-

LINK and MATIC have witnessed consecutive declines in the past few days.

Holders are currently holding at a loss due to their price declines.

At a casual observation, Chainlink (LINK) and Polygon (MATIC) might seem unconnected. However, an intriguing discovery can be made when examining their positions on the market cap list: their rankings display comparable trends.

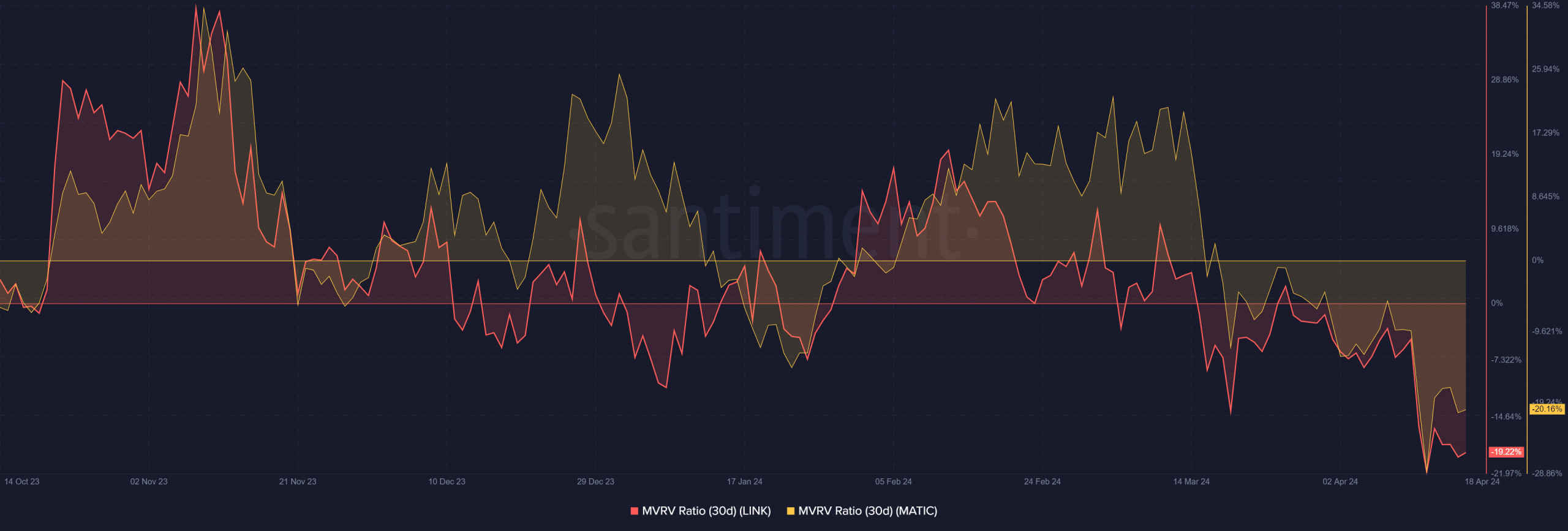

Additionally, looking at their MVRVs (Market Value to Realized Value) and Open Interest indicates consistent patterns.

Chainlink and Polygon’s market cap

Based on information from CoinMarketCap, Chainlink and Polygon hold the 16th and 17th positions respectively in terms of market capitalization size.

Currently, the total value of all LINK tokens in circulation is roughly equal to $7.7 billion, and the market capitalization of MATIC is about $6.5 billion.

Significantly, the value of LINK had dropped by almost 25% when this text was composed, while MATIC was seeing similar price declines. This shift in prices has sparked interest in the current earnings for token holders.

Analyzing the MVRV

Chainlink’s MVRV (Momentum Value Risk Ratio) assessment over the past 30 days showed a persistent negative value starting from March 26th. At present, the MVRV was approximately -20%.

During this timeframe, holders suffered a nearly 20% price decrease, whereas back in February, the MVRU (Market Value Realized vs Unrealized) ratio peaked at approximately 11%.

In simpler terms, Polygon’s MVRV has been showing a deficit of approximately 19.6% since March 17th. This implies that investors who bought during this timeframe have incurred a loss of over 19%, much like with LINK.

A decrease in positive MVRV values for LINK and MATIC could indicate potential price drops, providing an opportunity for new investors to join the market.

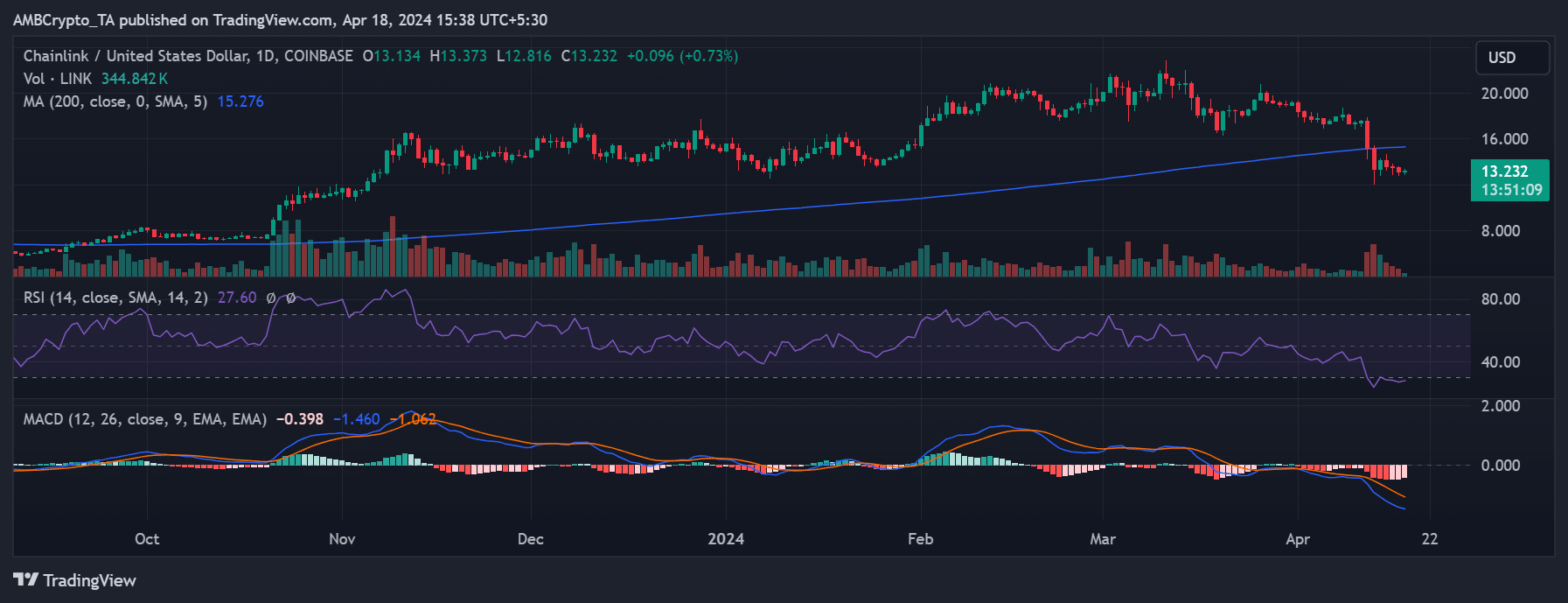

LINK and MATIC see consecutive declines

According to AMBC crypto’s assessment of the LINK daily chart, it seemed that the token was being sold more than usual and potentially undervalued at its present price.

A RSI reading under 30 indicates a strong downward trend with prices likely to be undervalued, as this level signals oversold conditions.

Based on its 30-day MVRV signal, this cryptocurrency’s current price level might indicate an upcoming correction. As of now, Chainlink is priced at approximately $13, experiencing a small uptick.

The chart showed that there had been a three-day downturn prior to this point, leading to a loss greater than 6% in total.

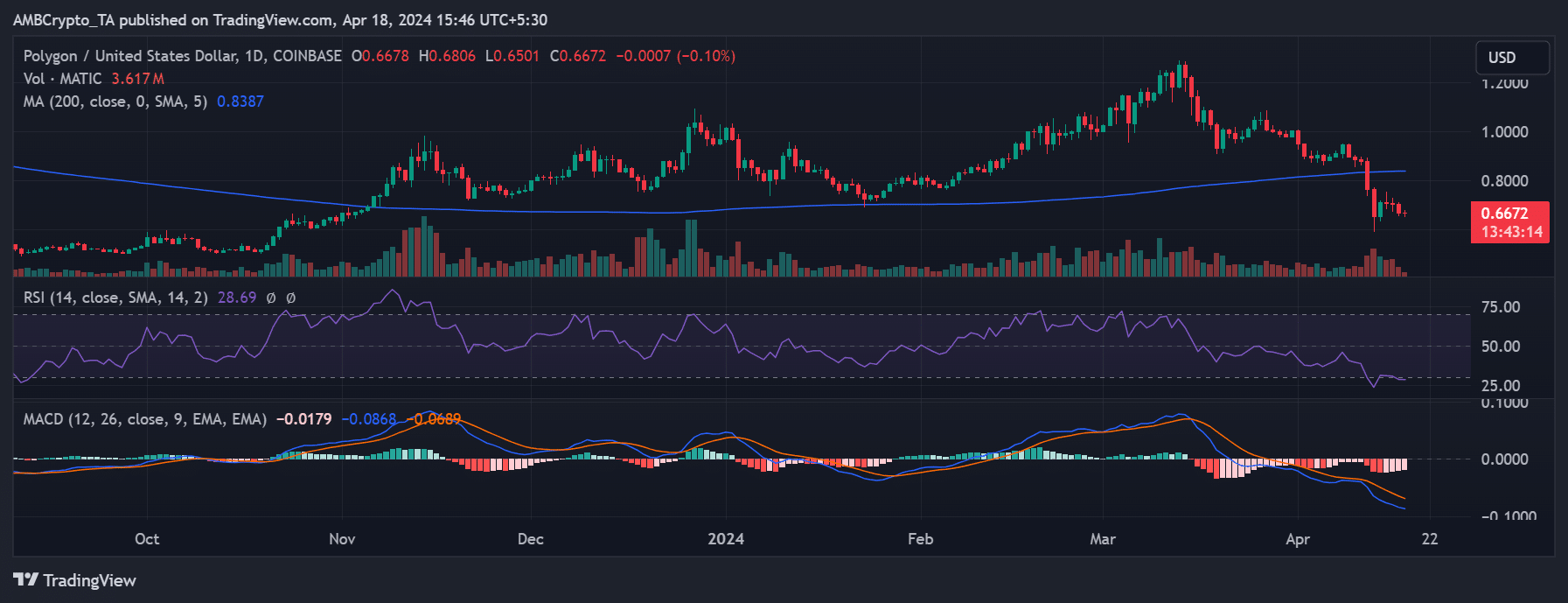

MATIC was following a comparable pattern. Currently, its RSI was less than 30, suggesting oversold status and a dominant downtrend. The coin was hovering near the $0.6 price mark, showing a minor decrease in value.

For the past four days in a row, MATIC has experienced a decrease, with the blue moving average now serving as a barrier to further price decreases due to the current unfavorable market conditions.

Traders’ interest cools off

Based on an examination of Chainlink’s open interest data on Coinglass, there has been a noticeable decline in investor attention recently. The figure shows a drop of approximately $100 million from the start of the week to now.

When I penned this down, the Open Interest of LINK was approximately $164 million, a decrease from its initial value of more than $276 million at the beginning of the week.

Realistic or not, here’s LINK market cap in BTC’s terms

Similarly, Polygon’s Open Interest decreased by over $100 million during the same period.

Currently, the MATIC Open Interest stands around $172 million. This is a decrease from the $294 million recorded at the start of the week. Such a drop implies that fewer funds have been pouring into these assets recently.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-04-19 10:17