- Solana revisited $145, causing a cascade of liquidations in the market

- High liquidity at $150 could drive the price up on the charts

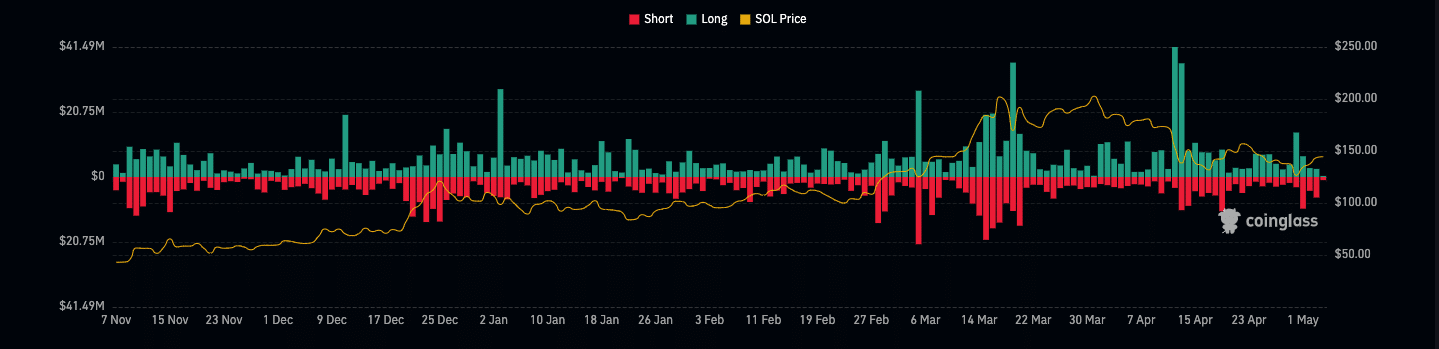

As an experienced analyst, I believe that the recent liquidations in Solana (SOL) at around $145 caused by its sudden price appreciation to $145.08 have created both opportunities and risks for traders. The liquidation of over $9 million worth of positions, with a majority being shorts, indicates significant market movement and volatility.

In the past 24 hours, a total of $9.14 million worth of Solana (SOL) investment positions were forcedly closed on the market due to price movements. Among these, approximately $2.37 million represented long positions, while short positions incurred losses amounting to around $6.77 million.

As a crypto investor, I understand that liquidation refers to a situation where my account balance falls short of maintaining the required margin for an open trade. Consequently, one or more positions are automatically closed by the exchange to prevent further losses. This unfortunate event can be triggered by various factors such as excessive leverage, unexpected market volatility, or incorrect market predictions.

For those new to this concept, long positions represent traders’ belief that the value of an asset will rise, while short positions signify the expectation that the asset’s value will decrease.

As a researcher conducting an investigation for AMBCrypto, I uncovered that the liquidations were triggered by Solana’s (SOL) price movement. Similar to other cryptocurrencies in the market, SOL experienced a significant drop on May 2nd. With this downward trend appearing on the charts, traders assumed the price might continue to decline and therefore initiated liquidation orders.

No giving up on the forecast?

As a researcher observing the market, I noticed an unexpected turn of events with the token’s price. It surged to $145.08 in just two days, representing a nearly 5% increase in the past 24 hours. If this upward trend persists, it may lead to significant losses for those holding short positions.

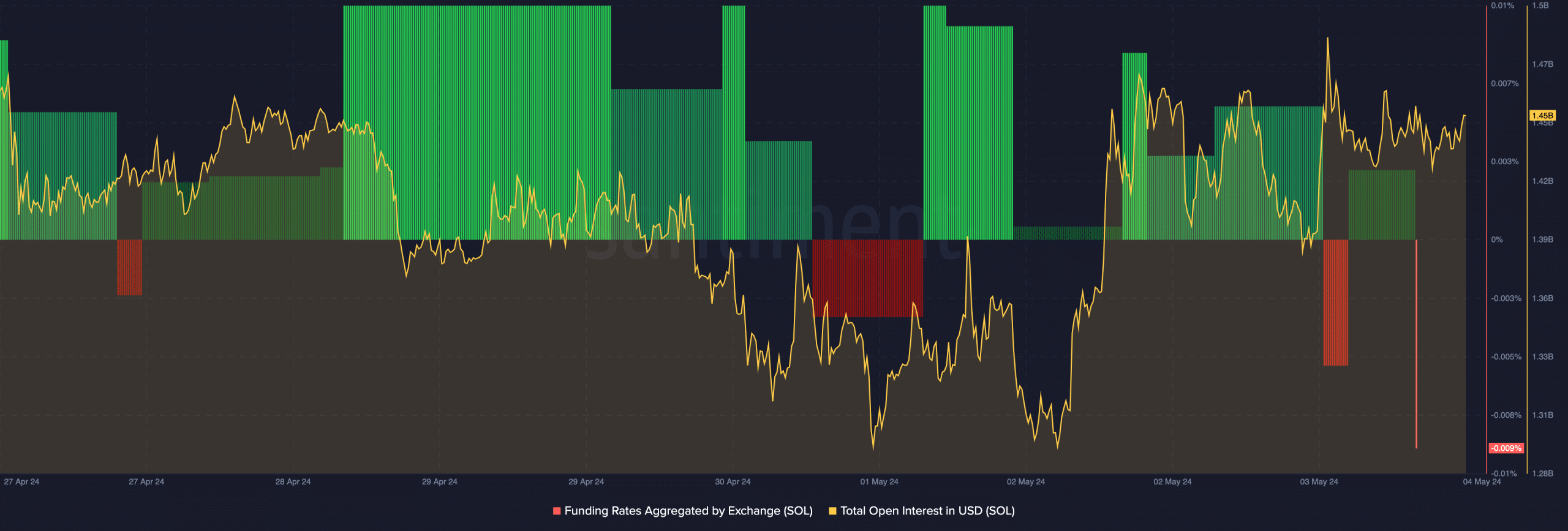

As a crypto investor, I’ve noticed an intriguing trend despite the recent liquidations. The Open Interest (OI) for Solana (SOL) surged to a staggering $1.45 billion, according to Santiment’s data. This surge in OI suggests that fresh capital is entering the market. Contrary to what one might expect following liquidations, an elevated OI implies that traders are actively closing their positions, indicating a renewed interest and confidence in the market.

The OI hike indicators a potential trend for crypto markets. Consequently, Solana’s (SOL) price may continue to rise in the near future.

Despite the possibility that OI may not be sufficient to trigger a rally, SOL‘s price could still fluctuate between the narrow band of approximately $145 and $150.

Additionally, AMBCrypto noted a noteworthy aspect regarding the Funding Rate. To clarify, when the Funding Rate is positive, it signifies that the perpetual contract’s price for an asset is trading above its fair value. Consequently, long positions holders are required to pay a funding fee to short positions holders.

In contrast, a negative funding rate implies that the perpetual contract price for SOL is lower than the market price. At present, the funding rate for SOL stands at -0.009%.

SOL to $160 looks possible

With a strongly bearish indication, it seems that short sellers have been actively pushing down the price. Yet, contrary to their expectations, the token’s value has risen instead, suggesting that they have not gained any profit from this position. If these trends persist, Solana (SOL) could strengthen its bullish stance, possibly leading to more shorts being forced to exit their positions.

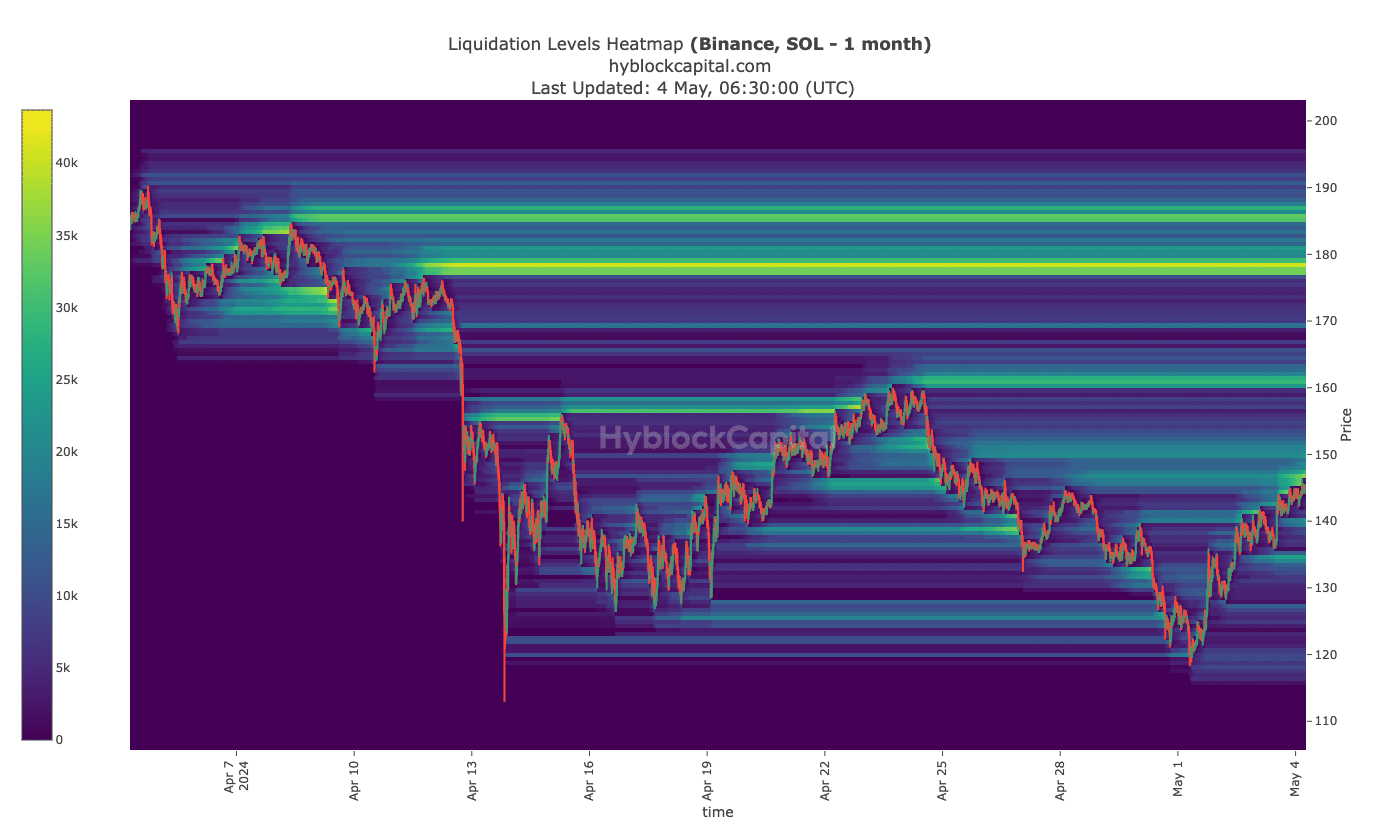

As a crypto investor, I personally find the liquidation heatmap to be an essential tool in my analysis arsenal. By examining this indicator, I can identify pockets of significant liquidity within the market. Moreover, the liquidation heatmap offers valuable insights into potential price movements. Essentially, it highlights areas where large positions may be liquidated, potentially leading to a shift in the market trend.

According to Hyblock’s findings, the prices of $150, $160.80, and $178.47, denoted by the yellow marks, indicate substantial market liquidity. Consequently, it is possible that the price of SOL may trend towards these areas.

Read Solana’s [SOL] Price Prediction 2024-2025

Should the price of the altcoin keep rising, its first significant resistance level would be around $150. At that stage, a potential roadblock may emerge.

If this area is penetrated successfully, it might lead to a swift increase in price up to $160.

Read More

- BRETT PREDICTION. BRETT cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

- Top gainers and losers

- Bitcoin – $75K or $55K? Here’s where BTC will go next

- OP PREDICTION. OP cryptocurrency

- MFER PREDICTION. MFER cryptocurrency

- 6-month low Ethereum fees suggest altseason is inbound: Santiment

- ZKasino scam suspect arrested, $12.2M seized by Dutch authorities

- ETH PREDICTION. ETH cryptocurrency

- FEG PREDICTION. FEG cryptocurrency

2024-05-04 18:15