-

Bitcoin’s price dropped while gold spiked

Peter Schiff’s advocacy diminished by BTC’s investment surge

The price of Bitcoin (BTC) has taken a dip and is now below the $70,000 mark, sitting at around $67,000 as we speak. In a single day, BTC experienced a significant loss of roughly 5% of its value.

Alternatively, Gold, which is known for being a conventional investment asset, reached a new all-time high as global financial markets became uncertain. So, what about Bitcoin’s position in this scenario?

What’s behind the surge in gold prices?

Previously mentioned price differences sparked controversy among Bitcoin critics, with figures like Peter Schiff publicly expressing their doubts. In a recent podcast, Schiff questioned certain news reports linking gold’s price surge to global conflicts, specifically citing tensions in Ukraine and Israel.

Yet, he holds the opinion that this rationale fails to capture the real cause for the rising gold prices. He expressed this viewpoint instead.

“When people buy gold, they see it as a form of protection, don’t they? In a sense, they’re correct. But what they’re actually safeguarding against isn’t geopolitical instability, but rather inflation.”

Schiff pointed out an intriguing observation: despite the US Dollar looking robust compared to others, it’s secretly losing ground, as indicated by gold’s price surge against all currenies.

Taking to X (Formerly Twitter), he noted,

“This represents a refusal of reliance on fiat currencies and could signal the decline of the US Dollar’s status as the global reserve currency.”

The U.S dollar’s position as the world’s primary reserve currency may be in question, and its current robustness could just be fleeting.

Bitcoin stands strong against gold

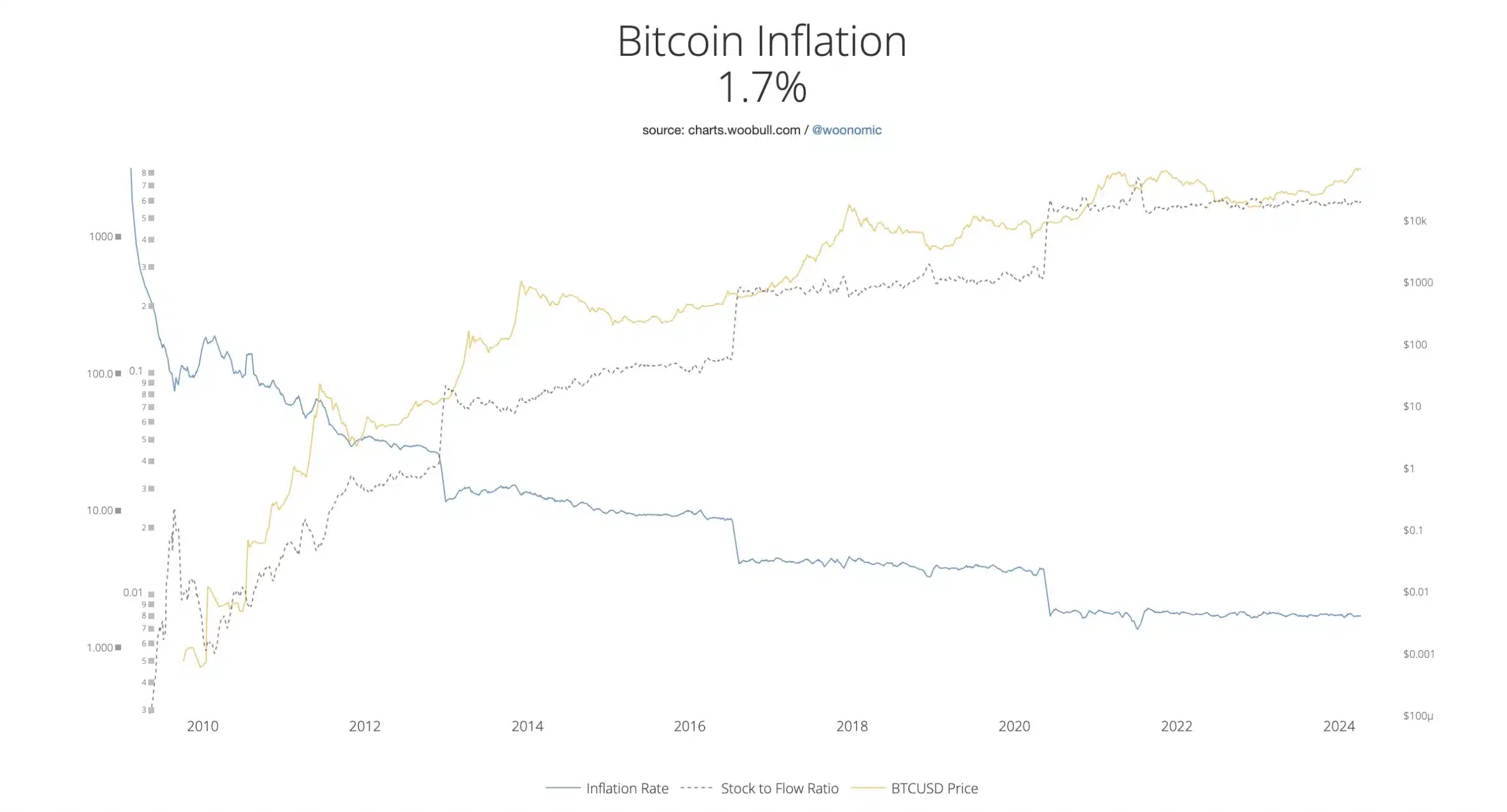

Although Bitcoin’s price has been unpredictable lately, Woodbull Charts have shown that its inflation rate has decreased significantly over the past four years. This decrease, from 3.72% in 2020 to 1.7% in 2024, may indicate that even if Bitcoin’s price experiences short-term declines, it might not lead to massive selling off of the cryptocurrency.

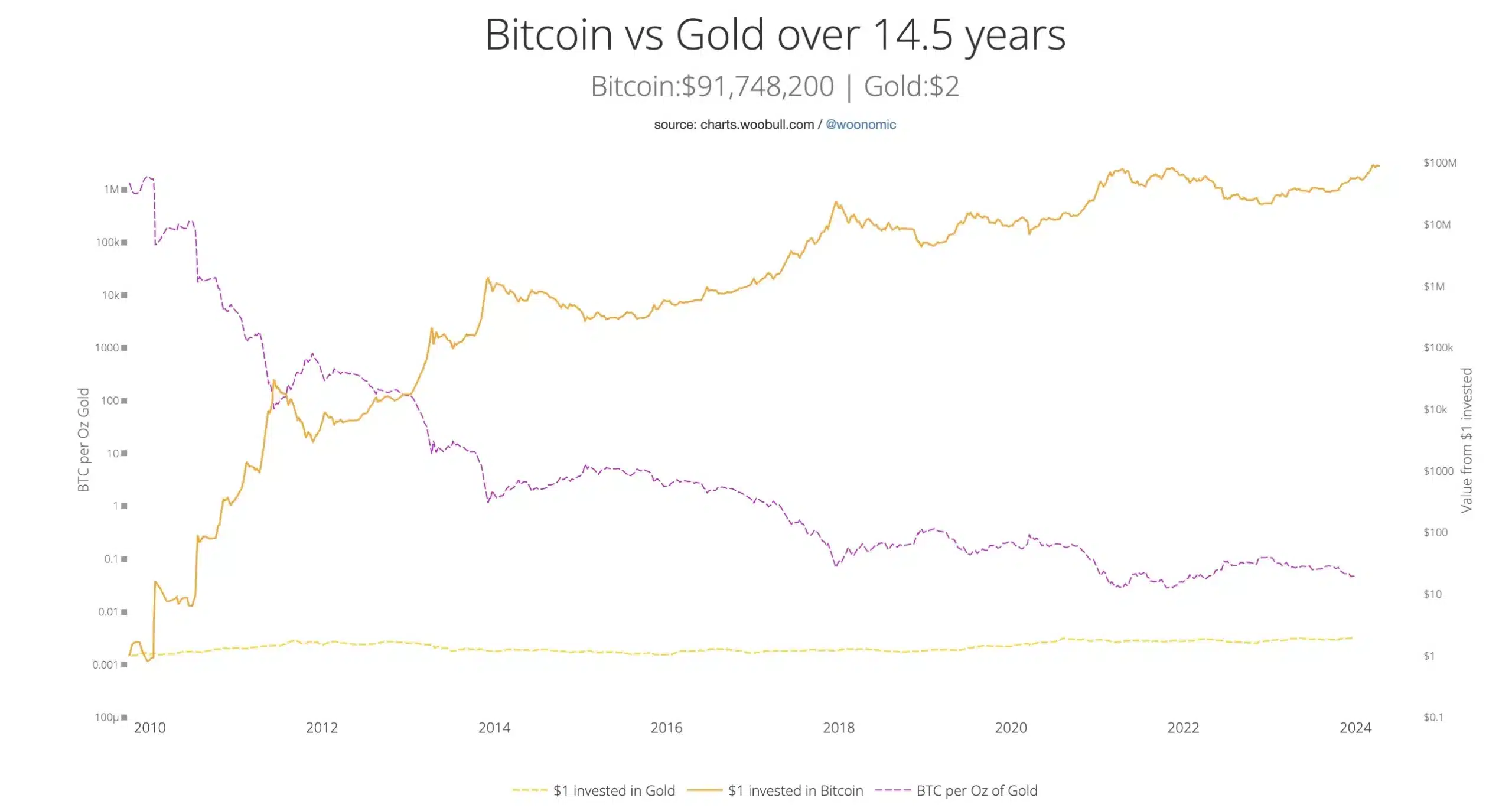

Based on these findings, Woodbull recently examined the 14.5-year-long comparison between Bitcoin’s and gold’s performance. As of April 2024, the value of Bitcoin as an investment was $19.83, while gold faced a tough time at just $1.97.

It’s important to mention that Woodbull Charts had a message for Peter Schiff and his supporters as well.

Bitcoin continues to win hearts

Despite Bitcoin’s unpredictable changes in worth, it has become an attractive investment option for numerous individuals. In reality, organizations such as MicroStrategy have begun adding Bitcoin to their holdings due to its impressive track record over the past few years.

Needless to say, sentiment around BTC remains as positive as ever, with one commentator claiming,

“Repeat after me. They won’t shake me out. 100k, BTC to the moon!”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-04-13 17:12