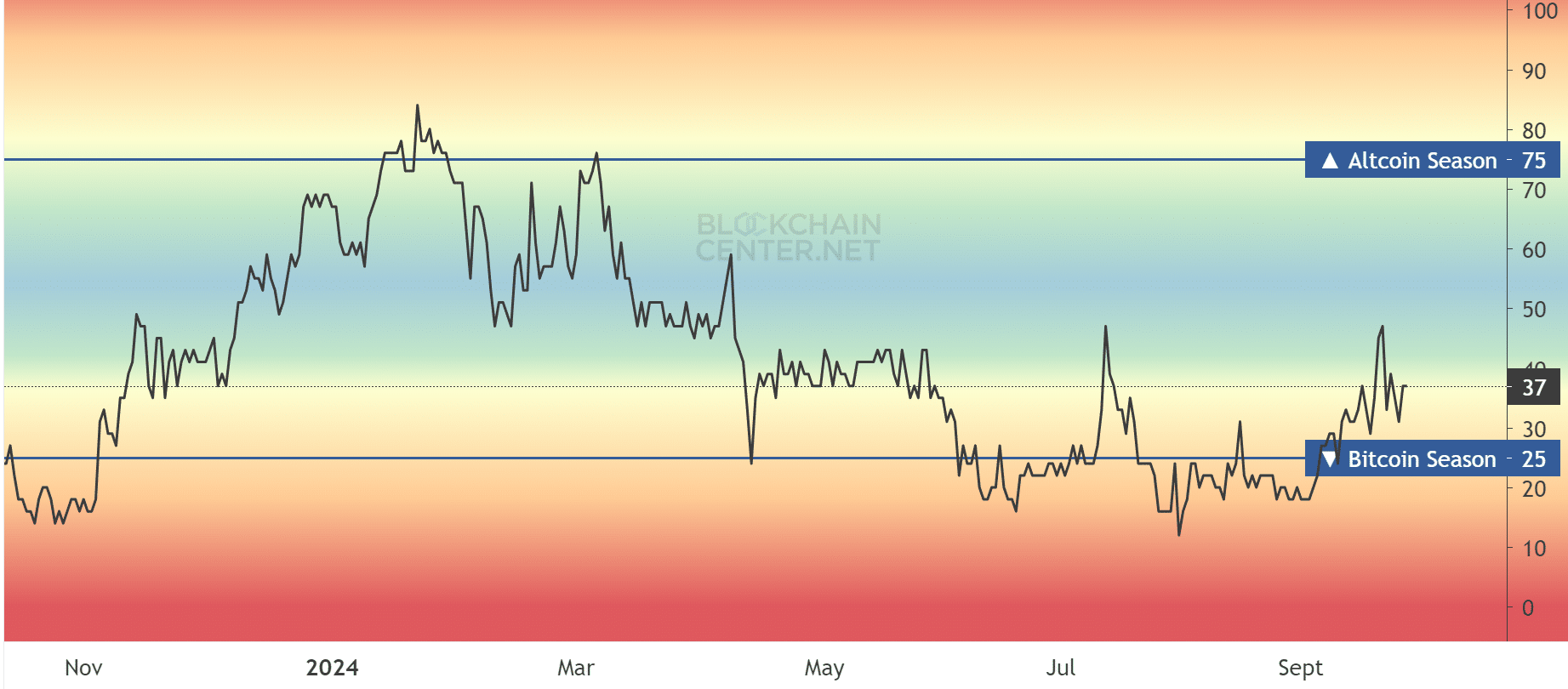

As an analyst, I observed a surge in the altcoin market during the recovery phase, with the Altcoin Season Index reaching levels comparable to those seen in July. Notably, certain select altcoins experienced substantial growth during this upswing, particularly within the artificial intelligence (AI) and memecoin categories.

Yet, the altcoin season had not reached its peak at that point, as indicated by an Altcoin Season Index score of 37.

Altseason setting stage?

Nevertheless, significant indicators pointed towards an optimistic scenario for an unpredictable cryptocurrency surge. To illustrate, Bitcoin’s dominance (BTC.D) showed growth in 2024 but encountered critical resistance near the 58% mark.

A drop in BTC.D value could signal a breather for altcoins to pick up greater momentum.

Another positive outlook was from the altcoin’s market cap, excluding BTC and ETH. According to Henrik Zeberg, Head Macro Economist at Swissblock, the Altcoin sector was primed to explode to a $3 trillion market cap.

Based on the bull flag pattern and momentum indicators, it appears that the total market capitalization of altcoins might reach approximately $3 trillion.

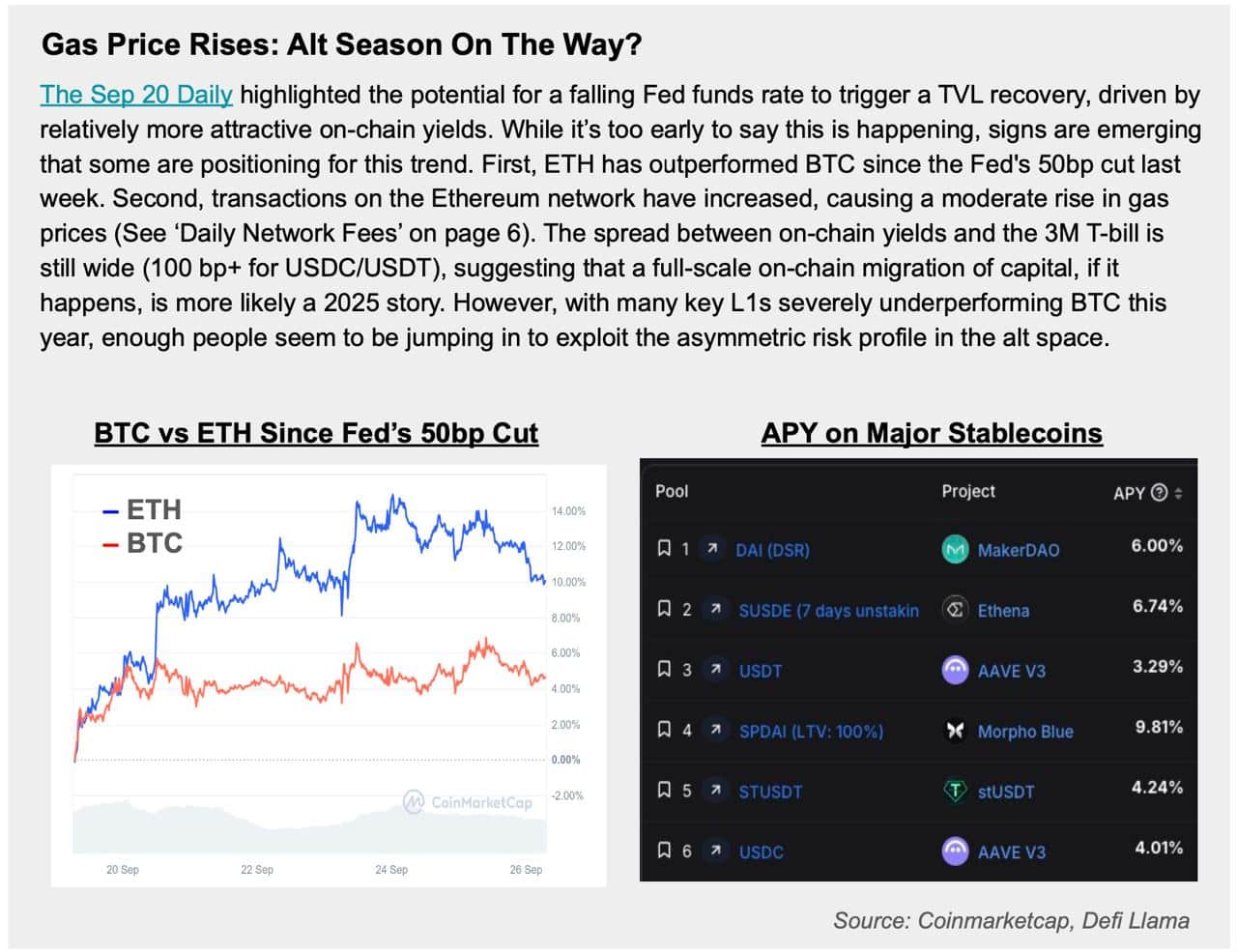

According to Presto Research, there might be a change occurring, as they point out a significant rise in the cost of transactions on the Ethereum network (ETH gas prices), which may indicate a growing intention to capitalize on a potential increase in the value of other cryptocurrencies (altcoin rally).

The research firm added that ETH has outperformed BTC since the Fed pivot.

The crypto research firm added that some speculators might be positioned to capitalize on the massive asymmetric risk profile since most altcoins were at yearly lows after recent headwinds.

The ETHBTC ratio regained close to 10% and climbed from a bottom of 0.038 to 0.042 following the Federal Reserve’s interest rate reduction. Yet, it has experienced a slight pullback as of now.

This indicates that the value of Ethereum (ETH) increased in comparison to Bitcoin (BTC). Given that ETH is often seen as a gauge for the overall condition of the altcoin market, this suggests that there was a significant rally among altcoins due to relief.

10X Research’s Mark Thielsen made a remark that echoes his perspective on altcoins, pointing out a notable transition among shrewd Korean traders and the trading community as a whole, where they are moving away from Bitcoin (BTC) towards altcoins.

With Bitcoin climbing above $60,000 and aiming to break through $65,000, shrewd traders have been buying up cheaper alternatives such as TAO, ENA, SEI, APT, SUI, NEAR, and GRT.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Solo Leveling Arise Amamiya Mirei Guide

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-09-27 17:11