Cardano’s Charles Hoskinson, the bard of blockchain, sang praises for USDM, a new stablecoin born under the stars of Moneta. Rumors whisper it may outshine the ancient USDC, a relic of the past.

The stablecoin realm, a battlefield of ambition, sees kings of finance and digital titans clash, each vying for the crown of the digital realm. 🏰⚔️

The Sage of Cardano Hails a New Dawn in Stablecoins

Hoskinson, the prophet of Cardano, extolled USDM, a coin forged in the fires of innovation. Its vision? To eclipse the old guard with a blockchain-native utopia. 🌟

Moneta’s USDM is becoming the most advanced stablecoin ever built

— Charles Hoskinson (@IOHK_Charles) July 31, 2025

In the vibrant streets of Buenos Aires, the crypto visionary unveiled whispers of a private stablecoin, a secret garden of financial privacy. 🌿

“While USDM is solid, what’s cooking in Buenos Aires is next level. Privacy-enabled stablecoins with granular permission controls? That’s not just disrupting TradFi, that’s replacing it entirely. The complexity jump from USDM to this is like going from checkers to 4D chess,” wrote X user T.

USDM, the child of Moneta, is nurtured in the cradle of privacy, its visibility a carefully guarded secret, and its functionality a titan among enterprises. 🧠

According to Andrew Westberg, W3i’s CTO, its architecture is a labyrinth beyond USDC’s grasp. 🧩

Westberg described real-world use cases like payroll, where Bob sees his pay, Alice sees hers, and Mary in accounting… well, she sees everything. 🧩

The stablecoin is a small but important piece of the discussion in . That being said, the complexity is 10x to 20x that of USDM.

Imagine doing company payroll. Bob needs to see and control what he receives. Alice can see and control hers but can’t see Bob’s. Mary in accounting…

— Andrew Westberg (@amw7) July 30, 2025

USDC, the old giant, remains a colossus, its public face a beacon for institutions. 🏛️

This delineation places USDM in a distinct category of next-generation stablecoins aimed at replicating and potentially replacing traditional financial (TradFi) workflows using blockchain rails. 🚀

USDC Leads in Scale, Adoption, and Institutional Trust

Yet, the skeptics, like shadows, question the absence of government’s embrace, fearing the new coin may be a dream without foundation. ⚖️

“Love the ideas behind it, but this is why I can’t shake the feeling USDC would’ve been a better fit and less reinventing the wheel so to speak. I also see very few uses for stable coins that lack government level integrations,” one user observed.

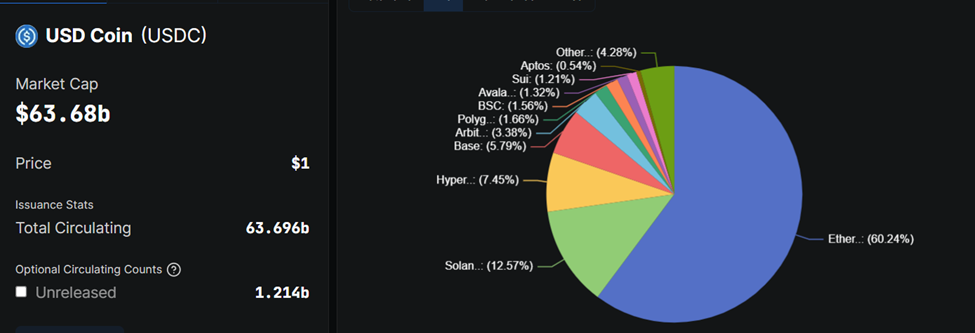

USDC, the colossus of the market, towers with a $63.68 billion empire, its reach spanning Ethereum, Solana, and beyond. 🌍

Circle’s stablecoin is also issued across a broad range of networks, including Ethereum (60.24%), Solana (12.57%), Base (5.79%), and Hyperliquid (7.45%). It currently circulates over 63.7 billion tokens. 📉

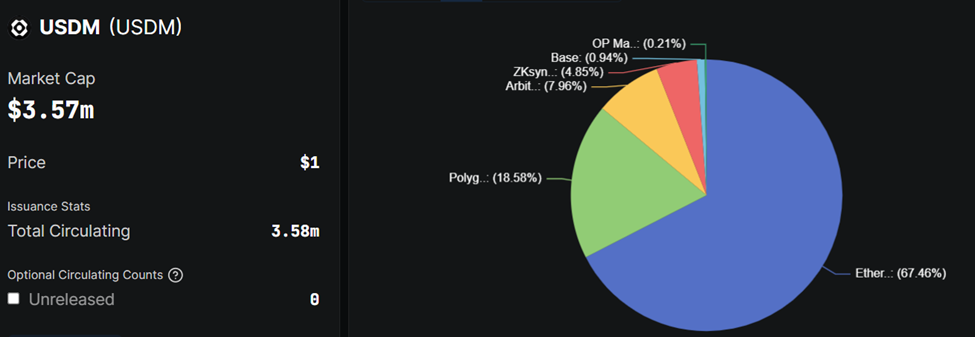

USDM, the fledgling, flutters with a mere $3.57 million, its wings yet to master the skies of global finance. 🦋

Its deployment is currently concentrated on Ethereum (67.46%), Polygon (18.58%), and Arbitrum (7.96%). USDM also has a limited multichain presence compared to USDC’s broad reach. 🌐

USDC’s issuer, Circle, recently went public, adding to its institutional edge. The listing enhances Circle’s transparency, regulatory access, and credibility, which are critical factors for large institutions looking to integrate stablecoins. 🧱

This public status likely gives USDC a further advantage over experimental offerings like USDM, especially regarding compliance and onboarding within TradFi. 🛡️

Still, USDM’s focus on privacy and complex role-based access could carve a niche for enterprise applications and legally sensitive environments. 🧩

If it delivers on its ambitious design, it may not rival USDC in scale anytime soon, but it could set a new benchmark for what stablecoins are capable of. 🌟

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- How to Build a Waterfall in Enshrouded

- The Sci-Fi Thriller That Stephen King Called ‘Painful To Watch’ Just Joined Paramount+

- The Lord of the Rings Card Game With Telltale-Style Storytelling Was Being Made at Eidos Montreal – Rumour

- Battlefield Just Made a Change That Will Make Rush & Breakthrough Easier for Attackers

- Death Stranding 2: Best Enhancements to Unlock First | APAS Guide

- DWTS: Zac Efron Makes First Appearance to Support Brother Dylan Efron

2025-07-31 12:53