-

ADA, SOL and AVAX witnessed a massive decline in prices over the last few days.

All these L1s showed similar performance in terms of TVL and DEX volumes.

Despite a stellar performance by altcoins in the past few months, their price rallies have been abruptly stopped by recent developments. Each token has suffered significant price drops as a result.

High correlation

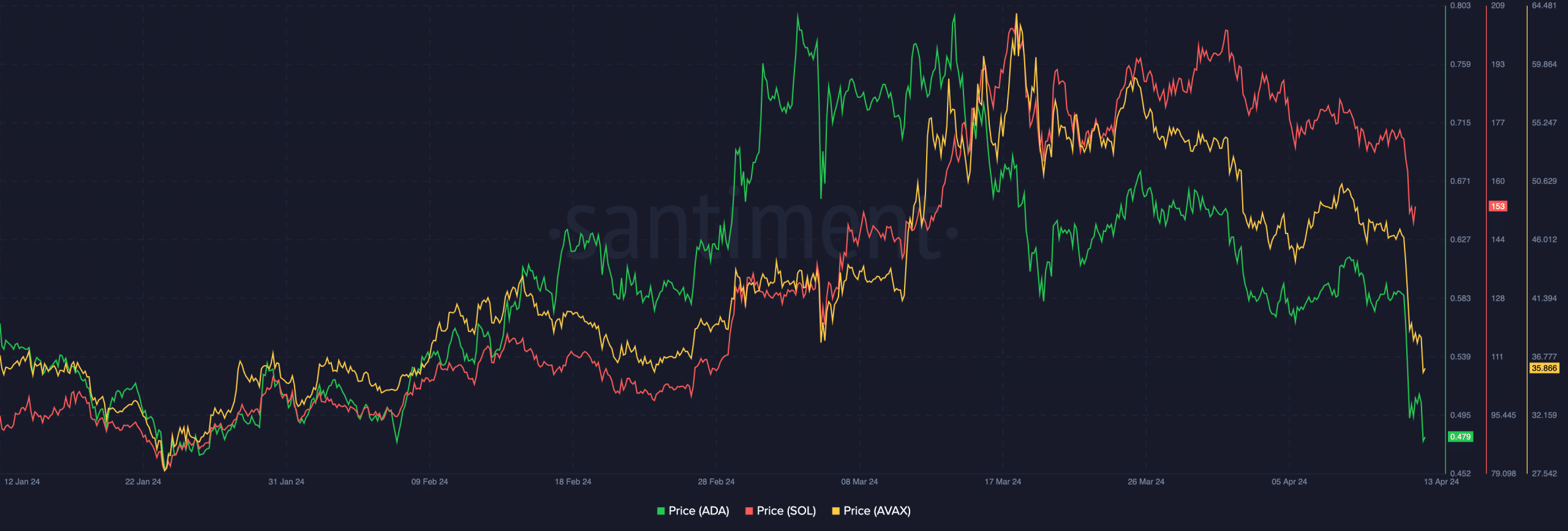

In the last 24 hours, there was a 9.45% decrease in the value of Cardano [ADA], Solana [SOL] experienced a drop of 7.73%, and Avalanche [AVAX] went down by 6.03%. (Or) The value of Cardano [ADA] decreased by 9.45% over the past 24 hours, while Solana [SOL] dropped by 7.73% and Avalanche [AVAX] fell by 6.03%. (Or) Cardano [ADA] declined by 9.45%, Solana [SOL] dropped by 7.73%, and Avalanche [AVAX] went down by 6.03% in the last 24 hours.

In simpler terms, even though these tokens each follow distinct procedures, their price changes have shown a significant relationship.

According to an analysis of Santiment’s data conducted by AMBCrypto, the prices of ADA, SOL, and AVAX have been moving in a similar pattern since March 26th.

These movements exhibited numerous successive low points that were lower than the previous ones, interspersed with even lower high points. This pattern suggested a downward trend, indicating bearishness.

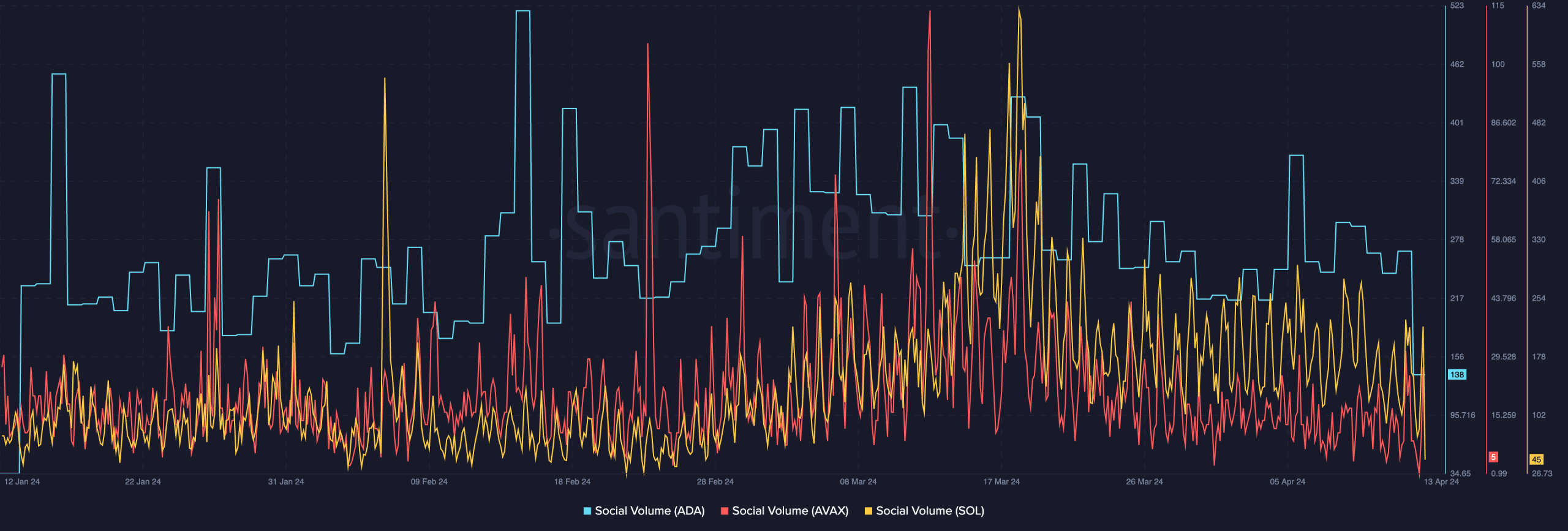

The decline in Social Volume further showcased the waning popularity of these tokens.

According to Santiment’s data analysis, there was a noticeable reduction in social media chatter about ADA, SOL, and AVAX, implying that investor and community engagement on these cryptocurrencies may be waning.

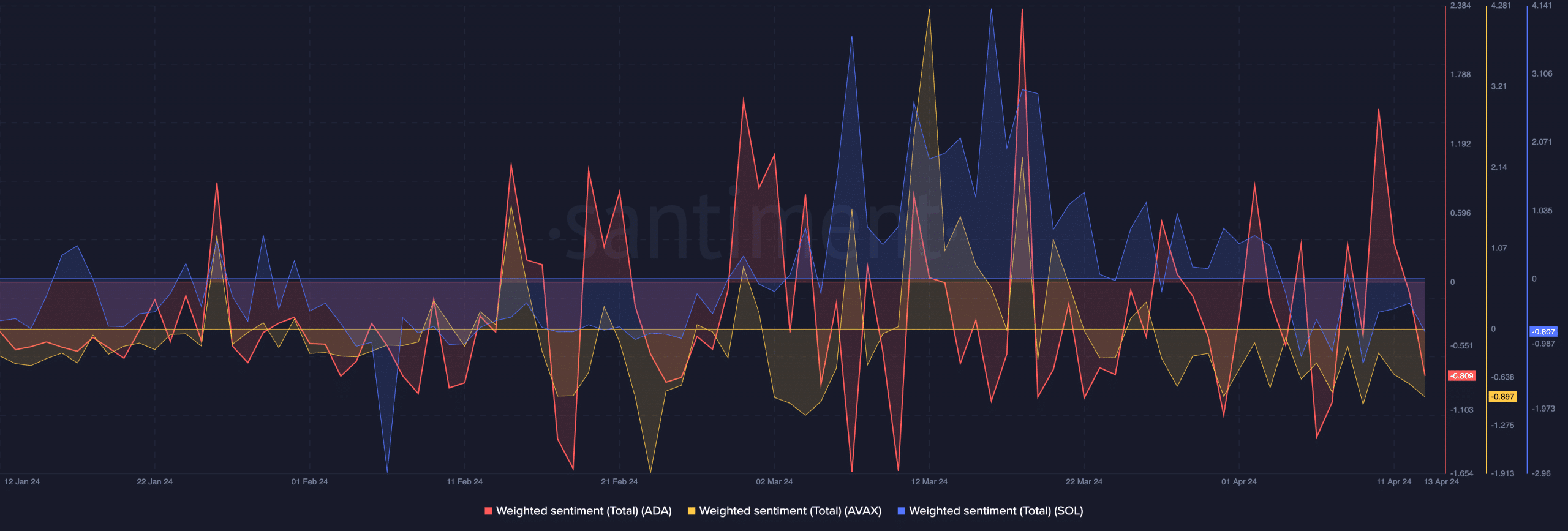

The feelings associated with these keywords were less favorable than before. A larger number of negative remarks were detected, suggesting a predominance of unfavorable opinions over positive ones.

Market participants began expressing increasing doubts and pessimism, potentially leading to price declines.

How are the protocols doing?

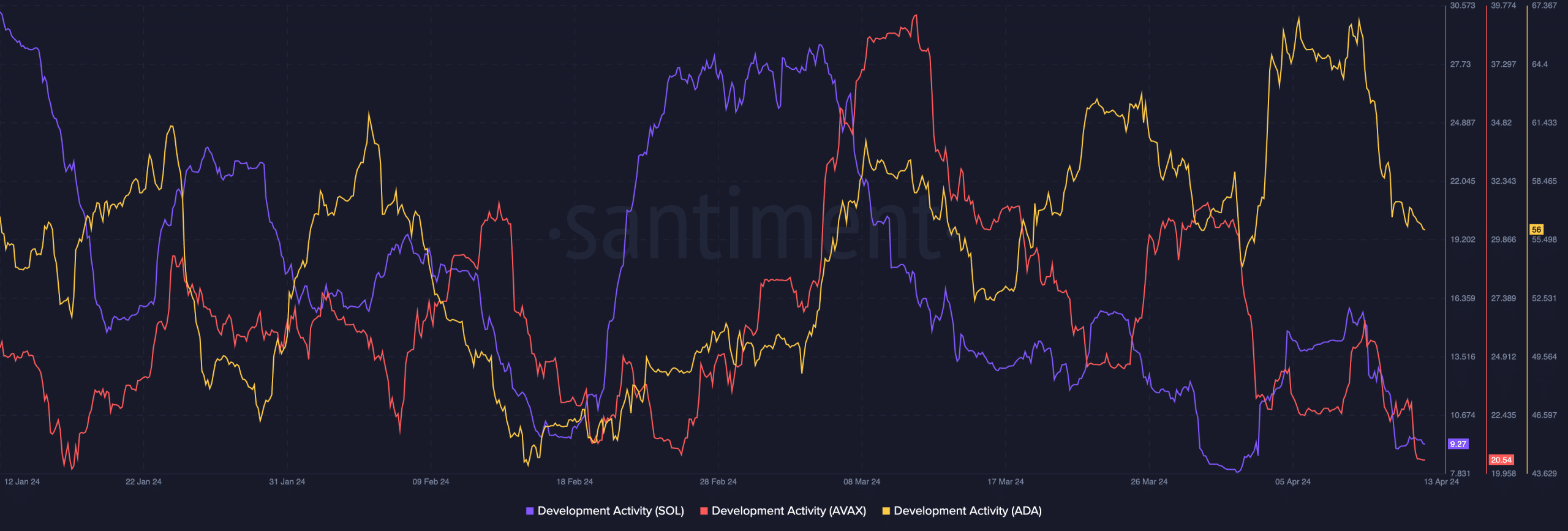

Solana’s network remains active despite the price drop, whereas the activity on Cardano and Avalanche networks has decreased.

Based on their recent performance differences, it seems that SOL might be more prepared for a possible price turnaround due to its strong protocol capabilities. On the other hand, ADA and AVAX may encounter a plateau or sluggish growth in the short term.

Although the price drop, trading activity on decentralized exchanges (DEXs) has increased noticeably across all blockchain platforms.

An uptick in trading on decentralized exchanges could signify greater market instability and heightened investor interest during a price decline.

On the other hand, the Total Value Locked (TVL) has decreased on Cardano, Solana, and Avalanche DeFi networks, indicating that fewer assets are currently secured within these protocols.

A reduction in Total Value Locked (TVL) could potentially lead to bigger issues regarding liquidity and investor trust in these markets.

Read Cardano’s [ADA] Price Prediction 2024-25

At the same time, development activity decreased noticeably within those networks.

Frequent new improvements and enhancements typically don’t boost public opinion towards the token right away, but they can lead to favorable price movements over time.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-04-15 07:03