- In a curious twist of fate, Binance dispatched a staggering $32 million worth of SOL to Wintermute, while Coinbase, in a valiant attempt to seize the moment, sent $30 million USDC to perhaps buy the dip. Ah, the irony! 💰

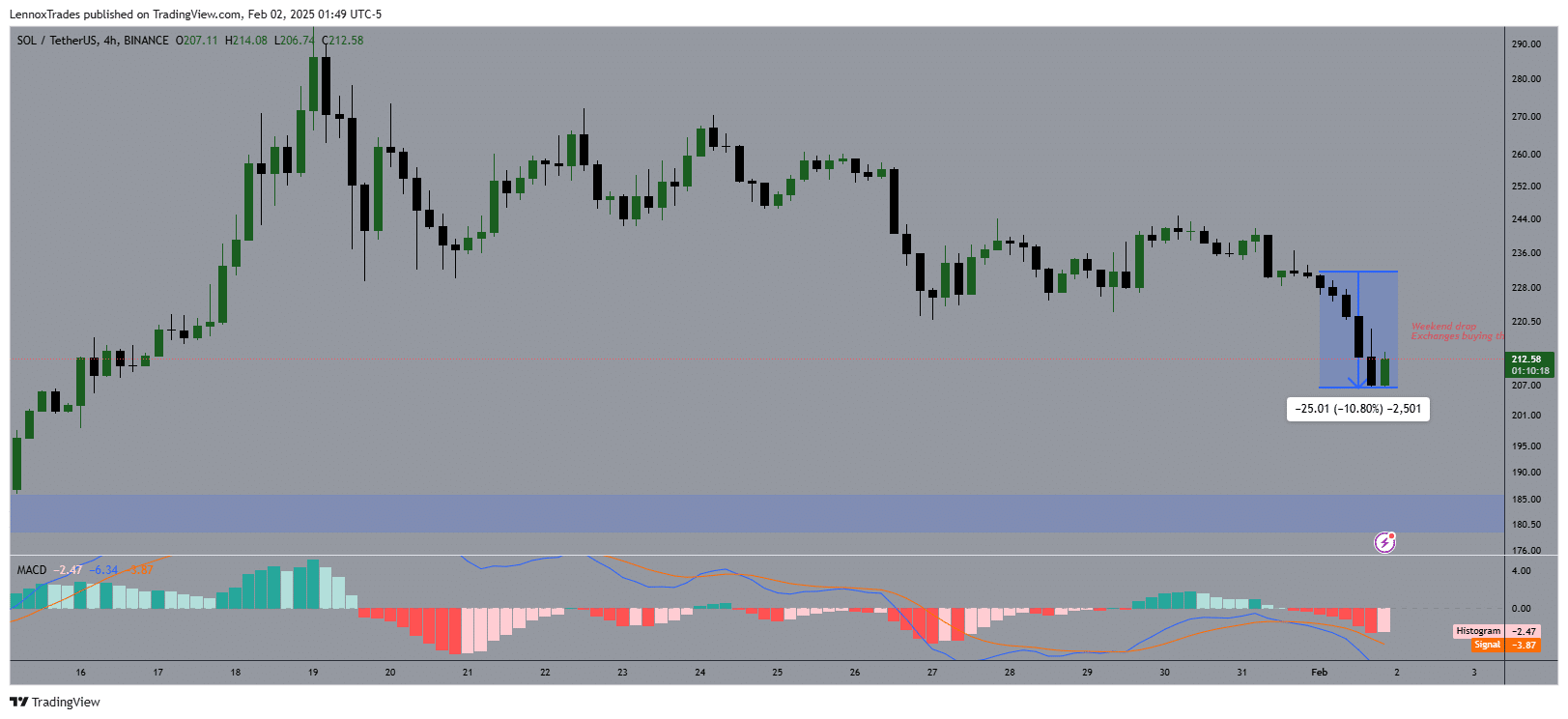

- As if scripted by the hand of fate, Solana’s market plummeted over 10% during the weekend, a decline that some whisper was orchestrated by Binance’s alleged manipulations. How quaint! 😏

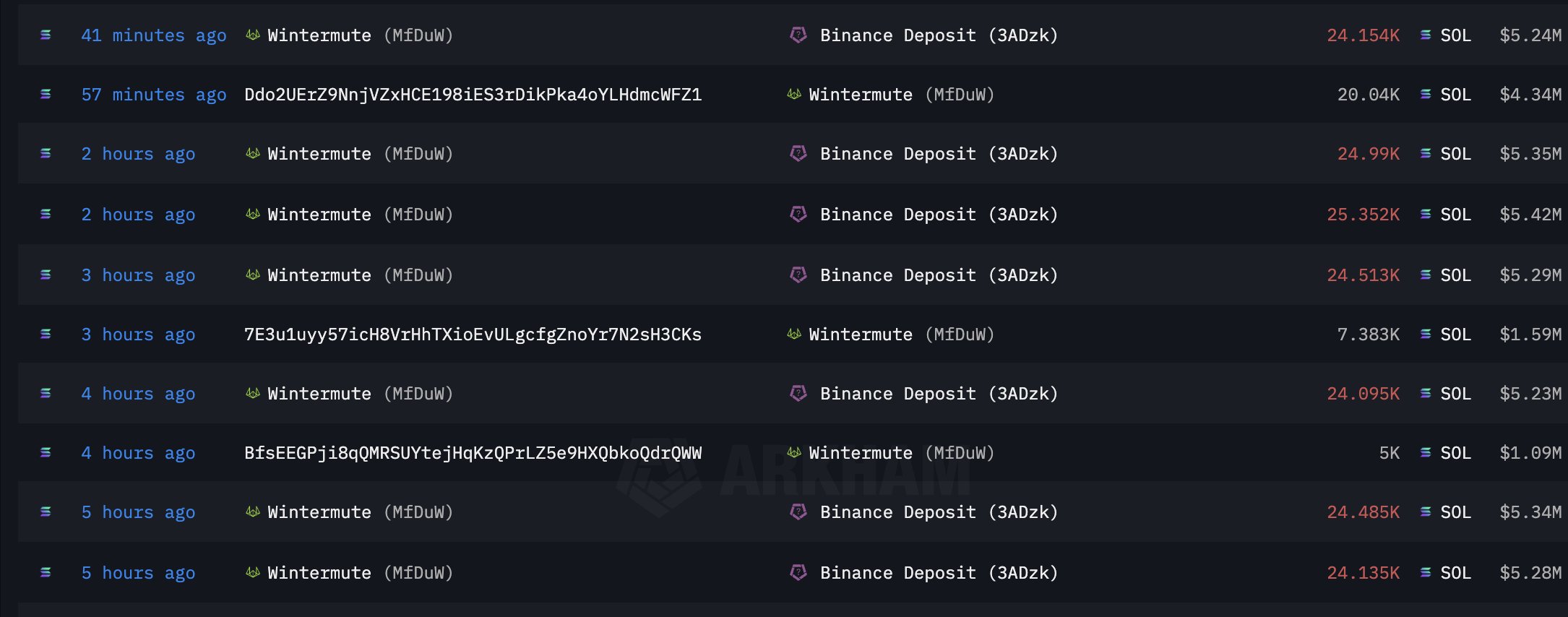

In a tale as old as time, Binance, that grand maestro of the exchange, recently engaged in what the cool kids call “flushing” or “liquidation hunting.” They sent over $32 million worth of Solana [SOL] to the market maker Wintermute during a weekend when the trading volume was as low as a snail’s pace. 🐌

⚠️ Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

View Urgent ForecastThe intent was as transparent as a freshly cleaned window: to drive the price of SOL down into the depths of despair, thereby compelling long-suffering leverage traders to liquidate their positions. A classic case of market manipulation, if ever there was one! 🎭

This cunning strategy shines particularly bright on weekends, when trading volumes are as scarce as a good cup of coffee at a bad diner, making the markets ripe for manipulation. ☕

According to the wise sages at AMBCrypto, who consulted the oracle known as Arkham’s data, Wintermute played its part with the finesse of a seasoned performer, selling the SOL at a lower price, thus further depressing the price, only to buy it back at these artificially low rates. Bravo! 👏

Once the dip was artfully crafted, Wintermute reportedly returned more SOL to Binance than it had initially received, reaping the rewards of the price difference. A win-win, or perhaps a win-win-win, if you count the laughter of the market makers! 😂

However, as the crypto commentator MartyParty so eloquently put it,

“The losers are the leverage traders and the panic sellers.” A round of applause for our unfortunate heroes! 👏

In a similar vein, Coinbase, not to be outdone, sent $30 million in USDC to Wintermute on Solana, presumably to take advantage of the dip, responding to recent claims of insufficient SOL holdings that left users in a state of withdrawal limbo. Oh, the drama! 🎭

This maneuver suggested a coordinated effort to exploit the market conditions, perhaps to stabilize or even profit from the delightful chaos of artificial volatility. How very clever! 🧠

How to Capitalize on SOL Manipulation: A Guide for the Brave

Understanding these tactics can be crucial for traders. By keeping a watchful eye on unusual large transactions from exchanges to market makers, traders might just predict potential price drops, in this case, Solana. A game of chess, if you will! ♟️

One strategy to capitalize on such manipulations involves waiting for signs of a forced liquidation event, then buying into the dip, anticipating a swift recovery as the market corrects itself. A risky gambit, but oh, the thrill! 🎢

SOL has already clawed back around a third of the weekend drop. A valiant effort, indeed! 💪

However, this approach requires a keen sense of market timing and an understanding of the risks involved, as not all market manipulations lead to predictable recoveries. A roll of the dice, if you will! 🎲

For those with a high risk tolerance, such strategies might offer opportunities to profit from the very volatility that others fear. A paradox wrapped in an enigma! 🔍

The price action chart of SOL displayed a sharp fall, reaching a low of $207 before rebounding as exchanges stepped in. The weekend buying by exchanges at this point suggested a strategic purchase during the dip. A well-timed intervention! ⏰

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Gold Rate Forecast

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- 25+ Ways to Earn Free Crypto

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- The Monkey – REVIEW

- Ethereum: Short-term pain or long-term gains for ETH holders

2025-02-02 13:14