Right then, on the twelfth of April in the year of our Lord 2025, Bitcoin, that digital marvel, commenced its day’s shenanigans trading somewhere between $83,583 and $83,856. A tidy sum, what? With a market cap that would make Croesus blush—a cool $1.65 trillion—and a 24-hour trading volume of $29.74 billion. One might say the markets were, shall we say, ‘lively’? Intraday prancing saw it dip to a measly $81,675 and then soar to an impressive $84,056. All in all, a session marked by a certain measured… *ahem*… ‘volatility’. 🙄

Bitcoin

Looking at the hourly chart—a thing of beauty, I assure you—bitcoin ( BTC) was, as they say, ‘rangebound’. That is, it couldn’t quite decide whether to go up or down, hovering between $83,000 and $84,200. A breakout above $84,200, mind you, could potentially initiate a new leg upward, presumably to the moon. 🚀 A breakdown below $83,000 might trigger local bearish sentiment—a most unpleasant state of affairs. The hourly setup favors range-based trading with well-defined stop-loss parameters. One wouldn’t want to lose one’s shirt, after all. 👔

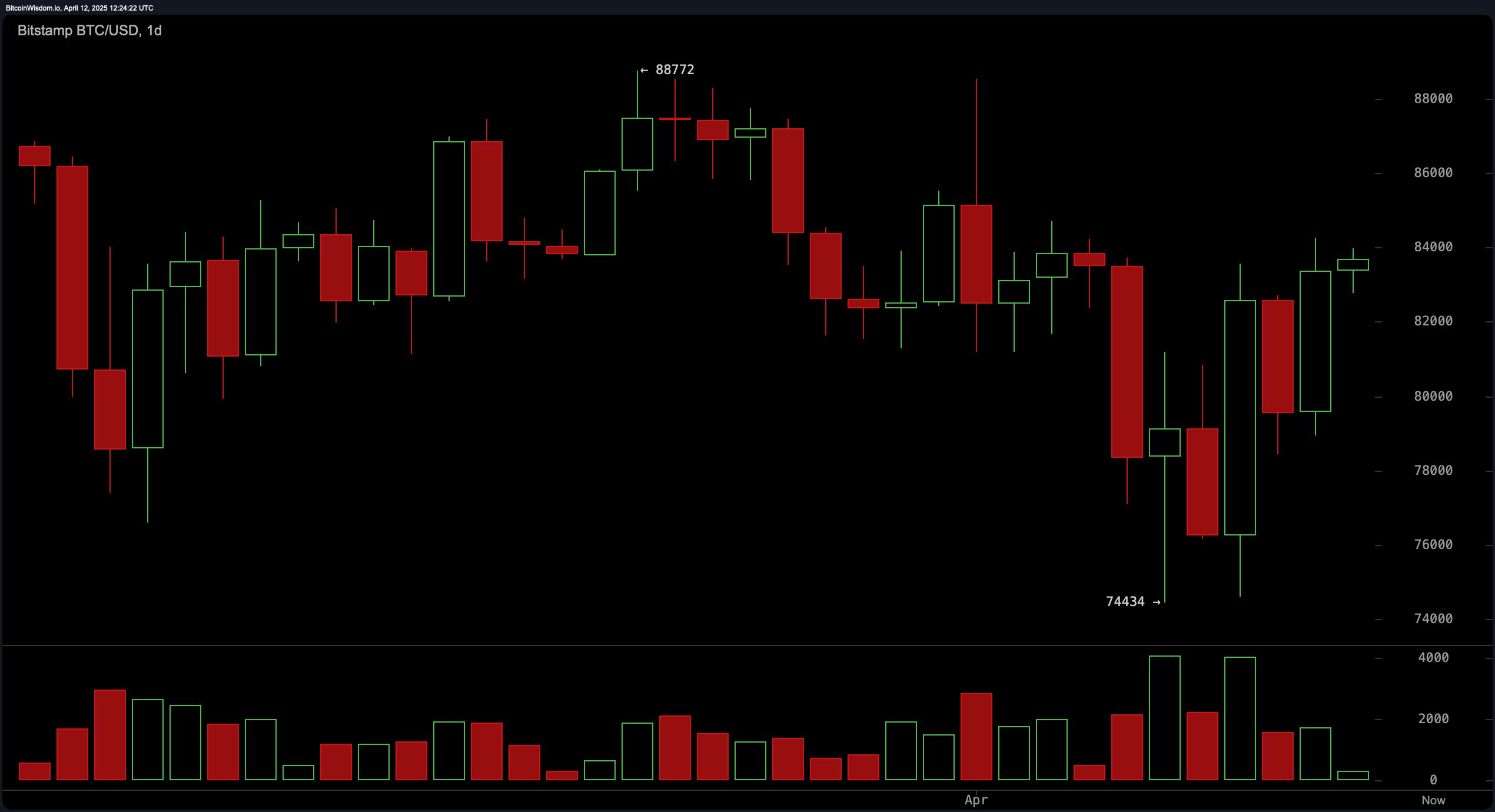

On the 4-hour chart, things take a turn for the… bullish! A V-shaped recovery, no less, from the recent low of $74,434. Bitcoin has been forming higher lows amid low-volume consolidation, suggesting that bulls are gradually absorbing selling pressure. Resistance at $84,500 remains pivotal, and a sustained breakout could target the $87,000 to $88,000 zone. Conversely, failure to break higher may lead to a retest of the $80,000 to $81,000 support region. Traders are advised to closely monitor volume surges and candle patterns for breakout confirmation. One does hate surprises, especially when they involve one’s hard-earned dosh. 💸

The daily timeframe provides a broader perspective of bitcoin’s evolving trend. Following a pronounced decline, the asset has shown signs of stabilization and recovery, evidenced by a shift toward higher closes and the invalidation of the short-term downtrend. Strong support is observed between $74,500 and $76,000, while the overhead resistance zone between $84,000 and $88,000 presents a formidable challenge. The macro view suggests cautious optimism, with the path of least resistance leaning upward unless the price drops decisively below the $74,000 level. A bit like trying to herd cats, isn’t it? 😼

From a technical indicator standpoint, oscillators remain largely neutral, with the relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and awesome oscillator all signaling non-committal bias. However, momentum and the moving average convergence divergence (MACD) are both in buy territory, offering moderate support to bullish interpretations. These mixed signals underscore the need for confirmation through price action and volume before initiating directional trades. All in all, a bit of a muddle, what? 🤔

In terms of moving averages, bitcoin is trading above its short-term trends. The exponential moving average (EMA) (10) and simple moving average (SMA) (10), as well as the EMA (20) and SMA (20), all indicate a buy signal. Mid-range indicators such as the EMA (30) and SMA (30) also support the upward bias. However, longer-term signals—EMA (50), SMA (50), EMA (100), SMA (100), EMA (200), and SMA (200)—reflect a bearish inclination, which could weigh on sustained momentum unless shorter-term trends pull the averages higher. This divergence between timeframes calls for a nuanced, time-sensitive trading approach. One needs to be as nimble as a cat burglar, you see. 🥷

Bull Verdict:

If bitcoin maintains its position above $83,000 and decisively breaks through the $84,200–$84,500 resistance zone, supported by bullish momentum indicators and buy signals from short-term moving averages, a continuation toward the $87,000–$88,000 range appears likely. Sustained accumulation and higher lows on the 4-hour chart reinforce a bullish trajectory, contingent on volume support and broader market sentiment. A jolly good show, if it happens. 🥂

Bear Verdict:

A failure to hold above $83,000—particularly if volume increases on a breakdown—may trigger a retracement toward the $80,000–$81,000 zone, with deeper correction risk down to the $78,000 or even $74,000 level. Longer-term moving averages reflecting bearish signals and neutral oscillators suggest that without renewed bullish volume, downside pressure could reassert itself swiftly. A most unpleasant prospect, indeed. 😨

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Gold Rate Forecast

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- OM PREDICTION. OM cryptocurrency

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- 25+ Ways to Earn Free Crypto

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- The Monkey – REVIEW

- Bobby’s Shocking Demise

- Ethereum: Short-term pain or long-term gains for ETH holders

2025-04-12 16:27